KENANGA Research (Kenanga) believes many developers who were unsuccessful in the Fifth Large Scale Solar programme (LSS5) will pivot to LSS5+ as an alternative path for project development.

Asset owners from previous LSS rounds, with proven track records, are well-positioned to benefit.

“We see strong chances for CYPARK, MALAKOF, SDG, SUNVIEW, JAKS, and SLVEST to secure awards given their previous unsuccessful bids in LSS5 and their likely continued interest in the programme,” said Kenanga.

But with a likely higher Bumiputera participation this time, this should improve the chances for the former three, such as MALAKOF, CYPARK and SDG.

“Up for grabs are sizable allocations of up to 500MW, which could strain balance sheets, though this could be surmounted via Bumiputera-led joint ventures in our view,” said Kenanga.

Assuming awards mirror the 100MW blocks seen in LSS5, Kenanga estimates around 15 awards remain up for grabs.

With the current solar panel prices, Kenanga expects winning tariffs to land between RM0.14 per kWh and RM0.18 per kWh, supporting a project IRR of roughly 8%.

Order books are hitting all-time highs as solar EPCC players race to deliver Corporate Green Power Programme (CGPP) projects before the end-2025 deadline.

At the same time, 4GW worth of LSS5 and LSS5+ contracts are about to hit the market, with completions targeted by end-2027, unlocking at least RM10 bil in solar EPCC value.

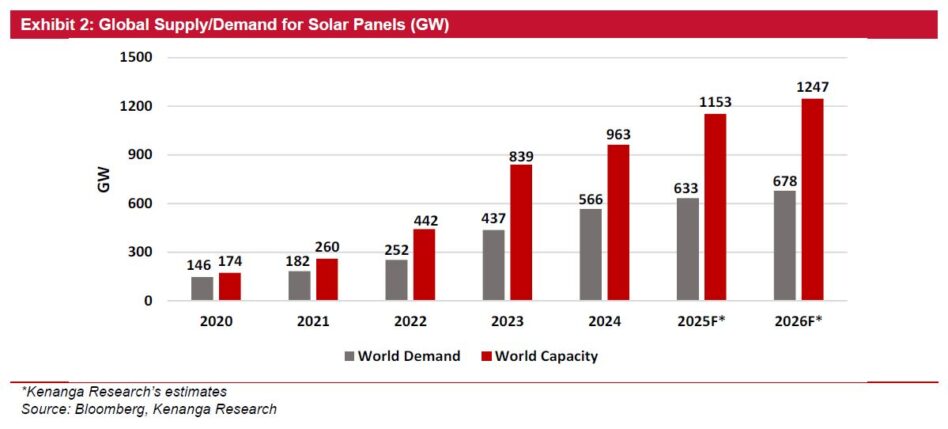

Kenanga projects average module prices to dip slightly as Tier-1 manufacturers flood the market.

Still, with weaker solar manufacturers exiting, a price rebound is possible, though not likely in 2025.

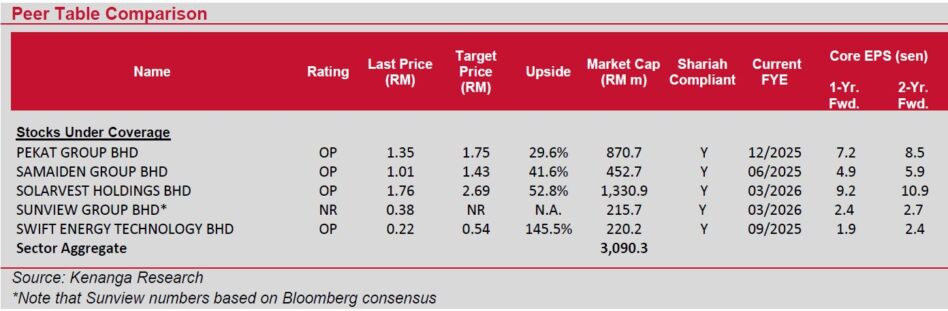

Given the low IRR of ~8% in LSS jobs and rising cost risks, Kenanga remain bullish on EPCC contractors over asset owners.

“In this space, we see market leader SLVEST stands out as a key beneficiary, expected to grab at least 30% of the EPCC market share,” said Kenanga.

Kenanga’s sector top picks are niche players like PEKAT and SET that stand out as profitability-focused RE players, offering cheap proxies to the RE play.

With contract awards expected to accelerate in the coming months and management maintaining a conservative outlook, upside surprises remain on the table.

PEKAT stands out for its focus on high-margin residential and commercial rooftop solar projects but the game changer here is its newly acquired switchgear business.

As the top four MV switchgear supplier to TNB, EPE is set to ride on TNB’s massive RP4 capital expenditure with further upside from leveraging on PEKAT’s network to capture a larger slice of private sector deals like DCs.

SET, the only certified player in explosion proof solar PV systems in ASEAN, is strategically positioned to ride the region’s growing focus on RE within the O&G up-cycle.

Regional giants (PTTEP, PTSC, Pertamina) are ramping up aggressively driven by favourable crude oil prices with net-zero commitment by 2050 guaranteeing continued green investments. —June 17, 2025

Main image: AFP Photo