AT first glance, Malaysia’s residential property market may appear quiet, but beneath the surface, a meaningful transformation is underway: a fundamental shift in how Malaysians approach property ownership.

Today’s buyers are intentional, value-focused, and sharply attuned to economic signals. The optimism of past years has given way to a more measured mindset shaped by global volatility, domestic caution, and a widening disconnect between asking prices and buyer expectations.

This is not a retreat from the market; it is a recalibration. Malaysians are still buying, but with greater purpose and scrutiny.

Supply expands, buyer expectations refocus

According to the Property Market Q1 2025 Snapshots by National Property Information Centre (NAPIC), residential construction jumped by 30.2% year-on-year, an expression of developer confidence.

Yet, transaction volume and value fell 6.2% and 8.9%, respectively, highlighting a growing misalignment between supply and demand.

This shift is not rooted in economic weakness. With policy interest rate steady at 3.0% and inflation down to 1.4% in April, Malaysia’s fundamentals remain stable. But instead of acting on optimism, buyers are choosing caution.

It is a clear signal: affordability today is no longer just about price; it’s measured by perceived value.

Bridging the price gap through buyer alignment

Differences between current residential offerings and evolving buyer preferences are becoming more noticeable across key regions.

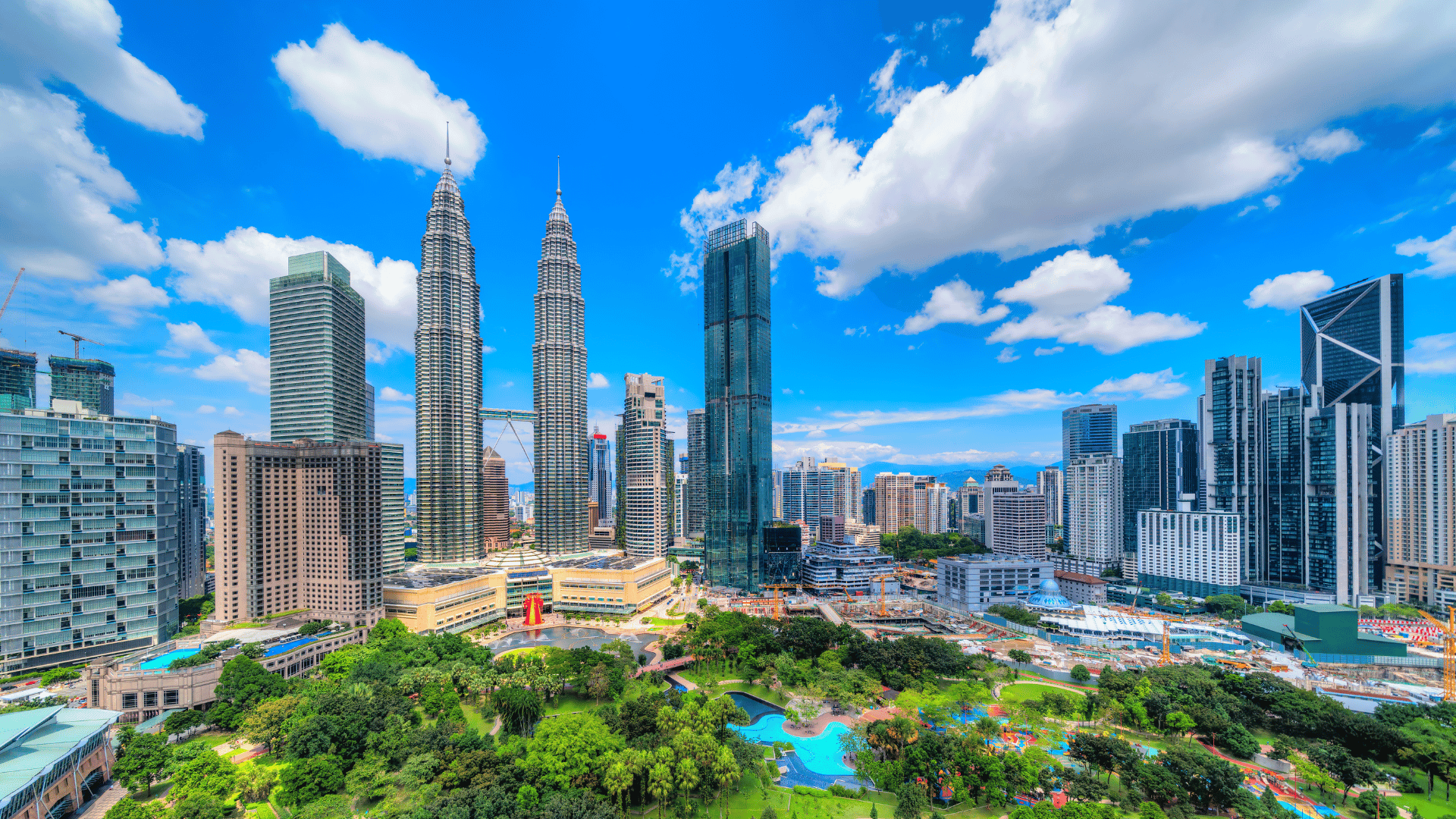

In Kuala Lumpur, high-rise homes took the biggest hit, with prices dropping 7.3% quarter-on-quarter, which was the steepest decline among property types.

According to NAPIC, overhang grew 14.8% year-on-year, with unsold units mostly being condominiums priced between RM200,000 to RM300,000.

However, data from PropertyGuru Malaysia for April 2025 indicates that the condominium market is stabilising towards an equilibrium, showing only a slight month-on-month decrease in demand of 0.7% for condominiums.

Selangor, meanwhile, tells a different story. According to NAPIC data, the price gap is widening in the apartment and serviced residence segments, but savvy buyers remain active when value aligns with expectations.

Overhang fell nearly 40% year-on-year, signalling strong movement in well-priced, practical homes. Across most segments, caution dominates mark-to-market activity amid ongoing economic uncertainty.

Penang continues to attract attention, especially in the condominium segment. PropertyGuru Malaysia’s April 2025 data showed a 9.1% increase in condominium listing views, driven by infrastructure developments such as the LRT Mutiara Line.

However, NAPIC data indicates a decline in transactions for homes priced above RM1 mil, reflecting growing resistance to premium price points.

Johor is shaping up as a market where rising prices are starting to test buyer patience. NAPIC reports an 8.7% year-on-year increase in high-rise prices for Q1 2025.

Correspondingly, PropertyGuru Malaysia’s April 2025 data shows a 19.5% year-on-year decline in interest for serviced residences, with overall views for non-landed homes also trending downward. Like the non-landed property types, demand for landed property types also decreased YoY.

The rise of the value-conscious buyer

A dip in the demand index does not mean buyers have disappeared. In fact, they are just more selective.

According to April 2025 data from PropertyGuru Malaysia, apartment views fell 14.1% while semi-detached homes dropped 21.4% year-on-year. Yet, property types that strike a smart balance between price, location, and lifestyle are defying the trend. Some even gain traction.

- Selangor is a standout. Terraced homes continue to outperform, with demand rising 2.7% year-on-year and overhang falling 40%, according to NAPIC. This points to a healthy alignment between supply and real buyer appetite.

- In Penang, condominium interest surged 9.1% year-on-year, buoyed by better connectivity and more competitive pricing, highlighting the positive impact of infrastructure upgrades like the upcoming LRT Mutiara Line.

- Meanwhile, in Johor, the story is more nuanced. NAPIC data shows a 3.2% year-on-year increase in the All-Housing Price Index, led by high-rise and terraced homes. However, the price growth appears to be dampening sentiment, with declining demand suggesting that affordability concerns are weighing buyer decisions.

These shifts tell us something important: buyers haven’t exited the market. They are just more focused on finding real value.

Developers are re–imagining value in real time

As buyers become more measured and data-driven, developers are also evolving their strategies to stay aligned.

The traditional playbook of driving volume or focusing solely on premium segments is being rebalanced to meet a market increasingly shaped by value-conscious demand.

Success now lies in realistic pricing, particularly in the resilient RM500,000 to RM800,000 bracket. Homes within this range continue to see steady interest, especially when paired with strong connectivity and well-designed, liveable environments.

Transit-oriented developments and communities with integrated green spaces are emerging as long-term favorites among buyers.

Equally important is understanding the new pace of decision-making. Buyers are being more deliberate, investing time in research, comparisons, and consultations before committing.

In this era of intentional ownership, developers who align with value-driven demand through realistic pricing, livability, and accessibility are well-positioned to thrive. ‒ June 26, 2025

Kenneth Soh is the country manager – Malaysia for PropertyGuru & iProperty.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.