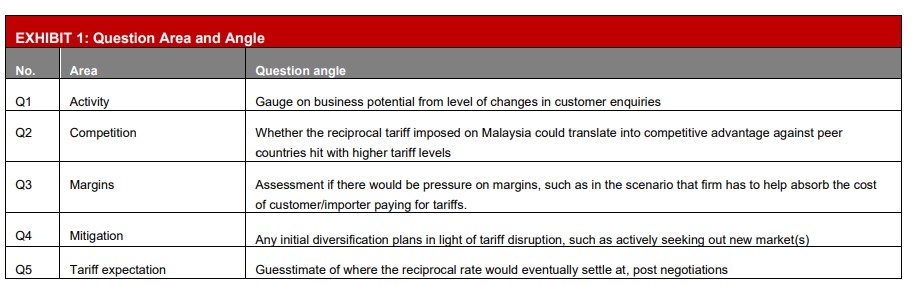

MAJORITY of respondents in a Kenanga Research survey of Malaysian public listed companies (PLCs) with regional exposure, particularly those with US revenue, expect the reciprocal tariffs mooted by US President Donald Trump “is here to stay and at a relatively high level”.

Such is the general feel from the research house’s corporate survey on 19 corporates under its radar in three categories, namely (i) technology sector; (ii) manufacturing, including gloves; and (iii) others which broadly included plastics & packaging, automotives and oil & gas (O&G)-related outfits, among others.

The purpose of the survey is to provide an on-the-ground appreciation amid the general stock market weakness to find emerging opportunities as well as to corroborate/strengthen the research house’s sector convictions.

“Margin pressure is a concern but exists in small pockets,” revealed Kenanga Research in a market strategy report.

“A silver lining is that some firms are perceiving the tariff differential as an advantage in securing new customers which reinforces our view of Malaysia being a relative beneficiary in the region.”

Even though its sample size is small, Kenanga Research said it was careful not to cherry pick the PLCs but instead selected corporates that meet its criteria of having geographically exposed operations and supply chain, especially those with US revenues.

A pertinent aspect of the findings is that the PLCs surveyed are generally not hopeful that tariff will land below 10% but instead would hover between 10% and 24%.

“Only two respondents are optimistic that rate eventually be lowered to less than 10% while 30% of respondents or five corporates) have basically resigned to the expectation that 24% will likely be the rate to proceed with,” revealed the research house.

“At the time of writing, Malaysia has rejected the tariff rate of 47% that Malaysia purportedly levies on the US and has tabulated a more comfortable 5.6%. To this end, we understand that Malaysia is eyeing the timeline of end-April to send a delegation to Washington for discussions.”

Margin risks

Moreover, about one out of five PLCs foresee some margin risk that may arise if importing customers in the US require Malaysian exporters to help absorb part of their import tariffs (presumably if it was difficult to fully pass on the cost to the US end-consumer).

“Another potential reason to look at margin slippage risk is also for the fact that US buyers may also adopt a wait-and-see approach for any potentially lowering of tariffs which may temporary cause some pause in orders,” projected Kenaga Research.

“In this regard, some of the corporates are watching for margins risk though gloves/manufacturing category firms mostly have lesser concerns over this area.”

As it is, Kenanga Research described the tech sector as “one bright spot in the room” whereby some PLCs are already getting more enquiries.

“This includes names in the EMS (electronic manufacturing service) field as the cost of doing business and the relatively lower tariff (for Malaysia at 24%) in combination still stacks competitively, thus leading for enquiries of additional or spare manufacturing capacity,” noted the research house.

“Additional business enquiries were also echoed in the glove/manufacturing segment. On the other end of the spectrum, some plastics and packaging companies have reverted with seeing less business enquiries this year.”

Nevertheless, Kenanga Research opined that there is some credence in the view that the reciprocal tariffs which kicks in today (April 9) – while high at 24% – still confers a competitive position or not being worse off than the Joneses. – April 9, 2025

Image credit: Business Standard