THE Madani government is strongly urged to cease the repeated deferments of its e-invoicing exercise by openly acknowledging the current lack of readiness for implementation and to embark on a comprehensive review of the nation’s long-term tax structure.

This is because the series of repeated delays are unfair to businesses that have already invested significant time and resources in preparation for the exercise, according to MCA’s Selangor Youth Chief Tan Jie Sen.

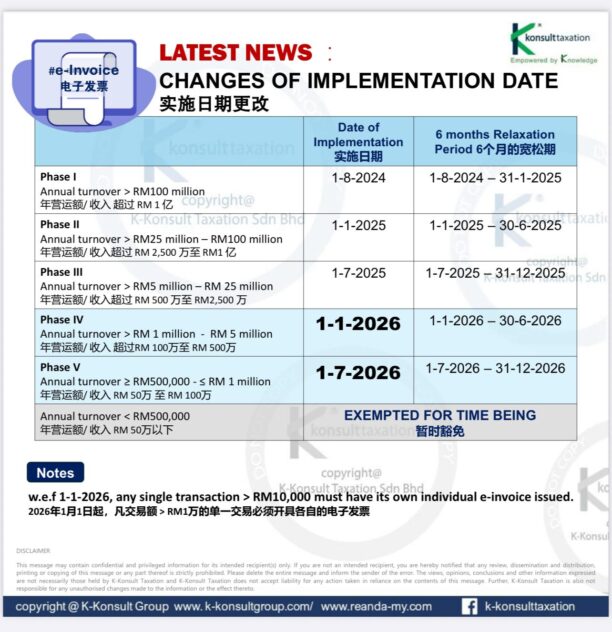

On Thursday (June 5), the Inland Revenue Board (IRB) announced yet another delay in its implementation of the e-invoicing system which is originally scheduled to be enforced this year for companies with an annual turnover of RM1 mil.

Following exemption granted to businesses earning less than RM500,000 annually, the e-invoicing implementation phase for taxpayers with annual income of RM1 mil up to RM5 mil is now postponed to Jan 1, 2026 while that of taxpayers with annual income or sales up to RM1 mil has been deferred to July 1, 2026.

“More critically, such indecisiveness undermines public and business confidence in government policy,” Tan who is also an MCA Youth central committee member pointed out in a statement.

“The postponements also reflect unresolved issues within the current e-Invoice framework and its support infrastructure.

“The Finance Ministry (MOF) and the IRB must be transparent about these shortcomings by providing a concrete and practical plan for improvement rather than resorting to indefinite delays.”

In a related development, MCA also took a swipe at the recent announcement by Deputy Finance Minister Lim Hui Ying that the government will soon expand the scope of the Sales and Service Tax (SST) via a gazette next week.

“This effectively amounts to a backdoor tax increase and lays bare the fiscal pressures facing the national treasury,” asserted Tan.

“Given the current state of strained public finances and rising fiscal burdens, the government must set aside political prejudices and seriously consider the reintroduction of the Goods and Services Tax (GST).”

He added: “Compared to the existing SST regime, GST offers a more structured, transparent and broad-based taxation model. It is also a more sustainable mechanism that can cushion the socioeconomic impact of subsidy removals in the future.” – June 7, 2025