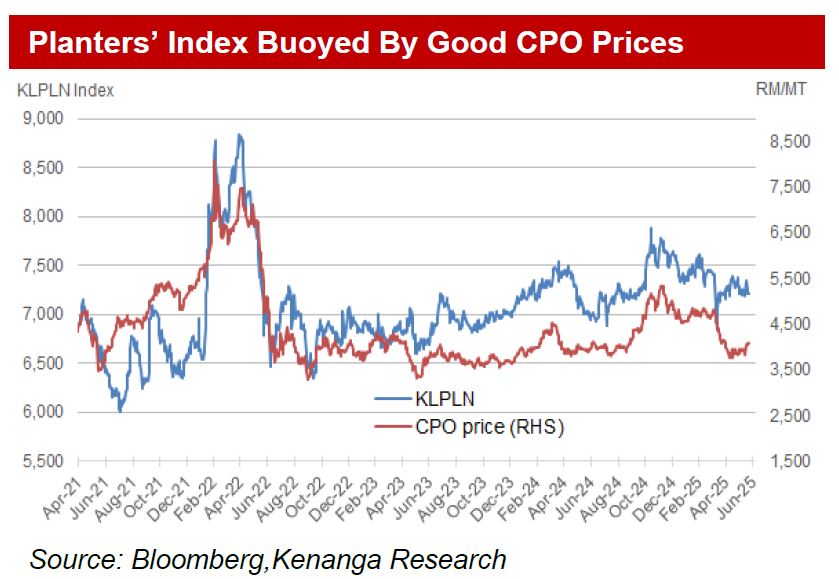

THE top palm oil producer, Indonesia, suffered poor yields in calendar year 2024 (CY24) causing palm oil prices to trade above soyabean oil for over half the year during CY24.

“As harvest is recovering this year, palm oil prices have since reversed to trade at discount against soyabean oil from Apr CY25 onwards,” said Kenanga Research.

Consequently, CY25 crude palm oil (CPO) prices should ease from RM4,212 per MT in CY24 to RM4,100 in CY25 and RM4,000 in CY26 but stay firm due to overall supply tightness in the international edible oil market.

A CY25 supply deficit looks increasingly likely with tightness to spill over into CY26. Oilworld’s latest edible oil supply growth forecast of 2% for CY26 concurs with Kenanga’s earlier view that trend-line demand growth of 3%-4% a year looks set to outstrip supply not only in CY25 but into CY26 as well unless a bumper harvest eventually emerged.

Hence, our expectation of firm to elevated edible oil prices over CY25-26. Once the fastest growing oil crop, palm oil output growth started to moderate from around CY19 onwards.

This is in part, due to ESG concerns over de-forestation but Indonesia was also starting to run out of good suitable land for oil palm planting while Malaysian oil palm area actually started shrinking since CY20s.

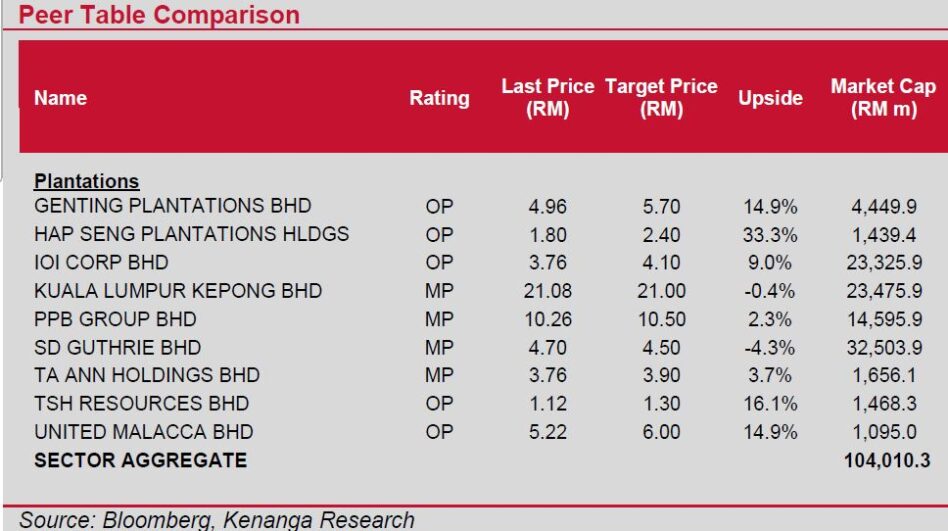

Whilst valuations appear to have bottomed out and are not excessive, there is no strong upside catalyst either.

Therefore, our NEUTRAL call thus hinges on firm CPO prices. Approximately 70% of edible oil made it into our food chain with c.23% as bio-fuel.

As such, edible oil demand is quite visible, resilient and with trend-line demand growth of 3%-4% yearly.

Meanwhile, supply is expected to grow by only 2%-3% over CY25-26; hence, edible oil prices including that of palm oil will probably stay sufficiently firm.

Overall, we expect non-integrated planters to become increasingly dividend-yield plays. For larger integrated players, we expect more M&A or diversification into non-plantation businesses – hence likely to stay net borrowers.

Even so, as the balance sheet of integrated players such as IOI, KLK and SDG are backed by valuable land bank, their current gearings levels should not be a key concern to investors.

Margins should stay healthy. Firm CPO and strong PK selling prices are expected to help absorb most of the cost upticks in CY25; hence, upstream margins are expected to stay healthy.

Downstream margins which stayed disappointingly soft in 1QCY25 is likely to remain so for the next quarter or two. Altogether, CY25 margins should stay robust thanks to upstream operations. —July 2, 2025

Main image: Palm Oil Alliance