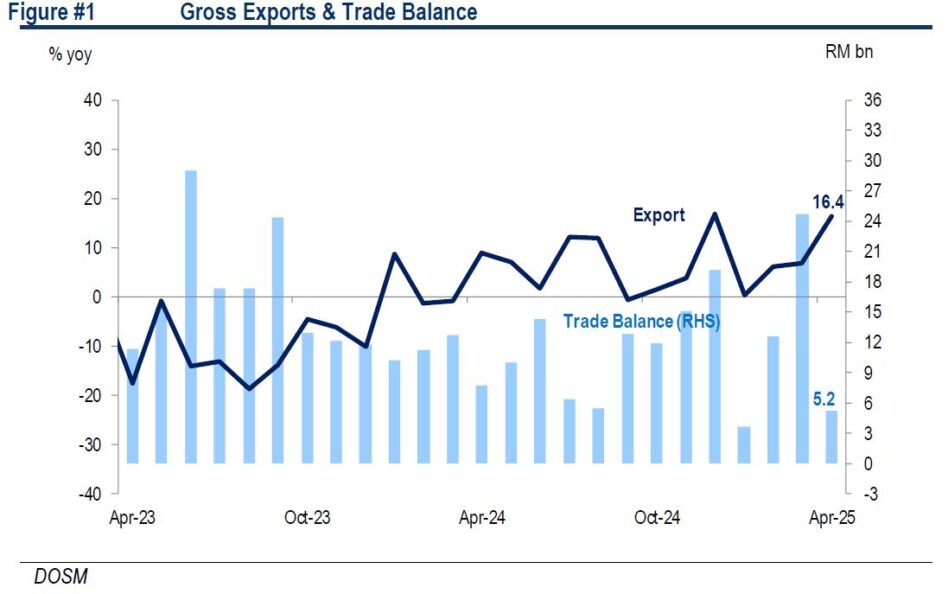

EXPORTS growth picked up substantially to +16.4% in Apr, largely surpassing consensus expectations of +7.5%. Meanwhile, imports rebounded strongly by +20.0%. Note that this is measured on a year-on-year basis.

“On a monthly basis, imports recorded larger expansion but exports slipped into contraction leading to a narrower trade surplus of RM5.2 bil,” said Hong Leong Investment Bank (HLIB) in a recent report.

In terms of major export markets, exports to the US remained robust (+45.6%), underpinned by sustained demand for E&E products, likely amplified by front-loading activities, as suggested by multiple surveys.

Similarly, exports to ASEAN jumped (+18.6%), while Japan (+6.8%) and China (+2.1%) recorded a positive turnaround.

In contrast, exports to the EU moderated (+5.8%). Exports of manufactured products expanded further (+21.6%), translating into an increased positive contribution of +17 ppt to overall exports growth.

The advance was lifted by a jump in exports of E&E products (+35.4%), consistent with faster growth in global semiconductor sales.

At the same time, export growth of machinery, equipment & parts nearly tripled (+31.0%), and optical & scientific equipment rebounded strongly by +14.0%.

Commodity-related exports continued to fall, albeit at a significantly softer pace (-2.6%).

Growth was dampened by persistent weakness in exports of petroleum products (-9.3%) following continued decline in both export volume (-23.8%) and average unit value (-14.7%).

Moderation was recorded for exports of palm oil (+1.8%) and rubber products (+3.4%). Conversely, exports of LNG rebounded (+6.7%), while crude petroleum registered a notably smaller drop (-8.7%).

Imports growth posted a sharp turnaround (+20.0%), primarily attributed to robust demand for capital goods (+114.1%) from the US, offsetting the contraction in intermediate (-1.7%) and consumption imports (-0.7%).

“In the near-term, we expect Malaysia’s exports to remain high, driven by front-loading purchases as companies take advantage of the 90-day reciprocal tariff pause that is expected to end on 8th Jul,” said HLIB.

The trade outlook remains subject to ongoing trade negotiations, potential semiconductor tariff under section 232 and likely economic downturn in key trading partners, with the overall balance of risks tilted to the downside in 2H25.

“As such, we keep our 2025 gross domestic product forecast unchanged at +4.0%, supported by domestic demand amid prevailing uncertainties,” said HLIB. —May 21, 2025

Main image: Business Recorder