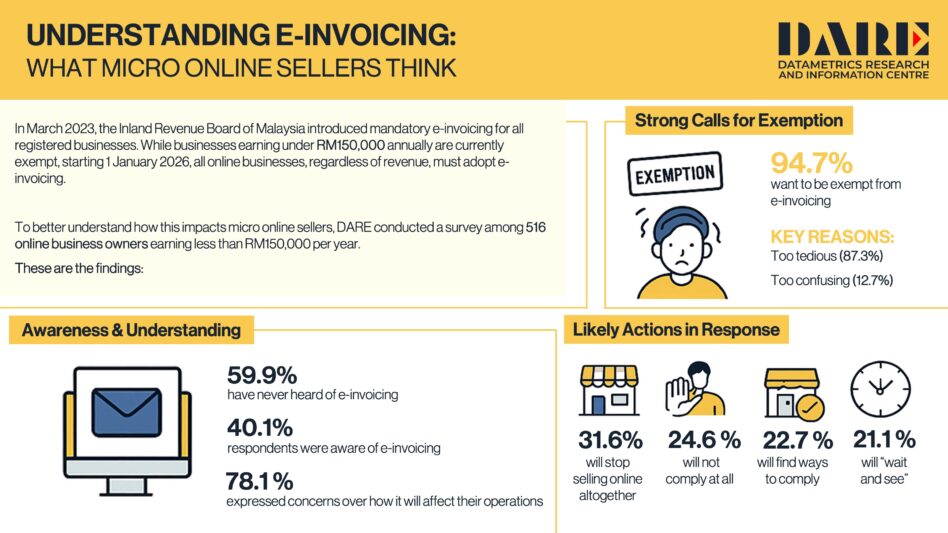

A POLL conducted by think tank Datametrics Research and Information Centre (DARE) has found that 94.7% of online business owners who are aware of e-invoicing are calling for exemption from the government’s mandatory e-invoicing requirement as they found it too tedious (87.3%) or too confusing (12.7%).

DARE’s survey which polled 516 micro online entrepreneurs earning less than RM150,000 a year over a two-week period through both online and on-ground channels also found that only 40.1% of respondents were aware of e-invoicing.

This points to a significant gap in outreach and readiness as the government plans to enforce mandatory e-invoicing for all businesses, including low-revenue online sellers with effect from Jan 1, 2026.

“The government’s push for e-invoicing is part of a broader effort to digitalise the economy but imposing this uniformly across all business types without exception, risks overwhelming the smallest players,” commented DARE’s managing director Pankaj Kumar.

“This poll was a two-week pulse check to capture the sentiment of micro online entrepreneurs in light of the growing number of news reports and public attention on e-invoicing. And the sentiment is clear – many are confused, concerned and feel unprepared.”

In Pankaj’s contention, the findings suggest a real need for the government to take a step back and conduct a more in-depth study into how such policies affect the micro-digital economy.

“At the same time, there must be targeted education and support initiatives to help small online sellers understand what’s required of them and how to comply, should they need to,” he pointed out.

“Without this, we risk making compliance unnecessarily difficult for the very group we should be supporting.”

As it is, the DARE survey found that the overall awareness and understanding of e-invoicing requirements are low.

More than half of the respondents (59.9%) had never heard of e-invoicing, and 78.1% expressed concern over how the new mandate would affect their day-to-day operations.

As for likely actions in response to the mandatory requirement, the poll found that 22.7% of respondents would attempt to comply while a larger portion (31.6%) said they would stop selling online altogether.

Another 21.1% planned to adopt a “wait and see” approach while 24.6% said they would not comply at all, signalling significant potential for non-compliance and disruption to the micro-digital economy.

According to Pankaj, outcome of the poll suggested a pressing need for policymakers to revisit the current approach, especially for micro online sellers operating at the margins of the digital economy.

“These are not large-scale enterprises with teams of accountants or digital infrastructure. Many of these online sellers are individuals trying to earn supplementary income through informal digital channels,” he justified.

“For them, implementing an unfamiliar, often technical system like e-invoicing is not just a procedural adjustment, it’s a significant operational disruption.”

Added Pankaj: If this group is forced to comply without adequate support or exemptions, we risk pushing them out of the digital economy entirely.

“It contradicts the very spirit of empowering micro-entrepreneurs and broadening economic participation through digital platforms.”

“Therefore, the government must re-think its one-size-fits-all approach and instead consider a phased, tiered or exempted model that protects and supports Malaysia’s smallest online sellers.” – April 25, 2025

Main image credit: esoft.my