ACCORDING to data released by Bank Negara Malaysia (BNM), total loan application for purchase of property rebounded by +6.1% month-on-month to RM47.3 bil in February 2025 after three consecutive declines in November 2024 to January 2025.

On yearly basis, loan application jumped by 18.1% year-on-year (yoy) in February 2025 after decline of -12.5% yoy in January 2025.

“We think that loan application is normalising from weaker loan application in January 2025 which was dragged by school holidays and Chinese New Year public holidays,” said MIDF Research (MIDF) in the recent Monthly Sector Report.

Looking forward, MIDF sees buying interest on property to stay healthy in 2025 which should lift loan application to grow from March 2025 onwards.

Approved loan for purchase of property fell in February 2025 despite the increase in loan application as loan approval ratio declined to 37.4% in February 2025 from 42.2% in January 2025.

On yearly basis, approved loan was flattish despite the surge in loan application, owing to the lower loan approval ratio.

The lower approval ratio has dragged total approved loan in month two of calendar year 2025 (2MCY25) lower at RM36.5 bil (-3.8%yoy).

“Nevertheless, we think that approval ratio should normalise in March and the expected higher loan application should support growth of approved loan in 2025. That also indicate better new sales prospect of developers,” said MIDF.

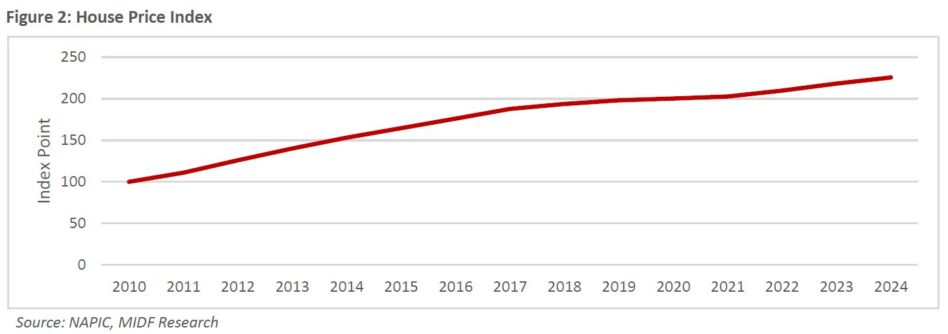

Property price in Malaysia remains stable with marginal growth in 2024. According to data released by NAPIC, the Malaysian House Price Index (HPI) stood at 225.6 points (preliminary figure) in 2024 which

represents annual growth of 3.3%.

House price in Malaysia is on uptrend except for marginal dip in 2020 due to Covid-19 pandemic. The increase in house price in 2024 is across all house types with semi-detached house recorded highest growth of 4.1%, followed by terraced house (3.6%), detached houses (2.6%) and high-rises (2.3%).

“Overall, we think that the stable house price outlook in Malaysia will continue to underpin confidence of property buyers and support buying interest on property in Malaysia,” said MIDF.

Meanwhile, Malaysia is hit with 24% U.S reciprocal tariff rate. Subsequently, President Trump has authorized a 90-day pause on his reciprocal tariff plans for all countries except China.

The imposition of tariff is expected to have knock-on effect on Malaysia economy amid expected slowdown in global growth.

“As such, our in-house GDP growth forecast for 2025 was revised down to 4% from 4.6% previously. The less optimistic outlook for economy is expected to adversely impact the buying sentiment on big ticket items such as property,” said MIDF.

Despite the market volatility that triggered by US tariff which may dampen economic outlook and affect buying interest on property, the stronger tie with China which may increase investment of China companies in Malaysia may partially offset the adverse impact of tariff on industrial property market in Malaysia.

Meanwhile, property sector should continue to support by Johor-Singapore Special Economic Zone (JS-SEZ) and The Johor Bahru–Singapore Rapid Transit System (RTS). —Apr 16, 2025

Main image: Gloria Jeans Coffee