PLANTATION profit is driven largely by palm oil prices, fresh fruit bunch (FFB) output and costs.

While international edible oil supply and demand often determine palm oil prices, FFB production hinges on yields and planted area.

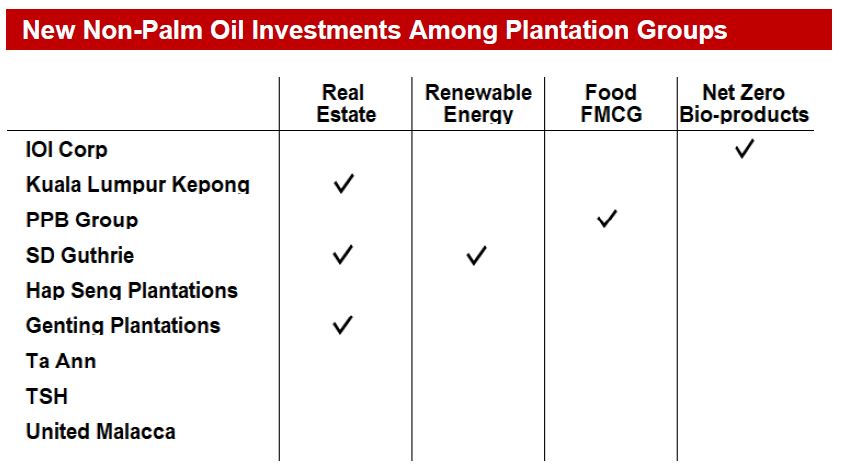

“As new planting for oil palm moderates with cost inflation likely over time, long-term earnings growth will have to rely on rising palm oil prices and other non-palm oil related income,” said Kenanga Research (Kenanga) in the recent Sector Update Report.

Building another business to grow earnings thus makes sense especially if that adds some stability to earnings.

Kenanga believes long-term ratings may improve. Historically, price to book value (PBV) can be a better valuation guide than price to earnings ratio (PER) for the plantation sector due to earnings volatility.

If sufficiently significant, new non-palm oil earning may nudge some planters to be valued based on PER which often leads to more generous valuation than strictly PBV driven ratings.

For 2025, the crude palm oil (CPO) prices have eased from the quarter four (Q4) 2024 levels with premium prices over soya bean oil having disappeared.

Bio-diesel demand has also contracted, notably in the US but buyers are busy re-stocking. Overall, a supply deficit remains likely in 2025 with inventory levels expected to worsen year-on-year (YoY).

Hence, prices are likely to stay firm, between RM4,000 to RM4,500 per MT. Our assumption is for CPO to average RM4,200 per MT in 2025 and RM4,000 in 2026.

The slightly higher CY25 price assumption is due to the high price premium enjoyed by palm oil over soyabean oil in 1QCY25, although this situation is reversing.

“Amidst current trade tension, tariff uncertainties and economic slowdown, we like plantations for its defensive earnings as food demand makes up approximately 70% of edible oil demand with 23% as bio-diesel fuel, hence demand is resilient with YoY uptrend likely even amid global economic slowdown or trade protectionism and tensions,” said Kenanga.

Their balance sheet remains strong as many planters hold net cash or manageable gearing. Also, margins will stay healthy thanks to firm CPO and strong PK prices, and ratings are not demanding. —Apr 29, 2025

Main image: Asian AGRI