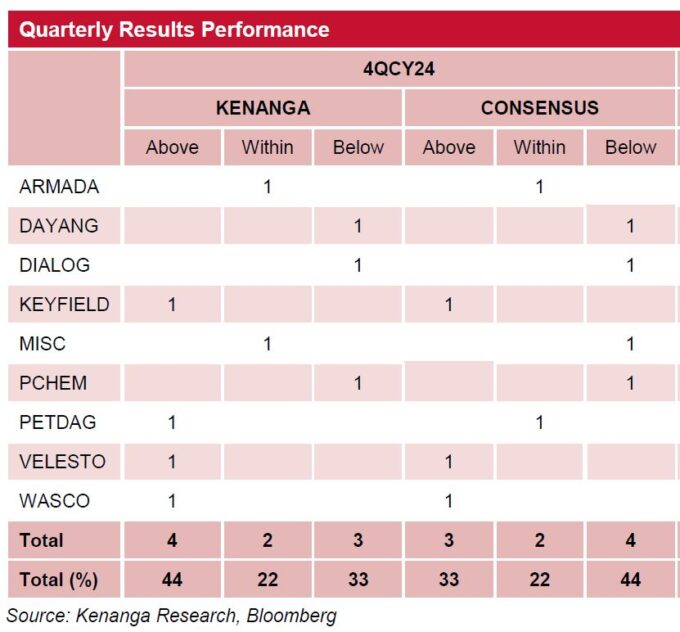

NOTABLE misses came from DIALOG and PCHEM due to EPCC cost provisions and challenges from Pengerang Integrated Complex (PIC) ramp-up, respectively.

“In contrast, KEYFIELD and VELESTO exceeded expectations thanks to stronger-than-expected daily charter rates, driven by robust demand for rigs and offshore support vessels (OSV),” said Kenanga Research (Kenanga) in the recent Sector Update.

PETDAG also performed above estimates on better operating margins, while WASCO surprised positively with strong revenue and margins from its oil and gas projects.

Upstream services are set to stay robust in 2025. DAYANG and KEYFIELD should continue benefiting from higher year-on-year (YoY) MCM and HUC activities, supported by stable demand and tightening OSV supply.

WASCO is likely to maintain solid pipe-coating activity, though repeating large engineering wins may prove challenging.

DIALOG anticipates fewer EPCC losses after the provisions seen in quarter two financial year 2025 (2QFY25).

Conversely, CELESTE and ARMADA expect weaker performance due to increased special periodic surveys (SPS) and reduced FPSO Kraken earnings as it moves into extension periods.

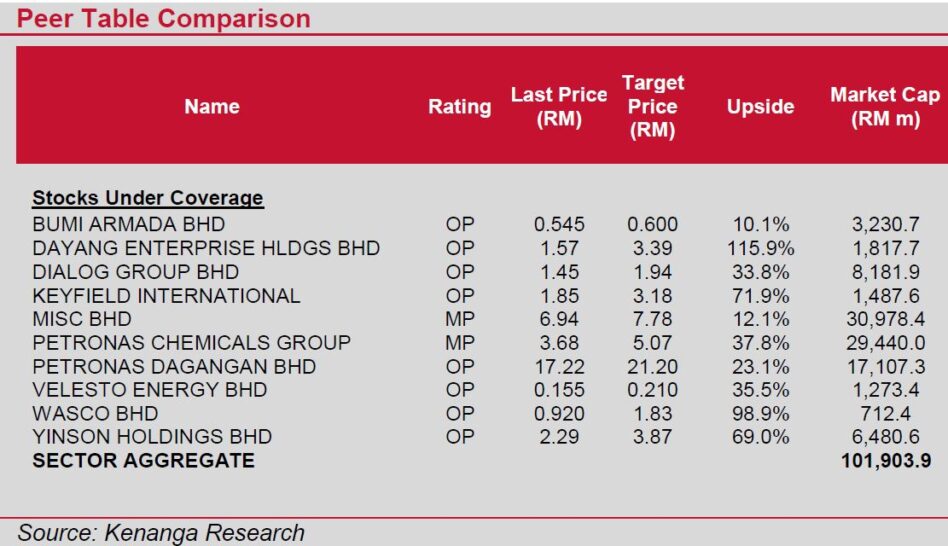

“We maintain our sector call at OVERWEIGHT with the same emphasis placed on upstream service providers and downstream player due to our expectations of a gradual improvement in the cyclical global PMI outlook in FY25,” said Kenanga.

In Kenanga’s view, the upstream services industry is still in an upcycle in terms of their fundamentals with topline and margins expected to be maintained or higher in FY25 particularly for maintenance-focused players but the recent deterioration in overall market sentiment continued to bring valuations of the small-to-mid cap service players down.

“While oil price outlook appears more tepid in 2025, we still believe that the valuation discount is unjustified given that the sector fundamentals remain intact and the players under our coverage still possess a very comfortable balance sheet,” said Kenanga.—Mar 11, 2025

Main image: Oil & Gas IQ