Editor’s Note: The Wall Street recovery rally fizzled out on Thursday (April 10) as the White House clarified its plan for a massive 145% tariff on China with a trade war now very much in sight.

After rising nearly 3,000 points Wednesday, the Dow Jones Industrial Average had a volatile day in the red on Thursday. The blue-chip index fell 1,015 points or 2.5%, pulling back after tumbling as much as 2,100 points mid-day.

The S&P 500 fell 3.46% and the Nasdaq Composite slid 4.31%. The S&P 500 was coming off its best day since 2008 while the Nasdaq on Wednesday posted its second-best daily gains in history. – Adapted from CNN Business

AS US stocks sank sharply on Thursday (April 10) to give back some of Wednesday (April 9) huge gains, investors the world over have started to point fingers at (if not cursed) President Donald Trump for his pump and dump antics.

They went on to trace Trump’s decision to postpone many of his sweeping tariffs on dozens of countries that came into effect on Wednesday (April 9) in the midst of Wall Street trading with great volatility after having tanked in the four previous sessions.

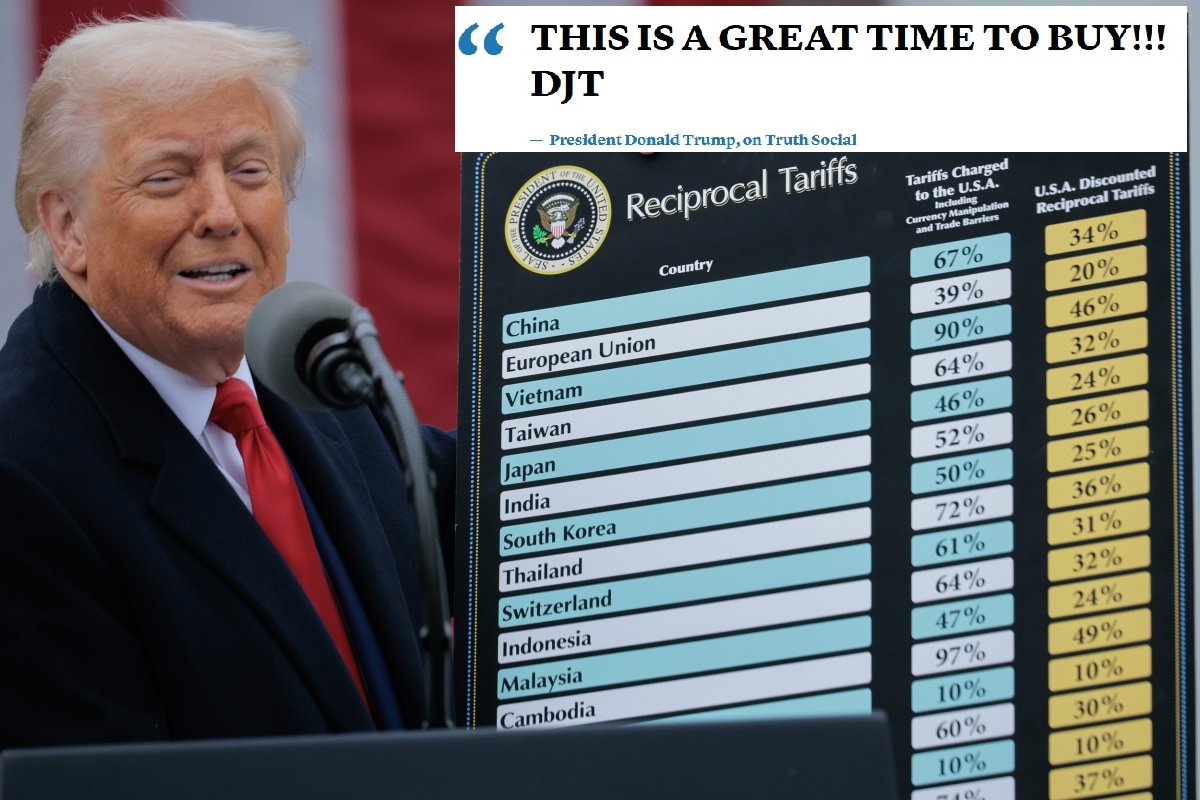

Their search culminated in the deemed most powerful man in the world – who is also renowned for his sleek entrepreneurial prowess – having tweeted on his social media platform Truth Social at 9.37am: “THIS IS A GREAT TIME TO BUY!!! DJT”.

The post ended with the letters “DJT” which is both the president’s initials and the ticker symbol for Truth Social’s parent company, Trump Media & Technology Group Corp, in which he holds a majority stake.

“Theoretically, anyone who bought into the market that minute on Trump’s urging netted a big return,” penned CNBC’s correspondent Alex Harring.

“Stocks shot up in a historic reversal in afternoon trading after Trump announced a walk back on some tariffs, a stark turn after his April 2 announcement of new import taxes torpedoed the market.”

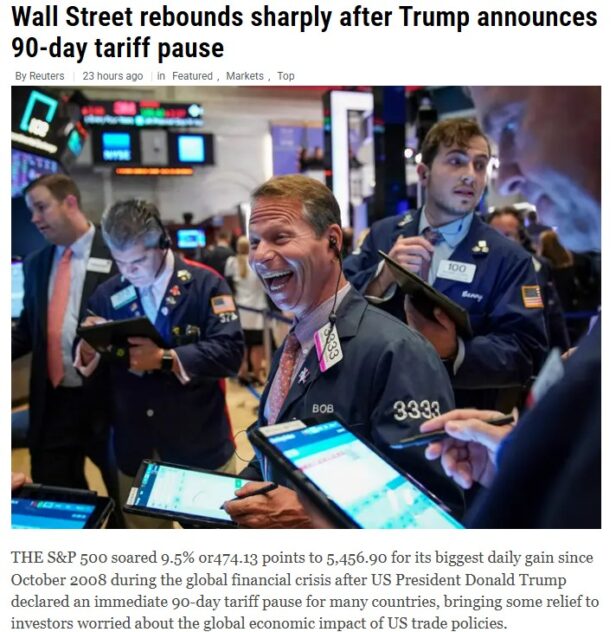

Less than four hours later, Trump announced a 90-day pause on nearly all his tariffs (sans China which he has now raised to 145% from earlier 125%). The S&P 500 soared 9.5% or474.13 points to 5,456.90 for its biggest daily gain since October 2008 during the global financial crisis.

It regained about US$4 tril or 70% of the value it had lost over the previous four trading days.

Elsewhere, the Dow Jones Industrial Average rose 2,962.86 points or 7.87%, to 40,608.45 while Nasdaq Composite spiked 1,857.06 points or 12.16%, to 17,124.97 for its biggest gain since January 2001 during the dotcom market bubble.

While it remains unclear if Trump was insinuating buying stocks in general – or Trump Media in particular – the ambiguity about what Trump meant was taken as a “buy” call, prompting many Americans to pour money into that stock.

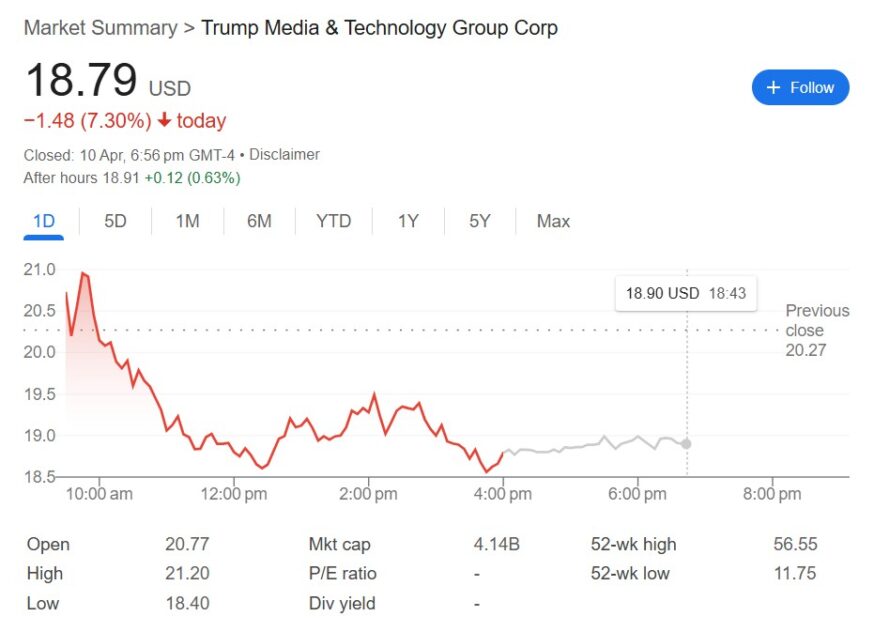

“Trump Media closed up 22.67% – soaring twice as much as the broader market – a stunning performance by a company that lost US$400 mil last year and is seemingly unaffected by whether tariffs would be imposed or paused,” observed AP’s correspondent Bernard Condon.

“Trump’s 53% ownership stake in the company – now in a trust controlled by his oldest son, Donald Trump Jr – rose by US$415 mil on the day.”

Added Condon: “Trump Media was bested, albeit by only two-hundreds of a percentage point, by another Trump administration stock pick – Elon Musk’s Tesla.”

As Trump Media has shed US$1.48 or 7.3% from the previous day’s close of US$20.27 in line with Wall Street’s retreat on Thursday’s overnight trading, those who chased the stock to buy at its intra-day high of US$21.20 (on Wednesday) would have incurred paper loss.

On the contrary, those who bought into the stock around its intra-day low of US$18.40 would have pocketed handsome gains depending on the size of their purchases. – April 11, 2025