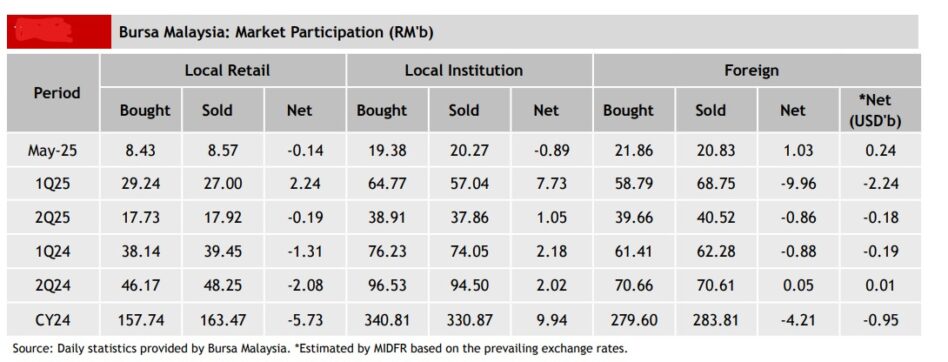

FOREIGN investors extended their streak of outflow on Bursa Malaysia to a second week for the May 26-30 trading period with a net withdrawal of RM1.02 bil which is nearly 2.6 times higher than the previous week’s outflow of -RM392.3 mil.

They were net sellers on every trading session with outflows ranging from -RM61.4 mil to -M456.7 mil, according to MIDF Research.

“The largest outflow was recorded on Friday (May 30) at RM456.7 mil followed by Thursday (May 29) with RM234.6 mil,” observed the research house in its weekly fund flow report.

“The three sectors that recorded the highest net foreign inflows were property (RM47.9 mil), construction (RM33.3 mil) and energy (RM5.2 mil).”

Meanwhile, the top three sectors with the highest net foreign outflows were financial services (-RM565.8 mil), consumer products & services (-RM172.2 mil) and healthcare (-RM129.9 mil).

On the contrary, local institutions continued with their two-week buying streak with net inflow amounting to RM876.5 mil which brings their YTD (year-to-date) net buying to RM8.78 bil.

Meanwhile, local retailers also extended their trend of net buying to two weeks by posting a net inflow of RM142.6 mil.

The average daily trading volume (ADTV) saw a broad-based incline last week. Local institutions and local retailers recorded marginal increases of +0.03% and +1.0% respectively but that of foreign investors rose exponentially by +45.6%.

In comparison with another four Southeast Asian markets tracked by MIDF Research, only Indonesia recorded its third consecutive week of net of net inflow at US$90.6 mil.

However, the Philippines extended its selling streak to three successive weeks with a foreign withdrawal of -US$266.3 mil last week, followed closely behind by Thailand with a net outflow of -US$137.6 mil to reverse a one week buying streak.

Vietnam posted the smallest foreign withdrawals of the four regional markets at -US$104.3 mil last week to extend its net outflow to a second week in a row.

The top three stocks with the highest net money inflow from foreign investors last week were Sunway Construction Group Bhd (RM74.0 mil), Telekom Malaysia Bhd (RM58.0 mil).and Tenaga Nasional Bhd (RM53.0 mil). – June 3, 2025