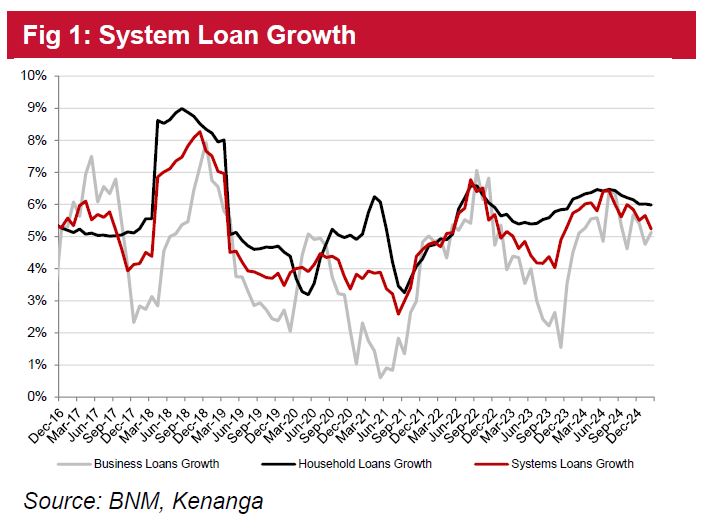

IN Feb 2025, system loans grew by 5.2% year-on-year (YoY) which is within Kenanga Research (Kenanga)’s 6.0% target for calendar year 2025 (CY25) as it approached a higher year-end base.

Household loans (+6.0%) held steady with both residential mortgage (+6.7%) and hire purchase (+7.4%) reporting a favourable MoM uptick by 0.1% and 0.4%, respectively.

This is likely attributed to pre-festive season backloading cascading into the overall system.

“Meanwhile, business loans gain 4.1% YoY with financial service sectors leaping 18% with the pickup in insurance and takaful, likely spurred by past floods impact now entering the system,” said Kenanga in the recent Sector Update Report.

Applications increased by 14% YoY with both household (+16%) and business (+11%) ahead of upcoming Hari Raya festivities in March.

Residential properties and credit card spending continued to be the most sought after, rising both on a YoY and month-on-month (MoM) basis. Thanks to the decline in applications and moderate increase in approvals.

Industry GIL came in at 1.45% where total industry impaired loans remained flat MoM.

“We anticipate this to be due to tight asset quality screening with industry LLC remaining relatively stable at 91.4%,” said Kenanga.

Kenanga is also wary that with the upcoming Raya seasonality. Missed payments are bound to occur as consumers prioritise cash flows towards festive purposes, though they do not see this as a concern as repayment habits typically revert thereafter.

They opine more lasting implications to GIL will be a result from:

i/ Unfavourable trade policies.

ii/ Tighter-than-expected RON95 subsidy rationalisation.

iii/ Seetbacks in data centre development.

Feb 2025 deposits increased by 3.4% YoY and 0.9% MoM although current account savings account (CASA) ratio remained stagnant at 28.8% as interest rate dynamics are still less favourable for CASA.

However, Kenanga notes that short-term fixed deposits (<1 year) saw a 3% YoY increase at the expense of long-term deposits (>1 year) plunging by 49% YoY as banks shift their funding mix to lower interest costs products with margin retention in mind.

Industry LDR hovered at 87.4%, which although is within the pre-pandemic average, may see a further creeping up as banks grow more accepting of non-deposit funding sources to deploy loans, with sukuk and more recently seen, equity capital market exercises.

“We anticipate the coming months’ readings to be mixed by festive behaviour which could blur signals spurred by macroeconomic factors such as unfavourable trade policies,” said Kenanga.

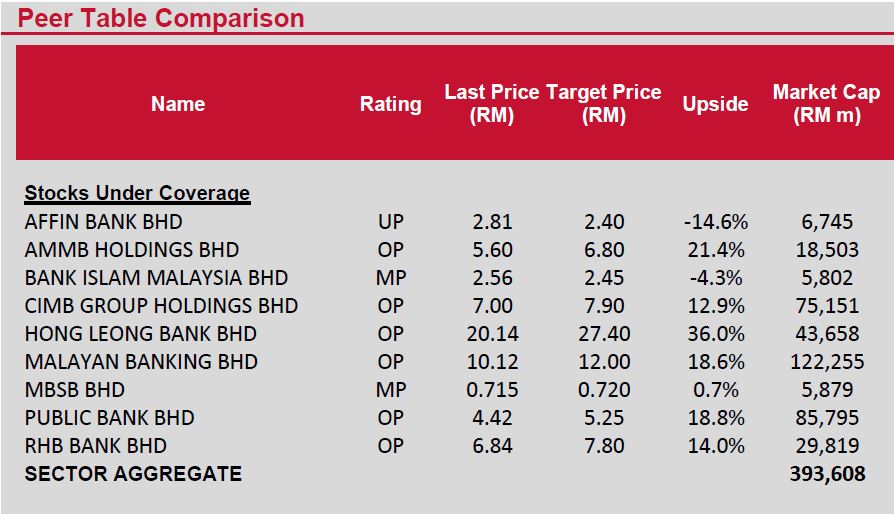

That said, they believe the banking sector is poised to show resilience on the back of a supportive Malaysian economy, where most banks also guided for stronger loans growth in CY25.

They anticipate overnight policy rate to remain steady state at 3% throughout CY25, though a potential 25 bps cuts would not overly dent earnings, at a tune of 2%-4% based on our models’ sensitivity analysis.—Apr 2, 2025

Main image: BLUEBRICKS