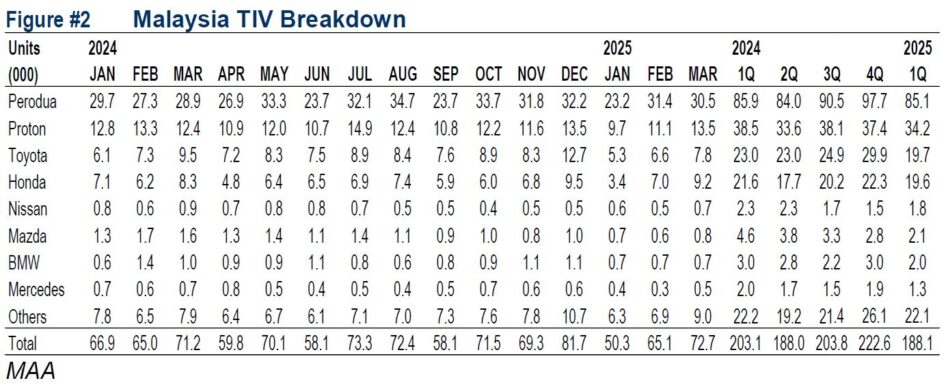

THE Malaysian Automotive Association (MAA) reported strong Mar-25 sales of 72.7k units, a growth of +11.7% month-on-month (MoM), mainly driven by more active working days during the month and more aggressive sales campaigns for Raya Festivities.

“On a year-on-year (YoY) basis, it posted a slight growth of +2.2%, on the attractive sales offer,” said Hong Leong Investment Bank (HLIB) in a recent report.

However, MAA is expecting a weaker Apr-25, affected by Raya holidays. The total industry volume (TIV) was still a drop of -7.4% YoY to 188.1k units, mainly due to easing consumer sentiment.

“We expect TIV for 2025 to normalise down to 750k units level, after achieving a new record high of 816.7k units in 2024, mainly due to declining order backlogs and easing new order intakes over the coming months,” said HLIB.

Nevertheless, there is still upside potential from:

(i) exciting new model launches in 2025.

(ii) more aggressive marketing activities to sustain sales by the various original equipment manufacturers (OEM)s, but at the expense of margins.

Current order backlogs have further dwindled in 2Q25 and this is expected to continue softening in subsequent quarters as consumer sentiment weakens in tandem with slower economic outlook.

“We expect earnings for the sector to drop in 2025 due to lower sales volume and higher operating costs, but partially cushioned by RM strength,” said HLIB.

HLIB’s top picks for the sector are MBMR and Sime Darby for their strong exposure to the national OEM Perodua sales, which command resilient sales volume and potential export growth in the longer term, coupled with sustainable dividend yields. —Apr 25, 2025

Main image: GMK Center