FOLLOWING almost two weeks of mutual missile strikes, the US President last week announced that Israel and Iran have agreed to a ceasefire, sending Brent oil prices to below USD70/bbl and effectively erasing gains driven by geopolitical tensions.

The oil price pullback is not entirely surprising as the conflict had minimal impact on the physical oil market.

We reiterate our view that the oil demand-supply fundamentals remain unexciting in view of rising barrels production from OPEC+ by 411kbpd in May and June, which would likely continue in 2H25.

We expect the planned production hikes by OPEC+ to tilt the oil market towards oversupply territory in 2025, aggravated by wobbling oil demand, as US Liberation Day tariffs dampen global economic growth.

EIA in its Short-Term Energy Outlook (June) forecasted an oil oversupply of 820kbpd in 2025, which may cap oil price upside in the near-term due to stock build over the course of the year.

We do not rule out any further oil price spike in the event of an escalation in geopolitical conflict, especially in the Middle East region.

However, judging by the fundamentals, we reckon that Brent oil prices may see strong resistance to sustain at above USD70/bbl.

Given their high earnings sensitivity to oil prices, companies with substantial upstream E&P exposure could see earnings contraction due to lower average realised oil prices (2025e: USD67/bbl) when compared to a high base of USD80/bbl in 2024.

The reduced exploration works as a result of dwindling oil prices and lingering Petronas-Petros debacle will continue to put drilling demand under pressure.

According to Wood Mackenzie, the oil industry is likely to delay growth capex and discretionary spending in view of softening oil prices and macro uncertainties, especially for major projects, given that US’ tariffs may inflict decision paralysis for some.

That said, oil prices of USD65/bbl may dent margins but unlikely to warrant significant budget cuts and development plan changes.

Our channel checks also indicate that the global O&G project pipeline remains largely intact but merely seeing some deferrals in contract award.

As such, the temporary pullback on development projects may, in our view, slowdown new FPSO project awards from oil majors.

The petrochemicals sector is still in the doldrums with a prolonged downcycle perpetuated by persistent demand weakness and global petrochemicals overcapacity.

Overall, the petrochemicals sector will remain in the woods in the coming years as global capacity addition will continue to outstrip demand growth, which will in turn weigh on global utilisation rate.

We retain our Brent oil price forecasts for 2025/2026 at USD67/bbl and USD70/bbl, with the view that oil prices will continue hovering at USD60-65/bbl in 2H25, barring escalation in geopolitical conflict.

On a macro level, we view that oil prices are skewed to the downside from current levels due to (i) dissipating geopolitical premiums given Middle East conflict de-escalation, (ii) increasing output from OPEC+ and (iii) potential demand slowdown induced by US Liberation Day tariffs.

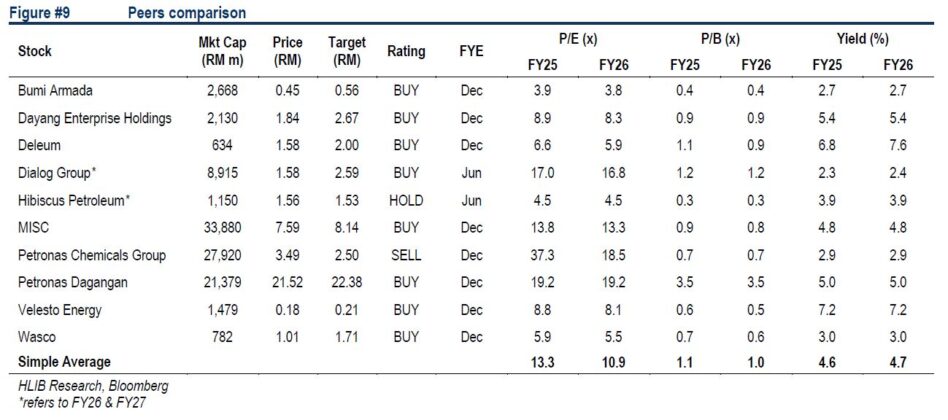

However, our OVERWEIGHT rating is based on a bottom-up view of the sector as most of our stock recommendations are BUYs due to favourable fundamentals and earnings profile of the respective stocks, along with undemanding valuation across the sector. —July 1, 2025

Main image: Siemens