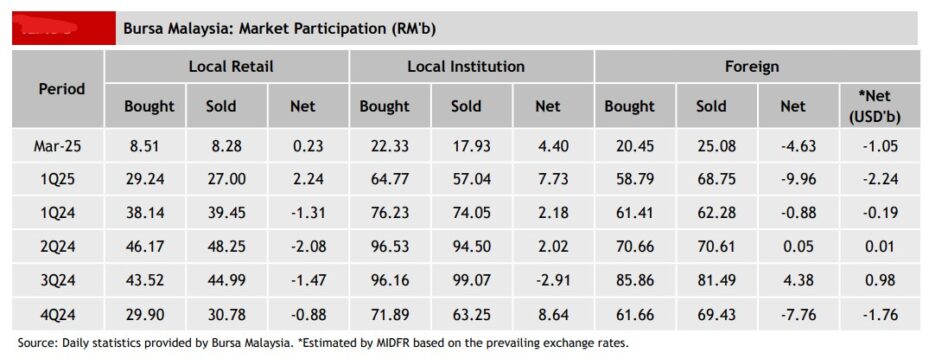

FOREIGN funds extended their selling streak on Bursa Malaysia for the 23rd consecutive week with a net outflow of -RM1.15 bil for the March 24-28 trading week which was slightly lower than the -RM1.25 bil posted in the previous week.

According to MIDF Research, foreign investors were net sellers on every trading session last week with Friday (March 28) witnessing the heaviest outflow at -RM384.0 mil.

“On the other days, the outflows range from -RM56.0 mil to -RM284.1 mil,” observed the research house in its weekly fund flow report.

“Only two sectors that recorded net foreign inflows, namely construction (RM7.1 mil) and plantation (RM3.9 mil).”

Meanwhile, the top three sectors that recorded the highest net foreign outflows were financial services (-RM564.4 mil), consumer products & services (-RM142.3 mil) and healthcare (-RM118.1 mil).

On the contrary, local institutions continued to provide a buffer against foreign selling by posting their 23rd straight week of net buying with inflows amounting to RM1.24 bil.

However, local retail investors reversed their six-week buying streak, turning net sellers with an outflow of -RM87.9 mil.

The average daily trading volume (ADTV) saw broad-based decrease with foreign investor participation plunged by -34.7% while that of local institutions and local retail saw declined by -12.7% and -13.8% respectively.

In comparison with another four Southeast Asian markets tracked by MIDF Research, Indonesia reversed a nine-week selling streak with a net inflow of US$195.9 mil as authorities moved swiftly to restore investor confidence following the previous week’s stock and currency slide.

However, Thailand extended its foreign withdrawal streak to a fifth week with -US$121.26 mil in outflows.

Similar trend prevailed in Vietnam which posted its eighth consecutive week of outflows totalling -US$82.15 mil while the Philippines ended its three-week buying streak with a net outflow of -US$34.09 mil amid mixed economic signals.

The top three stocks with the highest net money inflow from foreign investors last week were Tanco Holdings Bhd (RM32.8 mil), SD Guthrie Bhd (RM31.1 mil) and Alliance Bank Malaysia Bhd (RM29.2 mil). – April 2, 2025