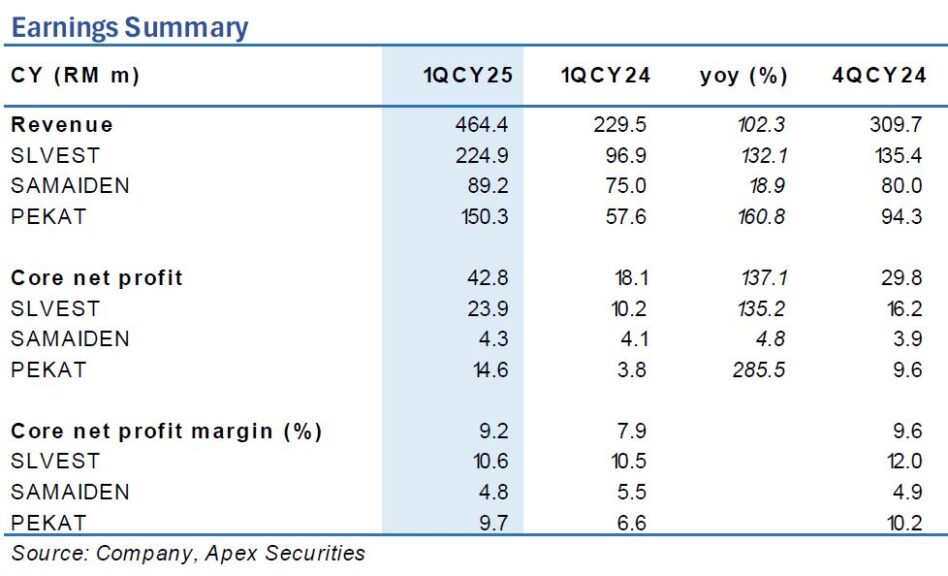

RENEWABLE energy solar players have shown commendable results for the first quarter.

The sector’s core earnings surged by 43.9% quarter-on-quarter, primarily attributable to higher revenue recognition from CGPP projects.

SLVEST and PEKAT reported strong earnings growths, primarily due to increased contributions from the EPCC solar segment.

Earnings growth was supported by higher revenue recognition from CGPP projects and greater demand in the C&I rooftop solar segment, which was likely influenced by the 14.2% increase in base tariff announced by TNB for the upcoming regulatory period (2025–2027).

For PEKAT, results also reflected two additional months of contribution from EPE Switchgear within the Power division.

“Meanwhile, SAMAIDEN recorded the weaker results among the covered companies,” said APEX Securities in a recent report.

Although earnings improved, the results were still below expectations primarily due to slower progress on CGPP projects and higher administrative costs.

“We expect solar EPCC contractors under our coverage to see sustained earnings improvement in the coming quarter, supported by the accelerated growth phase of the S-curve for CGPP EPCC projects,” said APEX.

Near-term order book replenishment is anticipated to be driven mainly by LSS5, with an estimated 50% of unallocated EPCC project opportunities valued at RM2.9 bil.

The sizeable project pipeline should keep solar EPCC contractors active until the end-2027.

The recent decline in solar module prices following the brief rebound in April has now stabilised at USD0.09/w, is expected to reduce the overall costs of solar systems. Lower system costs are likely to accelerate project pipeline conversions and reinforce the momentum of order replenishment for solar EPCC contractors.

As of 31 Mar 2025, the total unbilled order book for Solar EPCC contractors under our coverage rose to RM2.2 bil, up from RM2 bil at the end of 2024, notably with SLVEST’s order book reaching a record high of RM1.2 bil.

The ongoing rollout of LSS5 contracts continues to drive project opportunities, lifting the latest total unbilled order book to an estimated RM2.6 bil.

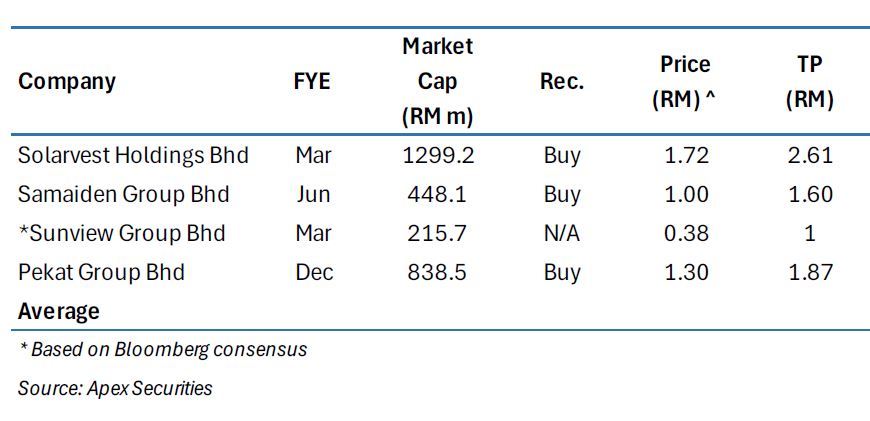

“We maintain our OVERWEIGHT recommendation on the RE sector, supported by the consistent rollout of strong RE initiatives and robust growth prospects,” said APEX. —June 4, 2025

Main image: Selfwealth