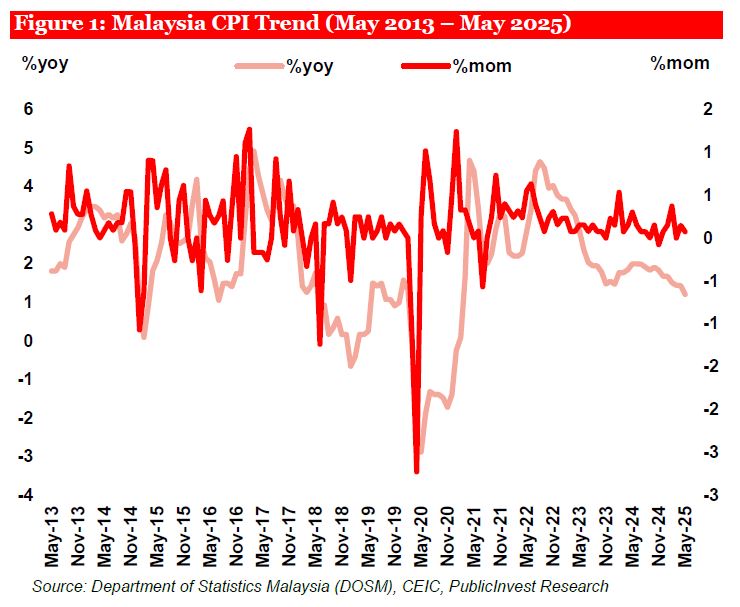

MALAYSIA’s headline CPI eased to +1.2% YoY in May (April: +1.4% YoY), falling below market expectations.

Core inflation also moderated to +1.8% YoY (April: +2.0% YoY), indicating that underlying demand-side pressures remain largely contained.

For the first five months of 2025, headline inflation averaged +1.4% YoY, down from +1.8% YoY in the same period of 2024, underscoring continued disinflationary momentum.

The increase in the national minimum wage to RM1,700 per month (from RM1,500), effective 1 February 2025 for firms with five or more employees, has thus far exhibited minimal pass-through to consumer prices. On a monthly basis, CPI rose by +0.1% MoM in May, unchanged from April.

“We have lowered our 2025 headline inflation forecast to +1.9% YoY (from +2.4% YoY), following a reassessment of inflationary pressures in light of the government’s narrower RON95 fuel subsidy rationalisation,” said Public Investment Bank (PIB).

The revision reflects lower expected passthrough from fuel to headline CPI, while core inflation remains contained across most demand-driven components.

“We continue to monitor potential upside risks from Tenaga Nasional’s non-domestic tariff adjustments effective July, though the impact on CPI should be limited given protections for residential users,” said PIB.

Other factors to watch include the SST base expansion from July, phased foreign worker levy reforms, and the deferred EPF contribution hike in 4Q25.

On balance, we expect the cumulative inflationary impact of these measures to remain modest, anchored by broadly stable domestic cost conditions.

Headline inflation increased slower to +1.2% YoY in May. May’s CPI was primarily driven by price increases in Personal Care, Social Protection & Miscellaneous Goods & Services, which rose by +3.7% YoY (April: +4.1%), followed by Education at +2.2% YoY (April: +2.3%), Food & Beverages at +2.1% YoY (April: +2.3%), and Housing, Water, Electricity, Gas & Other Fuels at +1.7% YoY (April: +2.0%). Price growth also moderated in Recreation, Sport & Culture to +0.9% YoY (April: +1.3%) and in Alcoholic Beverages & Tobacco to +0.6% YoY (April: +0.8%).

In contrast, Restaurant & Accommodation Services accelerated to +3.0% YoY (April: +2.9%), alongside Health at +1.1% YoY (April: +0.9%) and Furnishings,

Household Equipment & Routine Household Maintenance at +0.2% YoY (April: +0.1%). Insurance & Financial Services (+1.5% YoY) and Transport (+0.7% YoY) remained unchanged from the previous month.

Meanwhile, Information & Communication and Clothing & Footwear continued to register deflation, with prices falling by -5.2% YoY and -0.2% YoY respectively.

Core inflation, which excludes price-controlled and fresh food items, moderated to +1.8% YoY in May (April: +2.0% YoY), indicating that underlying demand-driven price pressures remain contained.

Excluding fuel-related components such as RON95, RON97 and diesel, the adjusted headline CPI also eased to +1.4% YoY (April: +1.5% YoY).

In May, most states recorded inflation rates below the national average of +1.2% YoY, with Kelantan registering the lowest increase at +0.3% YoY.

In contrast, five states posted inflation rates above the national average, led by Johor at +1.8% YoY, followed by Negeri Sembilan (+1.6% YoY), Selangor (+1.5% YoY), Melaka (+1.5% YoY) and Wilayah Persekutuan Kuala Lumpur (+1.4% YoY). —June 25, 2025

Main image: Compare Hero