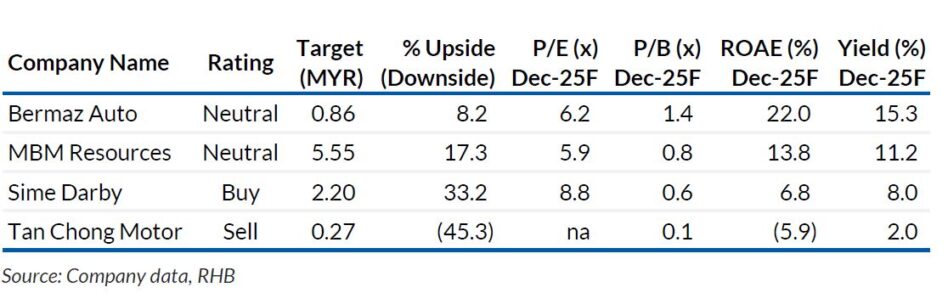

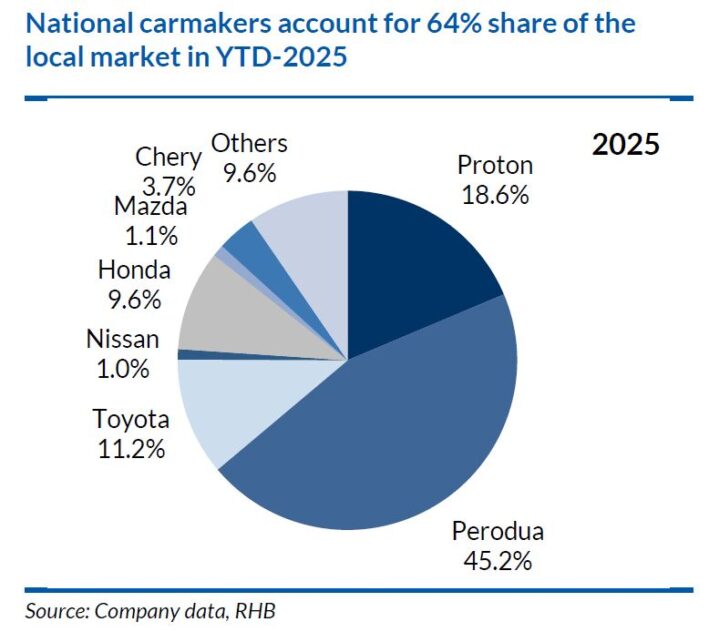

AUTO sales volumes continue to weaken, with year-to-date Total Industry Volume (TIV) down by 5.4% year-on-year (YoY), in line with RHB’s expectation of a sector-wide slowdown due to the lack of catalysts. RHB maintains neutral on the sector.

Automotive sales volumes may slow, but solid contributions from mass-market brands, that is, Perodua and Toyota, should cushion the impact.

Despite challenges in China, SIME continues to benefit from strong BMW support. Meanwhile, TCM remained in the red, amidst weak sales volumes and the lack of a clear turnaround plan.

MBMR’s quarter one 2025 (1Q25) core earnings declined by 11% YoY, in line with lower Perodua contributions. BAUTO’s 2025 earnings plunged by 56% YoY, in line with RHB’s projection.

Prime Minister Dato’ Seri Anwar Ibrahim has reaffirmed the Government’s commitment to removing the blanket subsidy as planned. While details remain limited, earlier indications may point to a rollout in the second half of 2025.

“Nonetheless, we believe the policy will raise vehicle ownership costs,” said RHB.

This could accelerate EV adoption or lead some consumers to downtrade, especially given the limited affordable EV options. Public transport may gain traction as an alternative, but much will depend on how the policy is executed.

“We maintain our 2025F TIV at 730k units, which translates to a 11% YoY decline. We do not see any compelling catalysts for 2025 auto sales to be maintained at the current elevated levels,” said RHB.

Therefore, RHB remains cautious in their outlook, due to the ongoing price competition in the non-national segment and softening order backlogs.

“While we think the impending expiry of the tax exemption on complete build up EVs post-2025 could result in a surge of EV sales volumes this year, the local EV market remains modest, accounting for 2% of total car sales,” said RHB.

Hence, it is unlikely that a surge in EV demand would materially move the TIV needle in 2025.

RHB anticipates TIV to soften YoY in quarter two, supported by the declining order backlogs, in view of 2024’s record-high TIV, the shorter working quarter due to long festive season holidays, as well as scheduled factory maintenance shutdowns by major carmakers.

In view of their cyclical downturn outlook for the sector, they maintained their sector weighting, premised on a lack of catalysts to drive sales and earnings to new highs.

Key downside risks include softer-than-expected orders and deliveries, and resurgent supply chain issues. The opposite represents the upside risks. —June 18, 2025

Main image: Britannica