AUTOCOUNT Dotcom Bhd, a Malaysian developer/distributor of accounting and business software, has posted its highest-ever quarterly financial performance to date via its 1Q FY2025 ended March 31, 2025 results.

The ACE Market-listed company saw its net profit swelled 235.4% year-on-year (yoy) to RM13.65 mil (1Q FY2024: RM4.07 mil) underscoring the strong demand for its e-invoicing solutions.

The robust profitability was supported by the group’s highest-ever quarterly revenue of RM25.55 mil, a 86.9% hump from RM13.67 mil in the corresponding quarter last year.

This exceptional performance was primarily driven by increased adoption of AutoCount’s e-invoicing module which aligned with the government’s on-going efforts toward digitalisation and compliance.

Additionally, AutoCount also reported strong operating cash flow of RM17.32 mil in the quarter, demonstrating the group’s financial resilience and solid capability to fund its on-going growth initiatives.

Net profit margin improved significantly to 53.4%, benefiting from a favourable cost structure which includes largely fixed expenses such as staff-related costs which do not increase proportionally with revenue, thus enhancing the operating leverage as revenue expands.

“Our record 1Q FY2025 performance highlights our strategic success in capitalising on the growing e-invoicing market,” commented of AutoCount’s managing director Y.T. Choo.

“Our scalable cost structure has enabled us to effectively convert increased revenues into higher profitability while our strong cash flow positions us well to sustain this growth trajectory.”

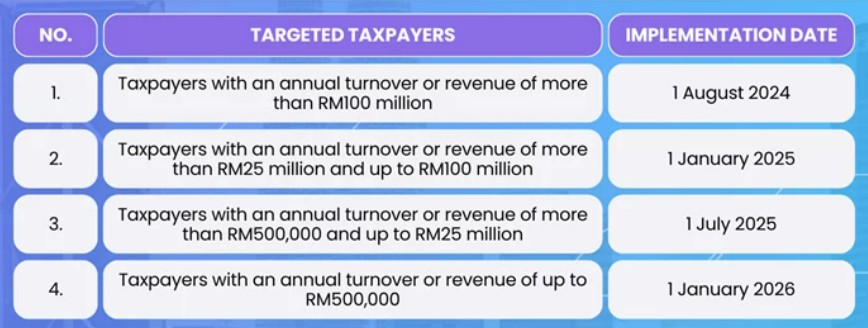

Moving forward, AutoCount remains optimistic about its future performance driven by the forthcoming implementation phases of Malaysia’s e-invoicing mandate.

Phase 3 which affects businesses with annual revenues between RM500,000 and RM25 mil will begin on July 1 followed by Phase 4 on Jan 1, 2026 which covers businesses with annual revenues between RM150,000 and RM500,000.

Moreover, the recently introduced AutoCount OneSales PalmPOS, a mobile POS solution designed specifically for micro-SMEs, is expected to further enhance the group’s growth opportunities while enabling small businesses to adopt digital financial practices seamlessly.

“With a clear market demand, robust solutions and supportive regulatory frameworks, we anticipate continued strong double-digit growth in both our top and bottom lines for FY2025,” projected Choo.

“Our unwavering commitment to innovation and supporting businesses through their digital transformation ensures our continued market leadership.”

At 9.30am, AutoCount was up 7 sen or 6.25% to RM1.19 with 4.07 million shares traded, thus valuing the company at RM655 mil. – May 27, 2025