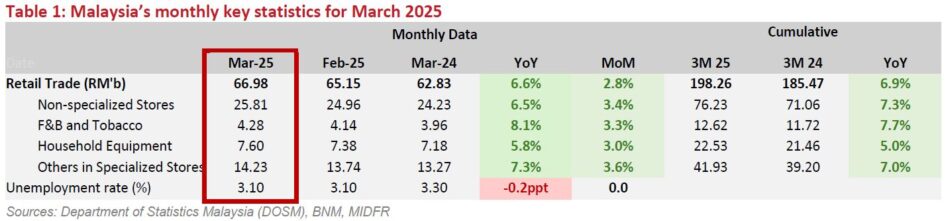

MALAYSIA’s retail trade continued to post firm growth, expanding +6.6% year-on-year (yoy) to RM66.98 bil in Mar-25, driven in part by elevated festive spending ahead of Hari Raya Aidilfitri.

Growth was broad-based across key segments, with food and beverages and tobacco sales rising +8.1% yoy, household equipment up +5.8% yoy, and non-specialised stores expanding +6.5% yoy.

On a monthly basis, retail sales rose +2.8% month-on-month (mom), marking a sequential recovery after February’s seasonal dip.

These trends reaffirm the sector’s resilience, anchored by strong demand fundamentals and festive-driven spending.

The labour market remained a key pillar of consumer resilience, with the unemployment rate holding steady at 3.1% for the fourth consecutive month.

At the same time, inflation remained well-contained. Headline CPI moderated further to +1.4% yoy in Mar-25, the lowest since Feb-21, while core inflation was unchanged at +1.9% yoy.

These suggested muted pricing pressure and sustained real purchasing power.

Together, a strong labour market, manageable price pressures, and sustained income growth continue to underpin household spending capacity and support retail sector growth.

“Looking ahead, we expect retail momentum to remain healthy, supported by structural drivers such as civil service pay hikes, minimum wage adjustments, cash assistance, and tourism recovery. These factors are poised to enhance disposable income and drive steady consumption growth,” said MIDF.

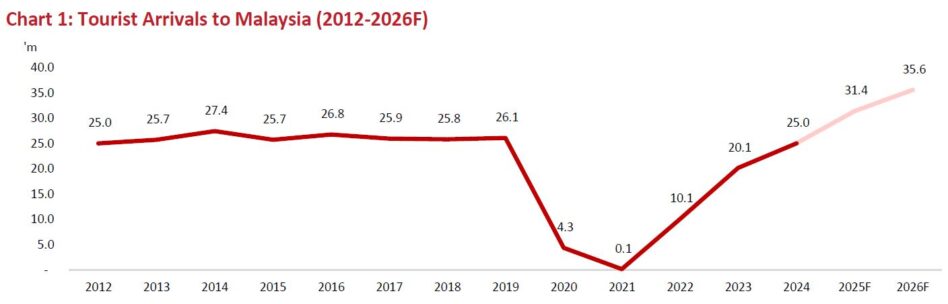

Malaysia’s tourism sector is off to a strong start in 2025, sustaining the solid momentum seen throughout 2024.

Malaysia welcomed 4.3 mil international tourists in the first two months of 2025, a +16.2% yoy increase, underscoring sustained demand from key regional markets.

Arrivals from China and India surged by +33.9%yoy and +34.2%yoy, respectively, reflecting the positive impact of visa-free entry initiatives.

The poultry sector remained stable in Mar-25, with average chicken prices inching up to RM10.56 per kg (+2.7%yoy) , reflecting healthy demand and manageable supply levels.

Egg prices, however, continued to trend lower year-on-year, with Grade A eggs at RM0.440 (-9.5%yoy), Grade B at RM0.419 (-12.5%yoy), and Grade C at RM0.391 (-11.5%yoy).

The softness in egg prices aligns with improved production efficiency and continued feed cost moderation, particularly with soybean meal and corn prices remaining subdued.

While this trend is favourable for consumers, poultry producers are expected to benefit from improved cost efficiency, particularly with input costs such as corn and soybean meal remaining relatively contained.

“We maintain our POSITIVE outlook on the consumer sector, supported by a convergence of macroeconomic stability and sector-specific tailwinds,” said MIDF.

In MIDF’s view, the sector is well-supported by five key catalysts:

(1) Rising disposable income, fuelled by broad-based wage adjustments, civil service salary revisions, and sustained government support.

(2) Resilient household spending, anchored by a robust labour market and low unemployment.

(3) A continued surge in tourist arrivals, which is set to lift footfall across F&B and retail channels.

(4) Improving cost dynamics, as a firmer ringgit and lower commodity prices ease margin pressures.

(5) The sector’s defensive earnings profile, with consumer staples offering attractive downside protection amid market volatility. —May 14, 2025

Main image: Economic Intelligence