THE escalating confrontation between Iran and Israel has reintroduced volatility to global oil markets. Brent crude surged over 8% following Israel’s targeted strikes on Iran’s nuclear and military infrastructure.

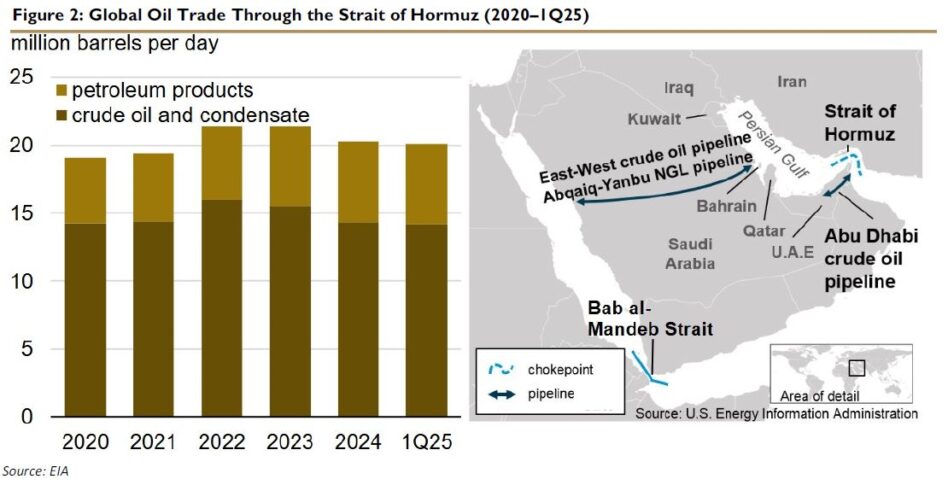

While initial reactions have been strong, TA Securities (TA) believe oil prices could stabilise unless critical assets, such as the Strait of Hormuz, face direct threats.

“We view the geopolitical premium as transient rather than transformative. The sector’s risk-reward profile remains balanced, justifying a Neutral call,” said TA.

TA reiterates their preference for oil and gas players with strong export linkages and robust cash generation, such as PANTECH and MISC.

The global oil supply backdrop remains relatively resilient despite the geopolitical turmoil.

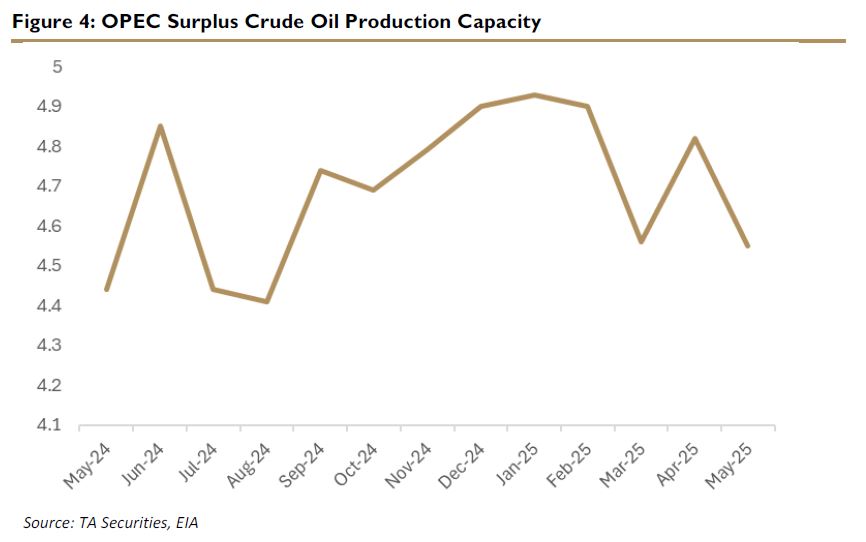

OPEC+, led by Saudi Arabia, holds sufficient spare production capacity to offset most short term disruptions from Iran.

According to EIA, global spare production capacity stood at approximately 4.55mn barrels per day (bpd) as of May 2025—primarily held by Saudi Arabia, the UAE, and Iraq.

This aligns with widely cited estimates suggesting that Saudi Arabia alone contributes about 3 mil bpd, while the UAE and Iraq collectively account for an additional 1–1.5 mil bpd.

This spare capacity, defined as oil that can be brought online within 30 days and sustained for at least 90 days, serves as a vital buffer in stabilising markets should Iranian exports (currently ~2 mil bpd) be curtailed.

In parallel, US shale producers continue to deliver robust output levels. Despite a decline in rig counts, production has held steady at 13.4 mil bpd, underscoring the productivity gains from technological efficiency and capital discipline.

Other non-OPEC contributors like Brazil, Canada, and Guyana are also ramping up supply, contributing to a broader narrative of a well-supplied global market.

As such, while the war may add volatility, the probability of a sustained supply shock remains relatively low unless additional producers or infrastructure become targets.

Even amid heightened geopolitical risks, the global demand outlook for oil remains underwhelming.

Structural headwinds, including muted industrial activity in Europe, China’s tepid post-COVID recovery, and persistent inflationary pressures across major economies, are weighing on overall energy consumption.

Airlines, a key post-pandemic recovery driver for jet fuel, are also seeing mixed signals. Ticket bookings are strong but jet fuel efficiency gains continue to limit actual oil consumption growth.

Furthermore, the stronger-for-longer interest rate narrative in Western economies has delayed business investment and capped industrial output, particularly in energy-intensive sectors such as manufacturing, construction, and transport.

Overall, while supply-side fears can generate temporary price rallies, the demand picture remains insufficiently supportive for a sustained oil bull cycle without further macroeconomic improvement.

“We retain our Neutral view on the Oil & Gas sector, as we believe the risk-reward balance remains evenly poised,” said TA.

While geopolitical tensions could intermittently support prices, the presence of ample global spare capacity, resilient non-OPEC supply, and muted demand growth limit the probability of a sustained price rally. In this environment, TA favour stock-specific opportunities over a broad sector call.—June 20 2025

Main image: Metro Holding