THE global economy is undergoing a seismic shift. With the recent move towards reciprocal tariffs and rising protectionism, the era of free trade is rapidly fading.

Once the torchbearer of globalisation, the US is now enforcing policies that prioritise domestic industries – prompting a chain reaction among trading nations.

The result? A shrinking global economy and mounting challenges for export-reliant countries like Malaysia.

Export headwinds

The Malaysian economy, particularly its cornerstone electrical and electronics (E&E) sector, is feeling the brunt of these changes. As global markets become less accessible while demand softens amid rising trade barriers, Malaysian exporters are being squeezed from both sides.

To make matters worse, China – facing its own trade frictions with the US – has begun diverting exports to Southeast Asian markets.

This influx of low-cost goods threatens to out-compete local Malaysian companies which are already operating on razor-thin margins. Without the scale or cost advantage of Chinese manufacturers, many local businesses may not survive the coming storm.

This pressure is visibly rippling through our financial markets. The FBM KLCI has seen sharp declines. The ringgit is under strain, driven by outflows and declining investor confidence.

These are not isolated symptoms – they signal a broader structural challenge that Malaysia must confront head-on.

Strategic intervention as nation builders

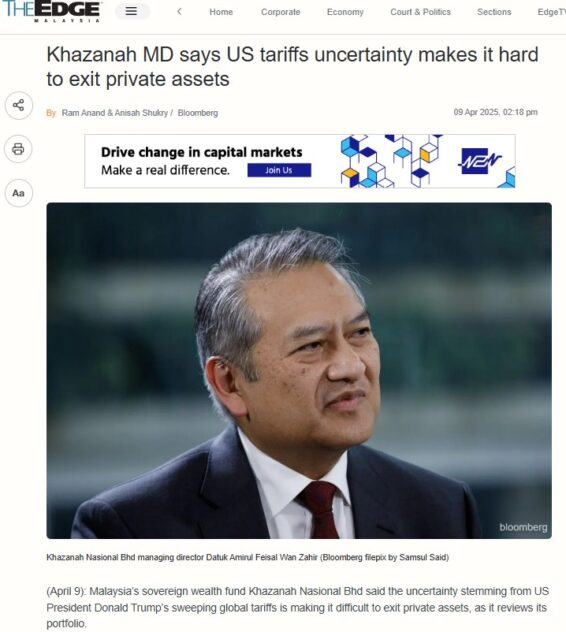

In this volatile environment, reactive policies and short-term relief measures are not enough. Malaysia must leverage its long-term institutional strengths – starting with Khazanah Nasional Bhd, our sovereign wealth fund.

Khazanah and other state-owned fund management entities like Permodalan Nasional Bhd (PNB) and the Employees Provident Fund (EPF) have the financial firepower and mandate to support national resilience.

It is time for them to take on a more active role – not just as investors but as nation builders.

By investing directly into local companies, especially in high-potential but under-capitalised sectors, sovereign wealth funds can provide the stability and scale needed for Malaysia to weather this transition.

These investments should focus on:

Technology and advanced manufacturing: To enable local companies climb up the value chain from simple assembly to high-tech production.

Strategic import substitution: Reduce reliance on foreign inputs by strengthening domestic capabilities.

STEM talent development: Establish national initiatives to train engineers and technical professionals in critical areas from robotics to chip design. Without talent, there is no transformation.

Future-proofing Malaysia’s economy

This is not merely a financial challenge but a generational one. The world is moving into a new era defined by economic blocs, re-shored supply chains and technological supremacy. Malaysia must adapt or risk being left behind.

We must pivot from being a cost-competitive exporter to a value-driven innovator. Sovereign wealth funds must serve as catalysts in this transformation by providing patient capital and long-term vision which align with national interest.

Khazanah once played this role in shaping Malaysia’s key industries – from telecommunications to healthcare. It must therefore rise again to lead a new wave of industrial revitalisation in tandem with other sovereign players.

If we can steer this wisely, today’s crisis may well become the foundation for tomorrow’s resilience. – April 15, 2025

Tan Wei Siang is a consultant at HEYA Inc, a non-profit thin tank and people’s academy.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.

Inage credits: The Edge