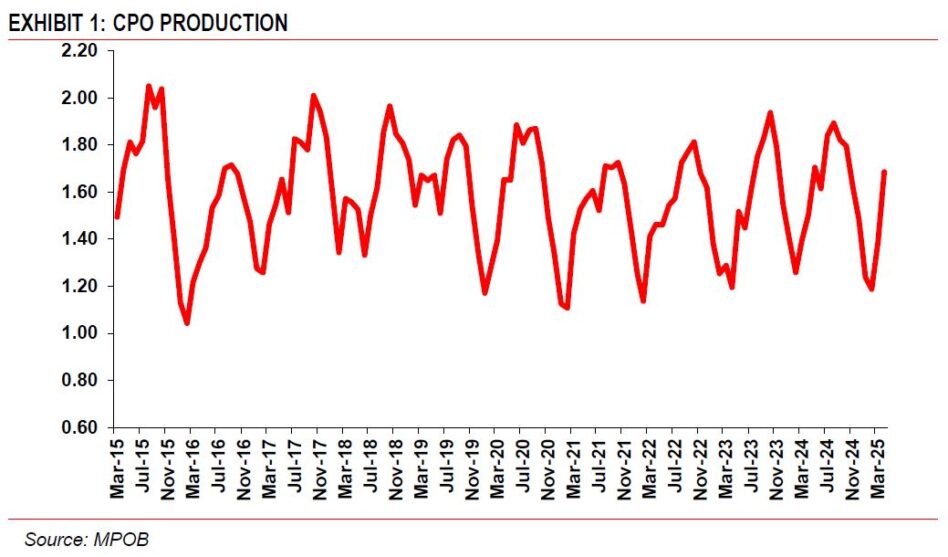

CRUDE palm oil (CPO) production soared by 21.5% month-on-month (MoM) to 1.7mil tonnes in April even after the 16.8% jump in March.

“We attribute the increase in fresh fruit bunch (FFB) yields in April to improved weather conditions and seasonal factors,” said AM Investment Bank (AMIB).

The second half (2H) is expected to account for 55% of full year’s CPO production while 1H is envisaged to make up the balance 45%.

CPO output in Sabah climbed by 26.3% to 384,803 tonnes in April from 304,638 tonnes in March while in Peninsular Malaysia, CPO production surged by 23.4% to 941,858 tonnes.

CPO output in Sarawak grew by a smaller 12.5% MoM to 359,301 tonnes in April. On a yearly basis, Malaysia’s CPO production eased by 1% to 5.5mil tonnes in the four months of 2025 (4M2025).

Palm imports slumped by 46.1% to 72,579 tonnes in April from 134,564 tonnes in March. On a yearly basis, palm imports amounted to 380,773 tonnes in 4M2025, more than two-fold higher than 163,717 tonnes in 4M2024.

Downstream companies in Malaysia have been buying CPO from Indonesia due to the huge price disparity.

“Going forward however, we expect palm imports to decline as the price differential between CPO in Malaysia and Indonesia has narrowed,” said AMIB.

“Going forward however, we expect palm imports to decline as the price differential between CPO in Malaysia and Indonesia has narrowed,” said AMIB.

Palm exports improved by 9.6% MoM to 1.1mil tonnes in April. After a lacklustre quarter one 2025 (1Q2025), demand for palm products is recovering.

“We reckon that demand would continue strengthening aided by the discount to US soybean oil and higher palm supply,” said AMIB.

According to Intertek, palm shipments to India climbed by 25.3% to 204,100 tonnes in April from 162,830 tonnes in March while exports to China surged by 54.4% to 83,980 tonnes.

On the other hand, Malaysia’s palm shipments to the EU sank by 21.1% MoM to 265,808 tonnes in April.

CPO’s average price discount to US soybean oil was 6.5% in April. In contrast, CPO was 13.2% more expensive than US soybean oil in March.

CPO prices retreated in April as palm production is increasing while soybean oil prices have been going up on the back of a potential increase in the US biodiesel blending mandate.

CPO prices retreated in April as palm production is increasing while soybean oil prices have been going up on the back of a potential increase in the US biodiesel blending mandate.

“If the US raises its biodiesel blending mandate to a range of 4.8 bil to 5.5 bil gallons from 3.4 bil gallons, we believe that 65% to 75% of US soybean oil would be used to produce biodiesel versus 47% presently,” said AMIB. —May 14, 2025

Main image: Malaysian Palm Oil Council