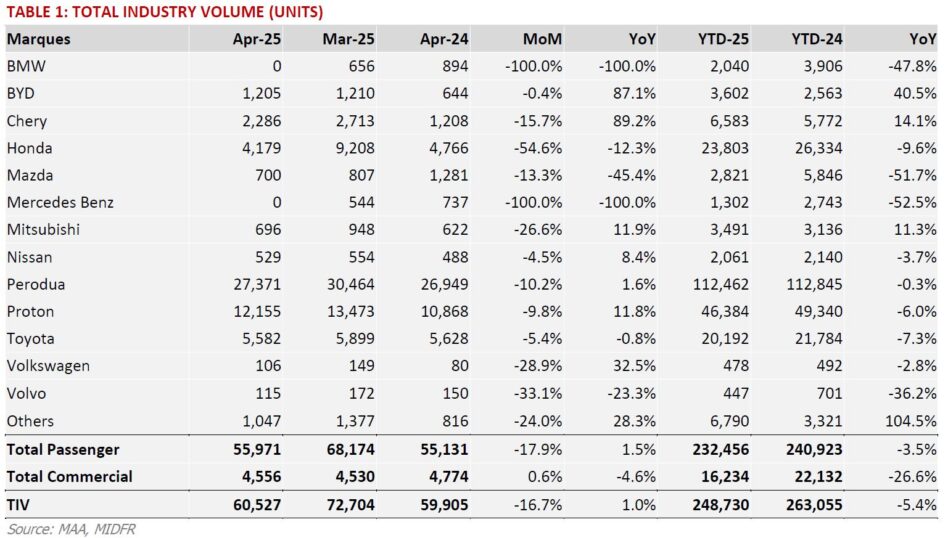

TOTAL industry volume (TIV) for Apr-25 stood at 60,527 units or an increase of 1.0% year-on-year (yoy).

“The softer month-on-month number was anticipated due to the extended Hari Raya Aidilfitri holiday break,” said MIDF Research in the recent monthly sector report.

On the production front, total industry production declined to 56,313 units ( -1.0% yoy), bringing the cumulative total to 233,916 units (-12.5% yoy).

The year-to-date weakness appeared broad-based across major marques, though the national marques showed slightly greater resilience.

Defying the overall market trend, the relatively new entrants BYD (+40.5% yoy) and Chery (+14.1% yoy) continued to register strong growth.

Notably, BYD’s market share in the passenger vehicle segment has increased to 3% year-to-date, driven by the launch of competitively priced new BEV models.

TIV in May-25 is expected to improve month-on-month, supported by stronger demand from East Malaysia ahead of the Kaamatan and Gawai celebrations, as well as a greater number of working days.

This will be further supported by sustained interest in new models introduced earlier this year.

The targeted RON95 subsidy rollout appears slightly delayed, likely to take place in the later part of second half 2025. The top 15% income group, yet to be identified, will be excluded, with eligibility verified via MyKad.

The programme is now under the Finance Ministry following its handover from the Economy Ministry.

The policy may prompt some consumers to down trade or shift to EVs, particularly with the approaching expiry of complete build up EV tax exemptions by end of this year.

With the revised excise duty for complete knockdown vehicles now scheduled to take effect on Jan 26, potentially raising car prices by +10% to +30% if the ruling is upheld, there may be some degree of frontloading in demand this year. —May 21, 2025

Main image: SGS