THE quarter four calendar year 2024 (4QCY24) performance of the automotive companies under MIDF Research (MIDF)’s coverage was largely disappointing, except for MBM Resources, which met expectations.

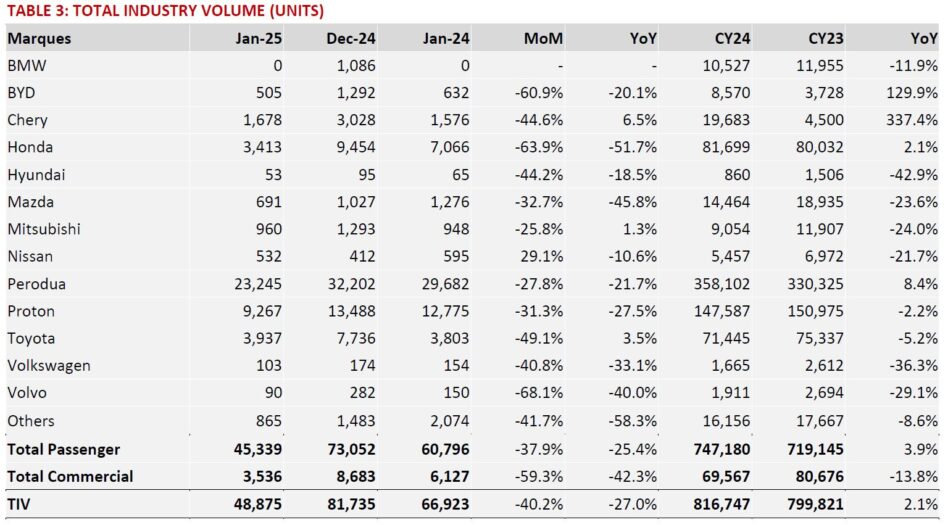

“As reflected in the Total Industry Volume (TIV) data, the decline in vehicle sales was more pronounced for non-national marques, whereas the affordable segment, particularly Perodua, remained resilient,” said MIDF in the recent Monthly Sector Report.

MBM Resources benefited from its exposure in Perodua, where its associate contributed close to 80% to its PBT, making it the only company with relatively stable earnings growth.

For other players, a key trend continues to be the market share erosion of nonnational marques to Chinese entrants.

As a recap, the Malaysian Automotive Association (MAA) reported a TIV of 48,875 units in Jan-25. The month-on-month decline was anticipated due to the shorter working month and the high base on Dec-24.

Nissan was the only brand to record a month-on-month increase in TIV, likely driven by the launch of the Kicks e-POWER.

Meanwhile, the year-on-year decline was largely broad-based, with most major marques seeing double-digit drops, except for Toyota.

On the production side, TIP dropped to 56,899 units. The 1MCY25 TIV represented 6% of our full-year projection, which MIDF deemed in line with expectations.

“We expect a gradual TIV decline in CY25 after years of strong backlog, forecasting 792,000 units, closely aligning with MAA’s 780,000 units,” said MIDF.

Perodua, last year’s key volume driver, has seen its backlog dropped from 80K in Dec-24 to 68K units currently and anticipates a -3.7% year-on-year (yoy) sales decline to 345,000 units this year due to planned production upgrades.

For Feb-25, TIV is expected to improve month-on-month ahead of the Hari Raya

“We remain NEUTRAL on the sector due to the anticipated downcycle. However, after the 4QCY24 results, sharp share price declines amid expectations of a weaker TIV have uncovered value opportunities,” said MIDF. —Mar 2, 2025

Main image: Bernama