MALAYSIAN Palm Oil Board’s March calendar year (CY) 2025 production rose month-on-month (MoM) to 1.387 mil MT but was flat year-on-year (YoY), within Kenanga and market expectations.

It is most probably the start of this year’s seasonal uptrend with fresh fruit bunch (FFB) harvest rising MoM from March till Sept or Oct.

However, exports of 1.006 mil MT is a decade-low for the month of March. Closing inventory thus rose 3% MoM to 1.563 mil MT but was down 9% YoY and 16% below the 10-year average.

Closing inventory also came in 7% above Kenanga forecast but within consensus estimate.

March CPO price held well at RM4,740 per MT. On a quarterly basis, quarter one (1Q) CY25 production, exports and closing inventory were poorer than usual; hence, the strong quarterly price of RM4,724 per MT, the highest in a decade after 1QCY22 when edible oil price soared at the onset of the Ukraine conflict.

“Maintain OVERWEIGHT for the sector’s defensive qualities. After enjoying elevated price premium in 4QCY24, palm oil prices are easing on seasonal supply uptick but CY25-26 looks to stay firm at RM4,200 and RM4,000 per MT,” said Kenanga Research (Kenanga) in the recent Sector Update Report.

Edible oil supply deficit is increasingly likely in CY25, potentially persisting into CY26. Margins should remain healthy as wage inflation is mitigated by strong PK prices.

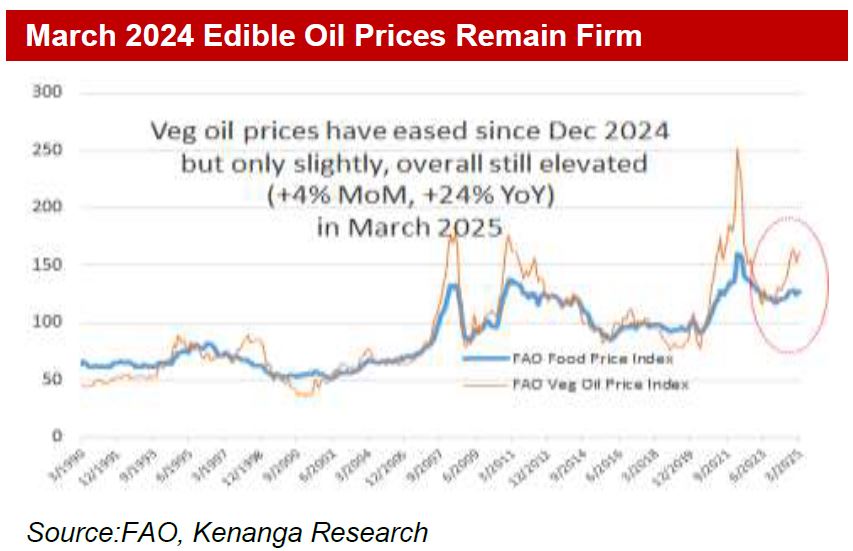

FAO’s vegetable oil price index for March CY25 rose 4% MoM in line with the 10-year trend.

However, with oil palm production often bottoming in Feb, and Brazil soya bean harvest often starting about now, edible oil prices should ease a little seasonally in 2Q.

This seasonal downtrend has been expected. Recent softness in hydrocarbon oil prices is another dampener for biodiesel demand but the impact on CPO prices remains limited.

“Our average crude palm oil (CPO) price of RM4,200 per MT for CY25. Maintain average CPO of RM4,200 per MT for CY25 and RM4,000 in CY26,” said Kenanga.

All in all, edible oil prices should stay firm but palm oil premium to soybean should narrow.

Recent 1QCY25 updates from US Dept of Agriculture and Oilworld suggest that an earlier scenario of a supply deficit in CY25 remains intact.

Supply growth looks set to trail the rise in demand. Among the challenges of global edible oil supply is that only four crops, palm, soya, rapeseed and sunflower, make up 80% of overall supply.

In CY25, only soya is expected to grow meaningful (5-7%) while lower rapeseed and sunflower outputs are likely, while market leader palm oil is expected to inch up by just 1%.

Meanwhile, latent demand growth is 3%-4%, thus 1%-2% of demand cannot be met for CY25. —Apr 11, 2025

Main image: Musim Mas