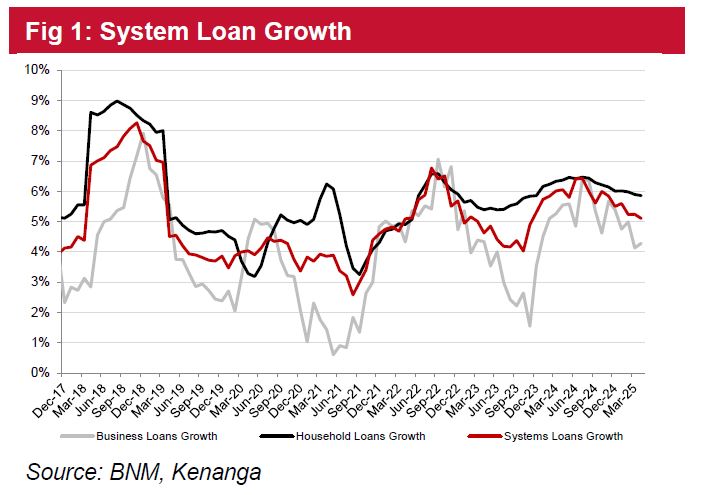

IN Apr 2025, system loans grew by 5.1% year-on-year (YoY) which Kenanga deemed within their 6% target for 2025, as in anticipation of loan disbursements to be more heavily reflected in the second half of 2025 from the growing application base.

Household loans (+5.9%) remain helmed by residential mortgage and auto loans (+7.0%).

While business loans saw a 4.0% expansion led by working capital loans, it seemed to decline on a month-to-month (MoM) basis (-0.6%), likely due to higher maturity tied against the festive seasons.

Most service industries did see a MoM decline, whereas manufacturing and construction sectors held as workflows slowly picked up towards the mid-year period.

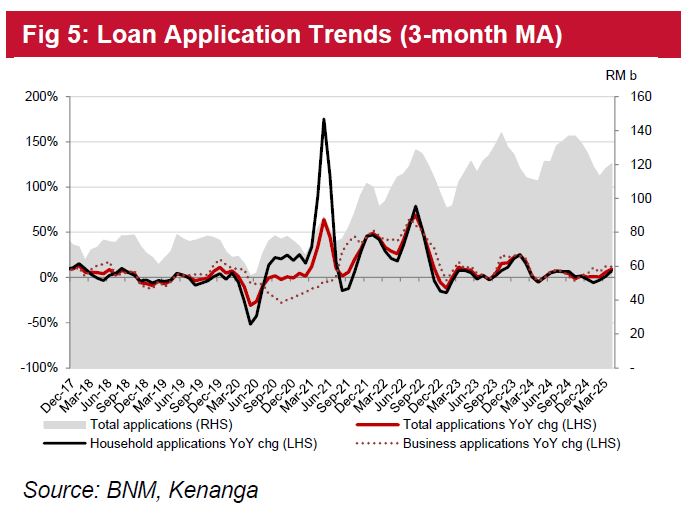

Overall applications grew by 11% YoY and 5% MoM, with both being lifted by business loans over housing loans.

Feedback from the Malaysian banks indicate that customers with direct trade-relationships with the US constitute less than 5% at most, while second order could be upwards to the high-teens.

Overall approval rates did ease slightly to 50.6% as banks likely remained cautious from looming macro-economic uncertainties, albeit not as tightly as it was in Jan 2025 when approval rates sat at 42.7%.

At least from the business loans perspective, the implications from US tariffs are perhaps more moderate than expected, hence the reason why Kenanga continued to see improvements in business gross impaired loans.

Most banks anticipate one overnight policy rate cut in the second half, which resulted in more concerted efforts to drive shorter-term fixed deposit products.

“Post-earnings season, we continue to find most banks to be resilient, comforted by their relatively low trade-related exposure of less than 5%, being more focused on respective domestic segments with a stronger focus on housing loans and small, medium enterprises,” said Kenanga.

Still, sector valuations declined likely due to foreign investors preferring a lower exposure to emerging markets, notwithstanding prolonged uncertainties that stemmed from trade tensions between US and China. —June 3, 2025

Main image: MRI Network