THE US-China tariff rollback may not favour Malaysia glove makers, in Maybank Investment Bank (Maybank)’s view, as it could delay purchasing decisions due to ongoing uncertainty.

“We believe a reversion to the previous tariff schedule on China gloves remains possible, depending on the outcome of ongoing negotiations,” said Maybank in a recent report.

At the same time, new capacity from China glove makers in Southeast Asia, expected from 2026, poses a growing supply risk.

In their view, these risks outweigh potential returns, hence the Malaysia glove sector has been downgraded to negative.

The US and China have reached a surprise agreement to temporarily reduce reciprocal tariffs for 90 days.

Under the deal announced on 12 May 2025, the US will cut the additional tariffs imposed on China imports in Apr 2025 from 145% to 30%, while China will lower its tariffs on US goods from 125% to 10%.

The mutual tariff revisions will be effective from 14 May-12 Aug 2025. However, Trump’s 20% fentanyl-related levies on China, imposed in Feb and Mar 2025, will remain, while China will suspend or

cancel its non-tariff countermeasures imposed on the US since 2 Apr 2025.

As a result, China-made medical and surgical rubber gloves will face a combined US tariff of 80% from 195% during the temporary reduction period.

In contrast, vinyl gloves, which are not affected by the former Biden Administration, will enjoy the reduced rate and be subject to only 30% US tariff.

Following recent tariff reductions, the landed price of Chinese medical nitrile rubber gloves is expected to drop which still does not make them cost competitive with Malaysian/Thailand alternatives, said Hong Leong Investment Bank in the Sector Outlook Report.

Despite the tariff reductions, Chinese nitrile glove makers are unlikely to recapture US demand from ex-China manufacturers (namely Malaysia and Thailand), due to persistent high landed price disadvantages.

However, the lower landed prices of vinyl gloves could weaken the prevailing narrative of a potential demand shift from vinyl to nitrile rubber gloves, a trend which we reckon will help to absorb excess supply from China’s largest glove producer.

On a positive note, there is still potential for a gradual demand shift away from vinyl gloves to nitrile rubber gloves by US buyers, mainly benefiting Malaysian producers, should the ongoing 90-day tariff negotiations between US and China conclude unfavourably.

Notably, the current tariff reductions remain fluid and subject to change. This shift from vinyl to nitrile could help absorb the additional rubber glove capacity coming from Intco, supporting the path toward restoring supply-demand equilibrium by 2026, based on HLIB estimates.

For context, China dominates the US vinyl glove market with a 70-75% share and has been selling for USD9-10/1k pcs.

However, the earlier 145% tariff will drastically inflate the price of Chinese vinyl gloves to USD22.0-24.5/1k pcs, which is more expensive than generic nitrile rubber gloves (USD15-16/1k pcs).

While both vinyl and nitrile rubber gloves are Type-1 allergy-free, nitrile rubber gloves offer superior elasticity and provide a better barrier against contamination.

Moreover, the steep US reciprocal tariffs (presently on 90-day pause) on Vietnam (at 46%) and Indonesia (at 32%) could discourage Chinese glove makers from expanding there. HLIB downgrades the sector to neutral. —May 13, 2025

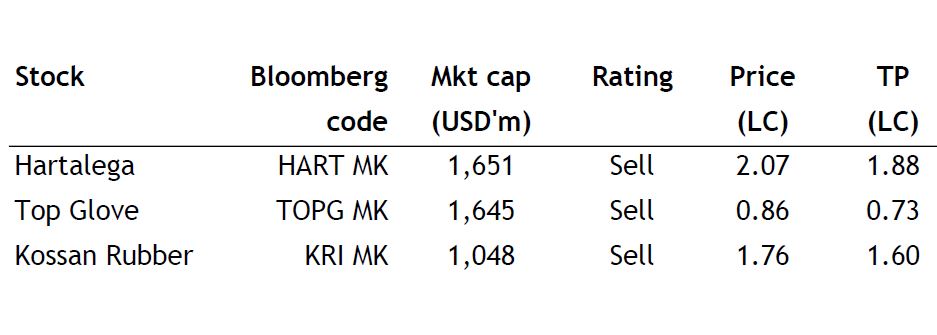

Main image: Bloomberg