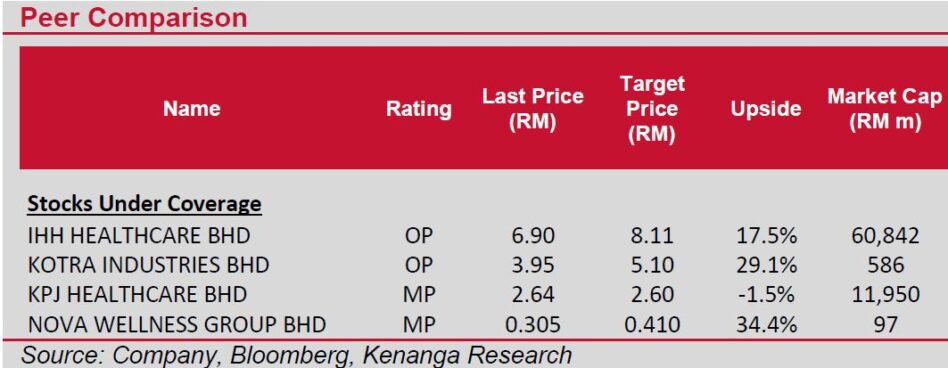

KENANGA Research (Kenanga) believes the Diagnosis Related Group (DRG) related regulatory impasse has gradually subsided as investors could gravitate towards the defensive nature of healthcare stocks amid a more risk-off environment.

“Pending further development on the DRG, we remain positive, taking a view of longer-term growth prospects of the healthcare sector, which will continue to be underpinned by an ageing population, rising affluence and cases of chronic diseases globally,” said Kenanga in the recent Sector Update Report.

Specifically, DRG is not easy to implement in private healthcare, partly stemming from issues including a wide range of medical insurance plans.

Moreover, due to the complexity of each medical procedure, DRG system requires extensive research and engagement with various stakeholders including medical insurance policy holders, regulators and private hospitals.

Kenanga gathered from channel checks that DRG is not easy to implement in private healthcare operators.

Rather, DRG in most countries is used to fund national healthcare scheme in countries like Australia, South Korea and Japan.

The Association of Private Healthcare Malaysia has rejected the insurance and takaful operators’ proposal for private hospitals to freeze costs for three years and also for the Health Ministry to regulate the pricing of pharmaceuticals or medication.

“Due to rising staff costs, higher medication input costs and utilities, we believe freezing costs could be challenging,” said Kenanga.

Separately, Kenanga believes an urgent need to address national healthcare financing to ensure equitable access to healthcare for all Malaysians, irrespective of their income.

Presently, Malaysia has a dual healthcare funding system, that is private and public. The private healthcare system is paid for by consumers via “out of pocket” and private healthcare insurance.

On the other hand, the public healthcare budget is borne by the government via mainly the Ministry of Health and to some extent the Ministry of Higher Education and Ministry of Defence.

Briefly, it is a multi-payor, multi-provider system with payors including federal and state agencies, local authorities, SOCSO and the EPF.

“In our view, a revamped healthcare insurance system could lead to better overall healthcare services for Malaysians, lower out-of-pocket spending, reduced waiting times and access to more modern medicines and technology,” said Kenanga.

For illustration purposes, the system could entail a hybrid version that is similar to the Australian system of a single-payer, multiple-provider arrangement, where public and private hospitals would provide equal facilities and functions to a patient.

Basically, it would mean that everyone has to contribute. Theoretically, all working citizens are obligated to set aside a portion of their income into a fund which they can draw upon to pay their own medical bills when the need arises.

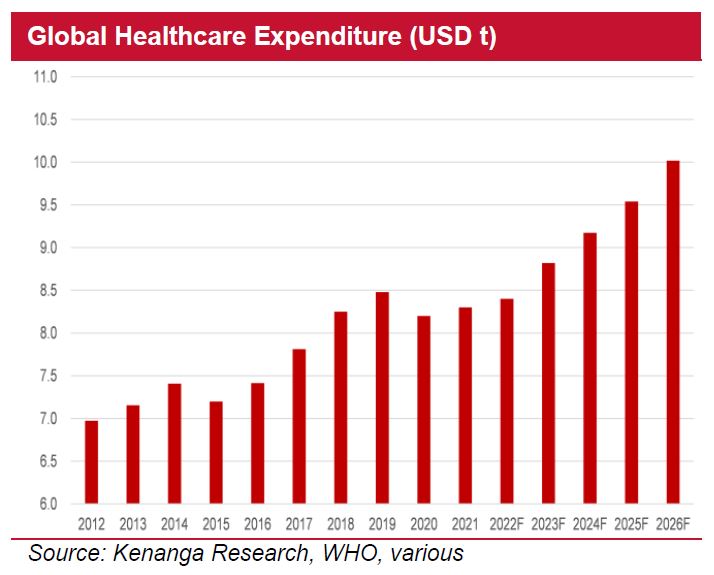

Global healthcare expenditure is projected to grow at a compounded annual growth rate of 3.5% to reach USD10 tri by calendar year 2026, underpinned by rising affluence and aging populations.

The demand for healthcare, a basic necessity, is inelastic despite high inflation. Another key driver is rising chronic diseases across the globe.

According to WHO, almost half of the global healthcare expenditures will be spent on three leading causes of death, namely cardiovascular diseases, cancer, and respiratory diseases. —Apr 7, 2025

Main image: USDSI