THE Bursa Technology Index remains under pressure, declining 26% year-to-date (ytd) since the start of 2025 and fell 16% month-on-month (mom) in Feb 2025.

“The weakness was driven by disappointing quarterly results that failed to meet investor expectations, alongside cautious outlooks from tech companies as customers remained wary of tariff threats,” said APEX Securities (APEX) in the recent Sector Update Report.

Meanwhile, sentiment continues to be weighed down by external headwinds, including AI export restrictions and uncertainty surrounding Trump’s tariff policies, which pose near-term risks to the sector.

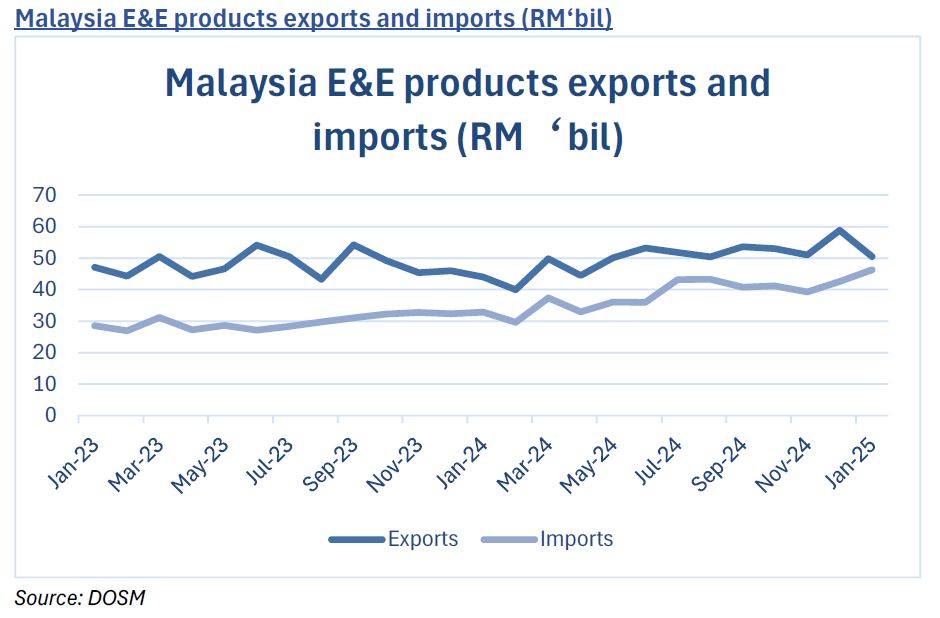

Malaysia’s exports of electrical and electronics (E&E) products continued to deliver robust year-on-year (yoy) growth, rising 15%, while imports increased by 9%, reflecting a better economic environment and sustained demand.

However, on a mom basis, exports declined by 14%, while imports grew by 9%, primarily due to seasonal factors affecting trade flows.

The ongoing US–China tech rivalry continues to drive significant regulatory actions, impacting semiconductor production, supply chains, and market access.

Notably, stricter scrutiny on Southeast Asian smugglers of AI chips to China has affected the industry supply dynamics.

Notably, stricter scrutiny on Southeast Asian smugglers of AI chips to China has affected the industry supply dynamics.

Meanwhile, discussions around potential US tariffs on semiconductor imports from Taiwan have prompted TSMC—the world’s largest wafer manufacturer to increase its investment in the US, committing an additional USD100 bil on top of its existing USD65 bil for its advanced manufacturing facility in Arizona.

These developments have introduced near-term uncertainties in the global semiconductor supply chain, adding to sector volatility.

“Looking ahead to 2025, we expect industry players to intensify efforts to geographically diversify their supply chains, build buffer inventories for critical chips, and strengthen cooperation with allied trading partners—all as part of risk management strategies to navigate ongoing geopolitical and trade-related challenges,” said APEX.

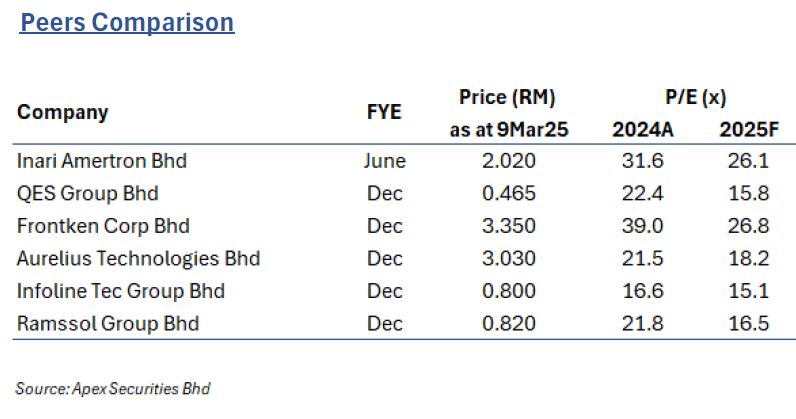

While APEX remains cautious on the technology sector in the near term due to weak sentiment and external headwinds, particularly the potential reimposition of Trump-era tariffs on Malaysia’s exports, APEX sees attractive risk-reward opportunities at current valuations.

Despite ongoing tariff pressures, Malaysia remains a key beneficiary of global supply chain diversification, as companies continue to relocate amid prolonged Sino-US tensions.

“While tariffs may pose challenges, we believe they are unlikely to trigger a full reshoring of the semiconductor supply chain to the US,” said APEX.

Instead, acceleration of diversification efforts may prompt companies to shift operations away from China toward alternative semiconductor hubs, including Malaysia.

“These dynamics support our Overweight stance on the sector, with selective opportunities to re-enter fundamentally strong technology names,” said APEX.

Their top picks for the technology sectors are Inari Amertron Berhad (BUY; TP: RM3.53) and Aurelius Technologies Berhad (BUY; TP: RM4.17). —Mar 10, 2025

Main image: Crowe