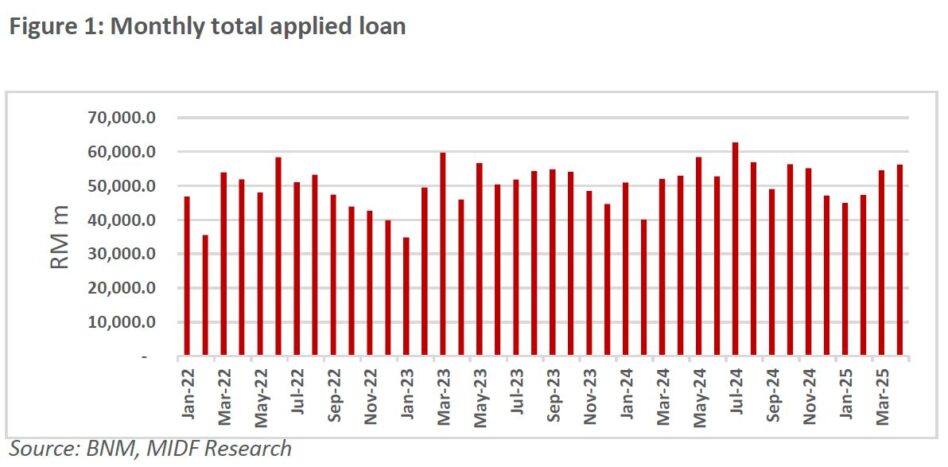

ACCORDING to data released by Bank Negara Malaysia (BNM), total loan application for purchase of property increased for three consecutive months on a year-on-year basis.

Total loan application gained +6.1% year-on-year (yoy) to RM56.2 bil in April 2025 after growth of +4.8% yoy and +18% yoy in March 2025 and February 2025 respectively.

“On a monthly basis, loan application in April 2025 remains resilient by growing +3.1% month-on-month (mom) despite the public holiday for Hari Raya Aidilfitri,” said MIDF Research (MIDF).

The higher loan application indicates that buying demand on property in Malaysia is stronger. On a yearly basis, approved loans increased for three consecutive months, climbing by +1.2% yoy in March 2025.

Approved loan recovers to the highest level in eight months, underpinning by higher loan application and higher loan approval ratio.

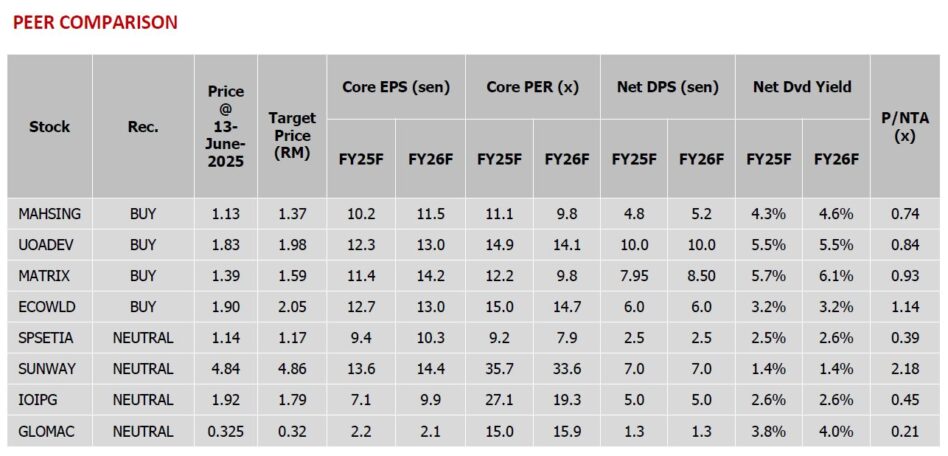

Quarter one of 2025 earnings of property companies were largely in line. Five property companies reported earnings that met expectation, one reported earnings that beat expectation and one recorded earnings that missed expectation.

Overall, most of the property companies recorded earnings growth except for SP Setia and IOI Properties Group which were due to higher earnings base in quarter one of 2024.

On a positive note, the earnings increase of other developers are mainly driven by higher progress billing of ongoing projects.

Meanwhile, new property sales are largely in line with expectation as sales are anticipated to pick up in the second half of 2025 amid acceleration of project launches.

In a nutshell, most of the developers are targeting higher sales in 2025 as market condition is favourable with stable demand for property.

“We remain positive on the property sector as buying interest on property is expected to remain healthy,” said MIDF.

Property sales of property companies are generally stronger which should underpin earnings growth going forward.

Meanwhile, impact of SST on property companies is expected to be minimal as residential buildings are exempted from 6% SST.

“On the other hand, we see limited impact on earnings from SST imposed on commercial and industrial buildings as we expect marginal impact on margin considering the strong demand for industrial assets,” said MIDF. —June 16, 2025

Main image: BossBoleh