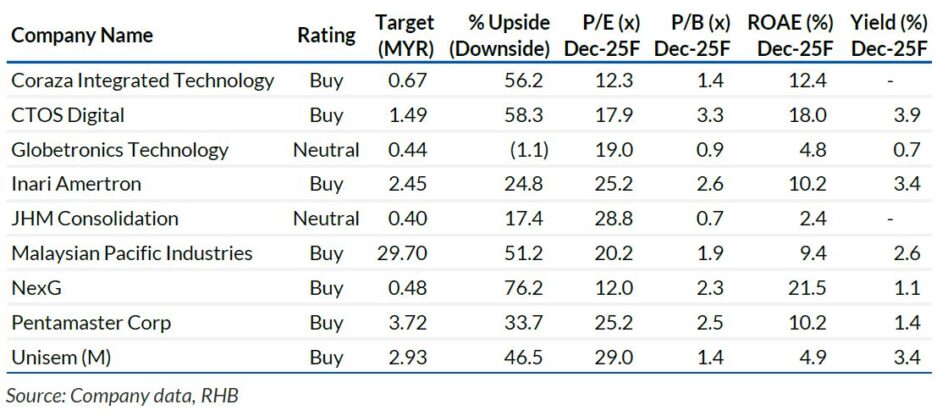

COLLECTIVELY, the tech sector result was largely in line with expectations, with five companies meeting projections and one outperforming estimates.

However, three players had numbers that missed expectations, due to slower order recognition, margin compression, and FX impact.

Most players booked declining earnings, except for Coraza Integrated Technology (Coraza), which maintained its revenue despite margin pressures from ASP erosion, pre-opening expenses, and higher costs.

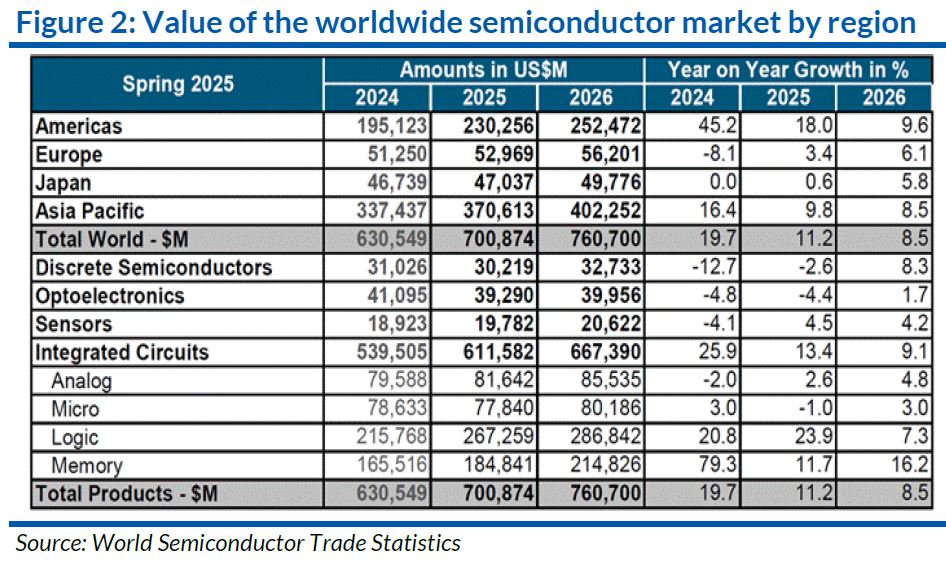

Engineering support players continue to book robust revenue growth, seen as a precursor to growth in automated test equipment or ATE manufacturers as well as outsourced semiconductor assembly and test.

“Hence, we expect stronger numbers heading into quarter two (2Q) and the second half (2H), supported by a broader recovery across the semiconductor supply chain,” said RHB.

Order and revenue trends remain constructive, supported by a sector recovery and potential front-loading activities, despite the ongoing uncertainty from US tariffs.

Most management teams have adopted an optimistic tone, on stronger loadings with the replacement cycle, new product introductions, a demand recovery, and technology advancements.

These trends are further bolstered by new opportunities emerging from China Plus One and Taiwan Plus One strategies.

“Our outlook still leans towards the positive, that Malaysia stands to benefit from US-imposed tariffs, via short-term rushed orders and long-term manufacturing reallocation activities,” said RHB.

The country’s robust ecosystem, talent pool, and infrastructure provide a competitive advantage.

While excessive inventory build-up could raise demand uncertainties, the sector remains in an upcycle, showing minimal signs of major disruptions so far.

Malaysian Pacific Industries and UNI are key beneficiaries of the chip sector recovery, China’s demand rebound, and the commencement of new programmes and customers.

On the domestic front, CTOS Integrated Technology is a standout, as it leverages on the digitalisation trend and has exposure to the fintech segment.

Among the smaller-cap stocks, Coraza should see a sterling earnings rebound, supported by robust revenue growth.

Tariff concerns slowing end demand, slower-than-expected orders, technology obsolescence, and unfavourable FX movements. —June 20, 2025

Main image: New Straits Times