SOLAR energy, harnessing over 170,000 terawatts, 10,000 times global consumption, is pivotal to energy transition.

“With an 89% levelised cost of energy decline from 2010-22 and a 27% capacity compounded annual growth rate (CAGR), global PV capacity hit 1.4 terawatt (TW) in 2023,” said Hong Leong Investment Bank (HLIB).

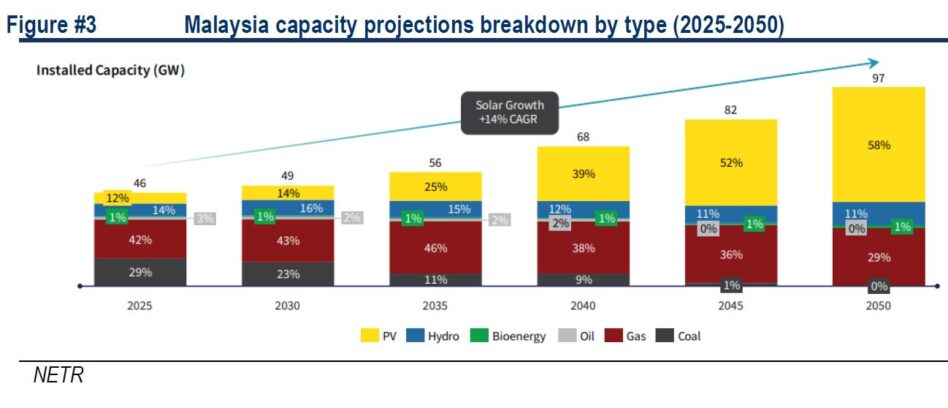

Malaysia with a 269 gigawatt (GW) solar potential targets 57 GW capacity by 2050 driven by convincing economics.

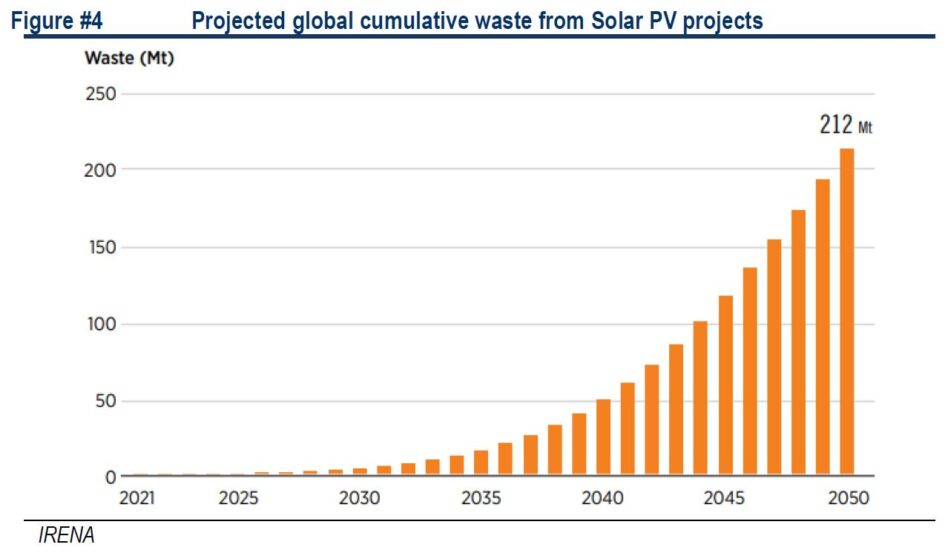

However, panels’ 25-30 year lifespan mean early 2000s installations are nearing end-of-life (EOL) and IRENA estimates 212 mil tonnes of global PV waste by 2050.

Recycling recovers valuable silicon and silver, but Malaysia’s nascent infrastructure requires robust guidelines to ensure a sustainable circular economy.

Solar energy’s environmental benefits hinge on robust end-of-life management to prevent waste from undermining its ecological gains.

Improper disposal risks leaching hazardous materials like lead, threatening ecosystems.

Recycling valuable materials such as silicon, silver, and copper reduces reliance on virgin resources, mitigating mining and manufacturing impacts and fosters a circular economy that minimises solar’s footprint.

The global solar panel recycling market is poised for significant growth, with forecasts projecting a 20-30% CAGR from 2022-2030 driven by regulatory mandates, technological advancements and rising environmental awareness.

Innovations enhancing recycling efficiency will improve economics, thereby incentivising broader adoption.

Malaysia is developing its solar waste management guidelines, trailing behind regions like the EU (WEEE Directive) or Singapore’s RSA.

Malaysia’s Environmental Quality Act 1974 broadly governs e-waste, while draft guidelines reportedly explore EPR, buyback systems, and collection centres.

HLIB’s visit to Zenviro Solar reveals existing challenges:

(i) many panels are landfilled or warehoused.

(ii) re-exported to poorer nations raising circularity concerns.

Challenges in recovery are also hampered by weak economics from lack of scalability, perhaps lack of regulatory mandates, while specialist recyclers struggle with financing.

Through proper recovery methods, close to 85% of a panel can be recovered while market value of these materials could amount to RM64 per panel.

“We make no changes to our oveweight sector rating due to strong structural themes as well as positive earnings growth cycle,” said HLIB.

Key catalysts include contract rollout and fresh RE quotas. HLIB identifies execution, slower-than-expected DC builds and cost pressure as risks. —May 16, 2025

Main image: The Edge