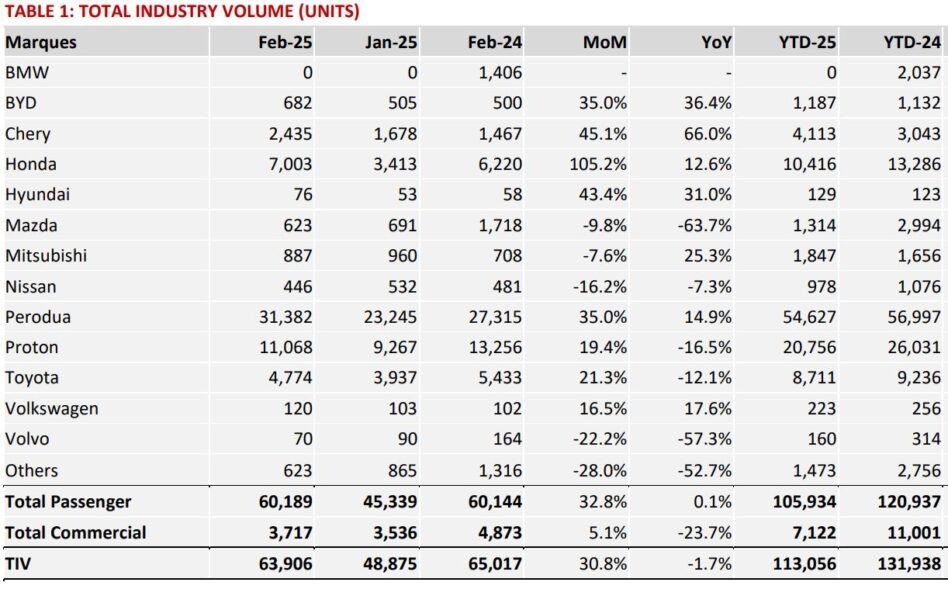

TOTAL industry volume (TIV) in Feb-25 came in at 63,906 units, bringing the year-to-date total to 113,056 units.

“This accounts for 14% of our full-year forecast of 792,000 units, which we view as broadly in line with expectations, underpinned by the anticipated easing of order backlogs,” said MIDF in a recent report.

Meanwhile, on the production front, total industry production (TIP) stood at 61,545 units, bringing the year-to-date cumulative total to 118,444 units.

Given the longer working month, the strong month-on-month increase in TIV was anticipated and was largely broad-based.

Honda’s auto sales more than doubled, followed by solid gains from Perodua (+35.0% month-on-month), Toyota (+21.3% month-on-month), and Proton (+19.4% month-on-month), while Mazda (-9.8% month-on-month) and Nissan (-16.2% month-on-month) recorded declines.

Among the major marques, only Perodua and Honda registered a year-on-year increase in TIV.

TIV in Mar-25 is expected to see further month-on-month improvement, supported by promotional activities leading up to the Hari Raya holidays.

In the upcoming quarter, the focus will shift to phasing out fuel subsidies for the top 15% income group (T15). Classification criteria for this group will be finalised and announced by the mid of Calendar Year 2025 (CY25).

The policy may prompt some to down trade or switch to EVs, ahead of complete build up EV tax exemptions expiring at year-end.

Meanwhile, the auto sector has secured a final extension for the revised excise tax, broadening duties on complete knockdown non-manufacturing components, which will now take effect in Jan-26, with complete knockdown prices expected to rise by +10% to +30%.

“We maintain our NEUTRAL call on the sector, given the anticipated downcycle,” said MIDF.

“Our projected -3.0% year-on-year (yoy) decline in TIV is broadly in line with MAA’s forecast of -4.5% yoy. Bermaz Auto is our top pick, backed by an attractive valuation and a dividend yield of over +10%,” said MIDF.

While domestic Mazda sales face stiff competition, its overall vehicle sales could be bottoming out, supported by Kia and contributions from new marques XPeng and the upcoming Deepal launch in the second half of calendar year 2025.

“We forecast a +6.1%yoy vehicle sales growth in financial year 2026 for BAuto,” said MIDF. —Mar 24, 2025

Main image: Xinhua