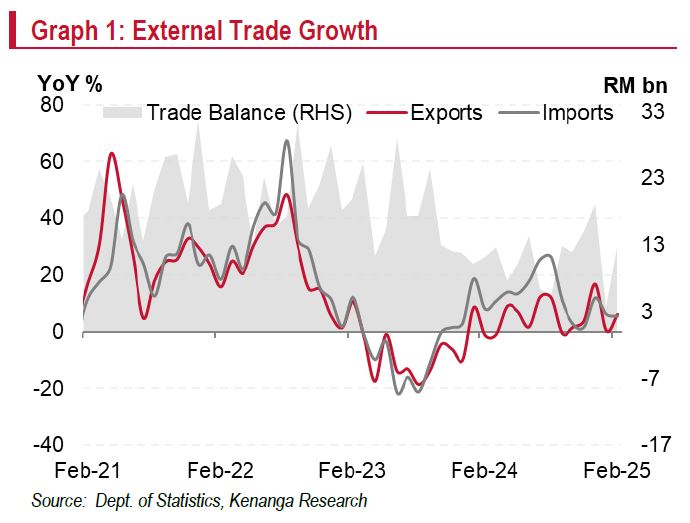

EXPORTS expanded to 6.2%, a tad below consensus of 6.5%, and significantly below house forecast of 15.9%. This is mainly due to strong exports to the US, EU, and high demand for E&E and palm oil.

Imports slowed to 5.5% from Jan at 6.2%, a three-month low and below expectations.

“A sharp slowdown in retained imports was partly offset by a rebound in re-exports,” said Kenanga Research (Kenanga) in the recent Economic Viewpoint Report.

Meanwhile, total trade expanded by 5.9% year-on-year (YoY) supported by last year’s low base.

However, month-on-month (MoM) growth declined by 7.5%. 2025 exports forecast was maintained at 5.0% despite slower-than-expected February performance.

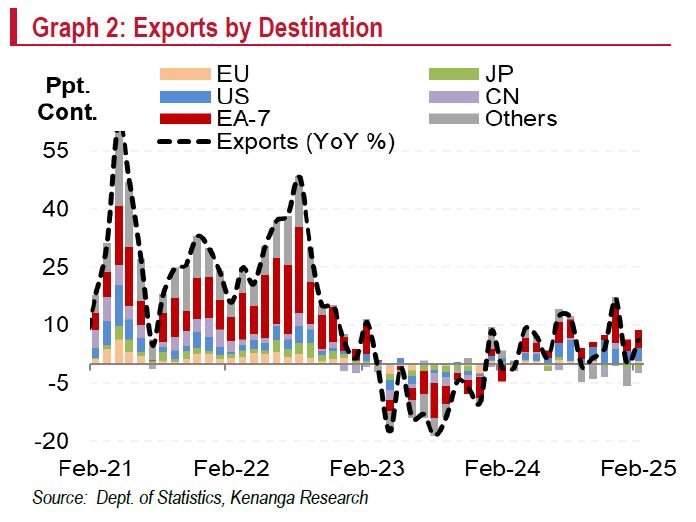

“Although February’s performance missed our target, we expect frontloading activity to accelerate in March ahead of Trump’s reciprocal tariffs in April,” said Kenanga.

This may not be sustainable for the rest of the year, but export growth should be supported by the global tech upcycle driven by AI related-demand, trade diversion spillovers, and expectations of economic recovery in key trading partners.

Demand is expected to rise from China, and potentially, Europe following the spillover effects of stimulus injection and monetary easing.

Meanwhile, uncertainty over the US economy from higher tariffs remains a concern.

A significant reduction in US imports due to higher tariffs could weigh on global trade, given the US role as a consumer-driven economy and an important export destination for Malaysia.

Key challenges remain, particularly the risk of a slower-than-expected economic recovery in China and global trade disruptions from Trump’s tariffs, which may dampen consumer and business sentiment.

“We maintain our 2025 GDP growth forecast at 4.8%. Growth should be supported by domestic demand, led by higher private consumption and investment,” said Kenanga.

Overall moderation reflects a base effect, normalisation of domestic economic activity, and uncertainties from global policy shifts under the Trump administration. —Mar 21, 2025

Main image: A Job Thing