MIDF Research (MIDF) expects domestic demand to continue to be the key driver of Malaysia’s economic growth in quarter one calendar year (1QCY25).

This was underpinned by positive fundamentals like a healthy labour market, sustained employment growth with high labour force participation, increased tourist arrivals as well as no strong price pressures.

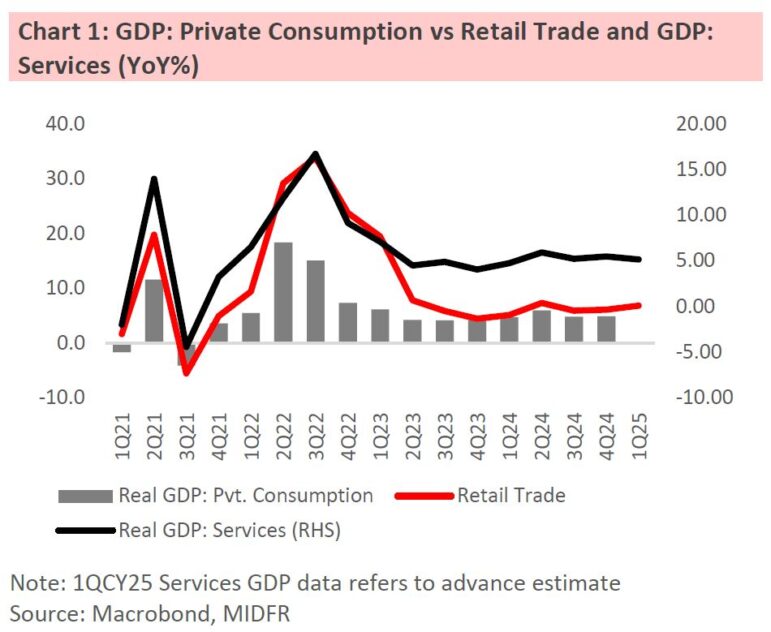

“We anticipate a sustained growth in private consumption considering the stronger expansion in retail trade and sustained albeit marginally slower rise in services sector as shown in the advance estimate,” said MIDF.

With employment growth growing robustly at +3.0% year-on-year (yoy) in 1QCY25, continued expansion in economic activities and increased labour demand also kept unemployment rate low at 3.1%, with unemployment count falling further by -5.0% yoy.

Meanwhile, inflation remained low and stable as the headline CPI increased slower at +1.5% yoy in 1QCY25.

“We remain positive, despite challenges to growth outlook from the uncertainties on the external front, Malaysia can still maintain growth this year backed by growing domestic demand,” said MIDF.

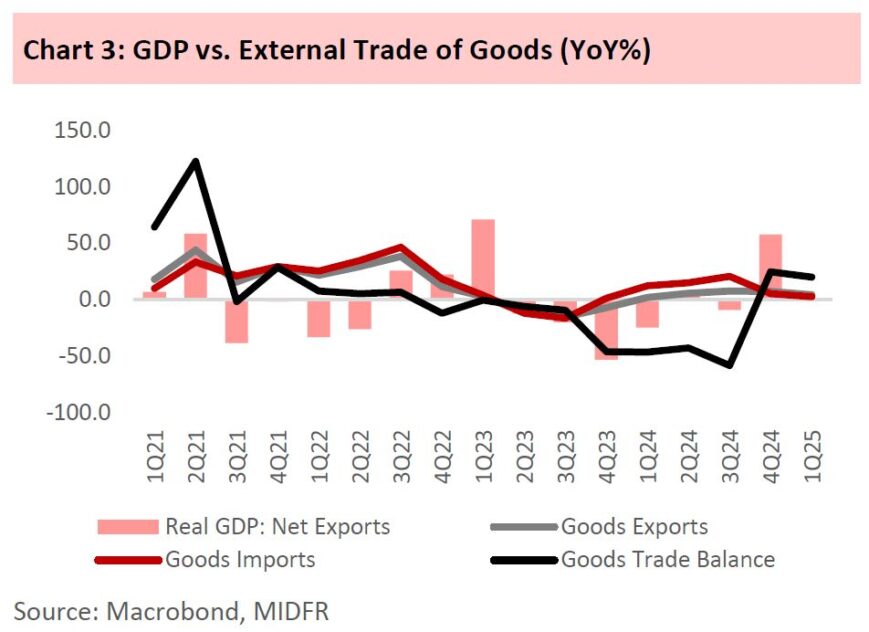

MIDF expects external demand will continue to contribute positively as net exports of goods were higher than a year ago.

This was attributable to relatively more robust growth in goods exports (1QCY25: +4.4% yoy) vis-à-vis goods imports (1QCY25: +2.8% yoy), although the pace of growth was more moderate from the previous quarter.

In particular, the domestic exports of goods grew at +4.8% yoy on the back of increased shipments of E&E products; palm oil & palm oil products; machinery, parts & equipment; and rubber products.

In terms of markets, sustained growth in exports to the US and Taiwan more than offset the weakness in exports to China, Japan and several ASEAN countries.

“Overall, we expect exports of services will also contribute positively to 1QCY25 GDP growth following further improvement in tourism activity and increased tourist arrivals,” said MIDF.

MIDF expects the full data for 1QCY25 GDP will show the growth in the manufacturing sector will be around the same pace as indicated in the advance estimate.

This is because the manufacturing IPI grew by +4.2%yoy in the first three months of 2025. Similarly, in the advance GDP estimate, the manufacturing sector’s growth moderated to +4.2% yoy.

MIDF believes the moderate output growth was in line with the easing in growth of goods exports. Given the pace of growth is similar, they do not expect any significant change to the manufacturing industry’s growth.

Meanwhile, the slower decline in mining IPI suggests there could be some upward revision to the mining GDP growth, which was estimated to have contracted steeper by -4.9%yoy due to weaker production of crude oil and natural gas.

The pace of growth in the construction sector remained robust as the construction work done still grew at double digit albeit moderating to +16.6%yoy in 1QCY25.

The work done by the private sector increased by +23.7% yoy, sustaining double-digit growth for the 5th consecutive quarter.

More than 70% of the private works were in the residential and non-residential buildings, which grew robustly at +26.5% yoy and +25.4% yoy.

For the public sector, the progress of works done by the government remained encouraging, rising by +13.1% yoy with stronger growth in non-residential sector and special trade activities.

Meanwhile, works done by the public corporations showed improvement, falling at a slower pace of – 0.3% yoy; but the decline was due to lower progress in the non-residential buildings (-45.2%yoy).

Looking at the moderate trend in construction work done, MIDF expects the construction sector will be around the same rate of +14.5% yoy as indicated in the advance estimate, moderating from +20.7% yoy in 4QCY24.

Taking into accounting the recent indicators and updates, MIDF estimate the full-quarter GDP growth for 1QCY25 will be similar to the advance estimate of +4.4% yoy, moderating from +5.0% yoy growth in 4QCY24.

“For the year, we still forecast Malaysia’s GDP growth to moderate to +4.0%, where domestic demand will be the key contributor to growth mitigating the effect of slowdown in external trade,” said MIDF.

Despite de-escalation in trade tensions recently, MIDF remain cautious that the uncertainties from the global trade war and possible shocks to the global supply chain will be among the downside risks that could affect Malaysia’s growth outlook this year. —May 16, 2025

Main image: Property Genie