ASIA PACIFIC (APAC) remains a heavyweight in the global private equity (PE) arena and continues to outperform other asset classes. Last year, the region’s private equity market topped out at a record US$1.2 tril (RM5.1 tril) asset under management (AUM) and now comprises one-quarter of global AUM.

This growth is a result of solid deal value that, in most countries, beat the five-year average for deal making, strong returns and US$388 bil in dry powder, or about 2.8 years of future investments.

However, a broad set of challenges confronts investors, forcing firms to adapt their strategy and approach to survive.

According to Bain & Co’s Asia-Pacific Private Equity Report, deal value in APAC decelerated sharply – down 16% to US$150 bil versus US$178 bil in 2018 – driven in particular by China, where macro issues hit hard.

A looming trade war, social unrest and stringent renminbi fundraising regulations created a slowdown in deal activity and fundraising. Meanwhile, deal activities in India and other regional markets grew or were on par with the past five years.

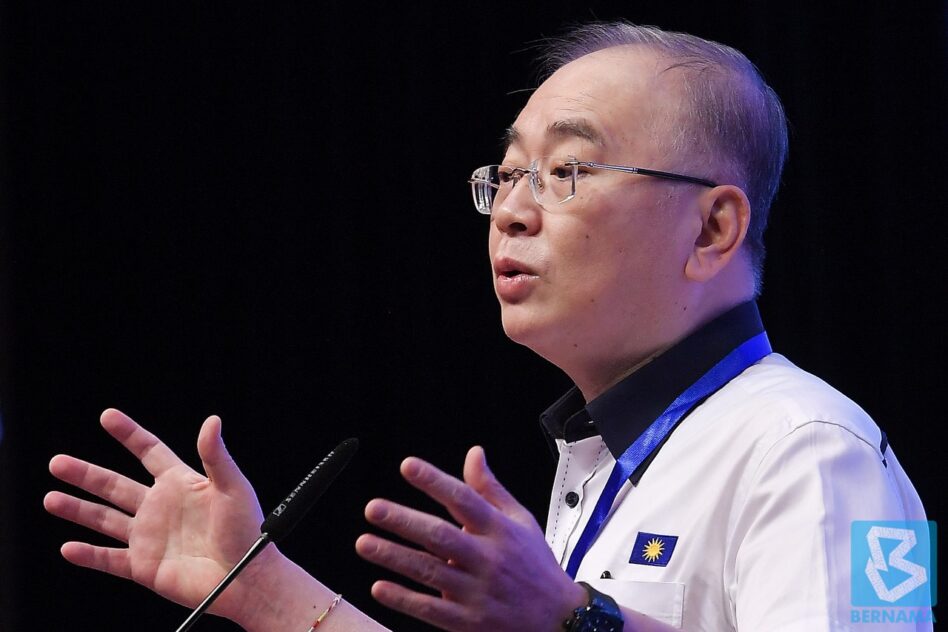

“Macro conditions have shifted the balance of PE power in APAC,” said Kiki Yang, who co-leads Bain & Co’s Asia-Pacific Private Equity practice and co-authored the report.

“China, while still dominant, has contracted and macro softness was the number one factor that kept PE funds focused on Greater China awake at night. The ongoing concerns surrounding the coronavirus outbreak in the region and globally are also clearly affecting the 2020 dynamic.”

Exits dropped even more precipitously than deal value. After setting a new high in 2018, boosted by the US$16 bil sale of Flipkart, APAC’s exit market plunged, breaking the recycling of capital that will fuel the next investment phase.

Exit values plummeted across the region in almost every market, falling to US$85 bil, down 43% and 31% respectively compared with last year and the previous five-year average. This is attributed to a poorly performing initial public offering (IPO) market, soft macro-economic conditions and a significant trim down of general partner’s (GP) portfolios in the boom years of 2017 and 2018.

Although a core of large and experienced funds raised capital with ease, APAC focused fundraising overall continued its decline in 2019. This drop was mainly the result of China’s stringent asset management rules, which were introduced in 2018 and continue to limit the ability of Chinese GPs to raise renminbi-based funds.

“The ongoing flight to quality in fundraising continues to polarise the market,” said Yang. “Large funds with a strong track record benefit from this winner-takes-all dynamic, requiring other firms to be even more distinctive and articulate in their strategy.”

The region’s private equity landscape is in flux. Looking ahead, elevated prices, increased competition and limited exit opportunities could make it tougher for GPs to replicate the same level of returns as in the past few years.

Bain & Co has identified two important themes that will shape the APAC private equity market in the future:

Disruption/recession

After a long and robust period of growth, many indicators now point to downturn and disruption globally. The International Monetary Fund warns that conditions are ripe for the next global financial crisis and banks are poorly prepared for it. Those somber forecasts have investors on edge.

Of APAC fund managers surveyed by Bain & Co, a striking 96% said they are expecting a downturn in the next two years. Their caution has merit if the past recession – during which about 40% of APAC PE and venture capital firms stopped raising capital – serves as any indication.

“Macro concerns are amplified by record high multiples, and about 40% of private equity deals are currently trading at valuations above 15x. If these were to plateau or decline, GPs would need to find new value creation levers to compensate for the lack of multiple expansion,” said Johanne Dessard, a global director for Bain & Co’s Private Equity practice.

With the risk of a global recession looming, Bain & Co has identified four characteristics of PE firms that successfully weathered the last financial crisis:

1) They tended to go for more deal control and active portfolio management

2) Firm size did not matter, but winners targeted larger deals

3) They also picked winners but did not have a specific sector focus

4) They adopted aggressive timing management

As PE firms prepare for a recession, Bain & Co sees an increasing need for developing a recession-proof strategy, which needs to be tailored to the sector and financial strength of portfolio companies.

While it is too early to tell what to expect next, powerful forces will likely reshape the business environment, requiring PE firms to cope with rising volatility and to take a much more structured approach to understanding disruption in their industries.

Technology

Over the last decade, investors have channelled a growing pool of capital to APAC’s burgeoning internet and technology sector. Although historically driven by China’s government initiatives and strong consumer demand, India is now driving growth in the sector, representing nearly a third of the APAC market, up from 14% in 2015.

Private equity investors have also turned their focus to more resilient tech sectors. While much of this boom had been built around first generation technologies, like traditional software, e-commerce and business-to-consumer (B2C) online services, investors are increasingly eyeing faster growing next-generation technologies, such as Software as a Service (SaaS), artificial intelligence and cross sector technologies, including financial technology.

These offer distinct advantages to investors: the opportunity to scale quickly, stable recurring revenues and the ability to disrupt entire industries given attractiveness to customers.

However, as alluring as tech’s growth characteristics are, the red flags are hard to ignore. Despite the sector’s dominance and the pull of new technologies, important shifts are happening beneath the surface. For the first time since 2017, internet and technology share of market activity has fallen.

Prices for internet and technology investments are at a record high, far exceeding the APAC median and return multiples have been trending down for several years. The negative IPO results have also stoked uncertainty among investors.

“Today, firms recognise they are far from meeting the full potential when investing in internet and technology,” said Bain & Co partner Usman Akhtar.

“Winning PE firms typically get the basics right when it comes to investing in internet and technology, including a focus on profitability by carefully evaluating the unit economics of the target’s business model, developing a tailored approach to each technology and building dedicated capability alongside strong partnerships.” – March 12, 2020