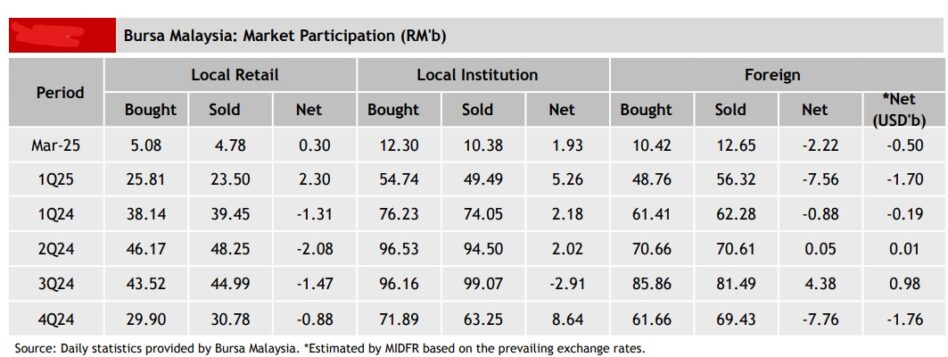

FOREIGN investors extended their net selling streak on Bursa Malaysia for the 21st consecutive week with a net outflow of -RM1.34 bil during the trading week ended March 14, a significant jump from the -RM881.5 mil recorded the prior week.

They were net sellers during every trading session with Tuesday (March 11) witnessing the heaviest outflow at –RM446.6 mil., according to MIDF Research.

“On the other days, the outflows range from -RM107.1 mil to -RM364.6 mil,” observed the research house in its weekly fund flow report.

The top three sectors that recorded net foreign inflows were construction (RM108.0 mil), technology (RM22.0 mil) and energy (RM6.4 mil).

Meanwhile, the top three sectors that recorded the highest net foreign outflows were financial services (-RM703.8 mil), consumer products & services (-RM122.6 mil) and utilities (-RM119.2 mil).

On the contrary, local institutions remained steadfast in supporting the market, marking their 21st straight week of net buying with a robust RM1.31 bil inflow, more than doubling the RM617.3 mil inflow from the prior week.

Likewise, local retail investors also extended their net buying streak for a fifth straight week though at a much slower pace with a net inflow of RM31.5 mil, a sharp decline from RM264.2 mil in the preceding week.

The average daily trading volume (ADTV) saw broad-based increases except for local retail investors. Foreign investors and local institutions recorded gains of +11.0% and +10.9% respectively while local retailers saw a marginal decline of -1.6%.

In comparison with another four Southeast Asian markets tracked by MIDF Research, the Philippines – despite facing political turbulence – led the region with a net inflow of US$32.5 mil to mark its second consecutive week of foreign buying.

However, Thailand encountered a third consecutive week of foreign withdrawal with a net outflow of -US$248.6 mil.

This was followed by Indonesia with a net outflow of -US$225.7 mil – its eighth week in a row of foreign withdrawals – while Vietnam extended its losing streak to six weeks with -US$66.9 mil of net outflow.

The top three stocks with the highest net money inflow from foreign investors last week were RHB Bhd (RM97.7 mil), Gamuda Bhd (RM91.6 mil) and Sunway Constriction Group Bhd (RM19.1 mil). – March 17, 2025