ENERGY Asia is an annual event that brings together global leaders, policymakers and industry players to discuss challenges and seek opportunities in the energy sector.

While the focus of the conference is on energy transition and green energy, it was also emphasised that immediately abandoning fossil fuels, which still makes up of 80% of global energy, is unrealistic amid growing energy demand.

Instead, efficiency and emissions reduction in existing energy systems were highlighted, in addition to a clear and coherent financial framework to support Asia’s clean energy shift.

To note, SE Asia only received 2% of global clean energy investments, based on 2023 data, despite its significant renewable potential.

Malaysia targets increasing the share of renewables in its energy mix to 70% by 2050. The energy sector had faced a multi-faceted challenges that hampered the adaptation of energy transition, including:

(i) complex and costly reserves.

(ii) supply chain vulnerabilities.

(iii) geopolitical tensions.

(iv) economic volatility.

(v) technological disruptions.

A purely idealistic or rapid transition without considering these interconnected risks is unrealistic and could destabilise economies. Therefore, a pragmatic approach is advocated, which include:

(i) diversifying the energy mix between low-emission options alongside emissions-abated petroleum and gas.

(ii) equity and inclusivity in decarbonisation efforts.

(iii) streamlining transition pathways, resources grants and development priorities.

AI is a game-changer with transformative potential, as the technology is often used for optimising energy systems.

Companies like Petronas are already implementing “AI Refinery” projects to optimise refining processes, reduce production costs, and leverage Generative AI for macro-level business operations.

This signifies a shift towards digital technologies and AI as core drivers for decarbonization, efficiency, and long-term sustainability within the energy sector.

During the conference, it was proposed that Malaysia reassess its entire energy strategy, including the possible adoption of nuclear power, to meet its net-zero carbon emissions target by 2050.

The need to balance affordability, sustainability, and energy security, particularly in addressing the nation’s baseload power requirements, highlighted this option.

While nuclear energy is not classified as a renewable, it remains one of the cleanest sources of energy, which still aligns with the net-zero goal.

However, the risks of nuclear may still need to be studied in a bid to improve public acceptance and preparedness for such development.

Malaysia’s Oil and Gas Services and Equipment (OGSE) sector is poised for continued growth as the country accelerates its energy transition under NETR.

OGSE services remain essential, particularly in supporting carbon capture and storage (CCS) initiatives, even as the focus shifts toward cleaner energy sources.

CCS and other transition-related projects still depend on Malaysia’s existing oil and gas ecosystem.

Nonetheless, the challenges remain on the adaptation of energy transition via ESG, by small and medium enterprises (SMEs).

SMEs account for approximately 80% of the OGSE ecosystem, with many at different stages of ESG awareness and readiness.

To bridge this gap, MOGSC will be working closely with Petronas to roll out targeted support programmes, helping SMEs align with sustainability goals.

Petronas has confirmed ongoing efforts to develop Malaysia’s 3rd liquefied natural gas (LNG) regasification terminal, in response to surging electricity demand, driven notably by the rapid expansion of energy-intensive data centres.

The group is proactively preparing for future LNG import needs as Peninsular Malaysia’s energy demand is poised to outpace domestic gas production. This aligns with government plans to secure long-term energy supply for Peninsular Malaysia.

This development complements the government’s broader gas market reform initiatives aimed at liberalising and strengthening energy security.

Regasification terminals play a critical role in converting imported LNG, shipped in liquid form for efficiency, back into gaseous form for domestic distribution via pipeline networks.

This new regasification terminal is expected to fill in a potential shortage in LNG in the Peninsular region.

While East Malaysia continues to export LNG to international partners, the Peninsular will soon require increasing LNG imports, anticipating a shift within the next 4-5 years.

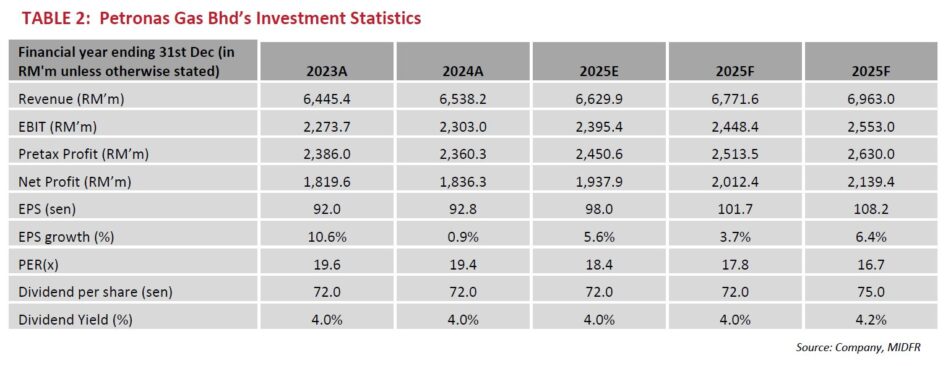

To note, Malaysia currently operates two regasification terminals – Sungai Udang, Melaka, and Pengerang, Johor. Petronas Gas is expected to be the main beneficiary of this project. —June 18, 2025

Main image: Green Kinematics