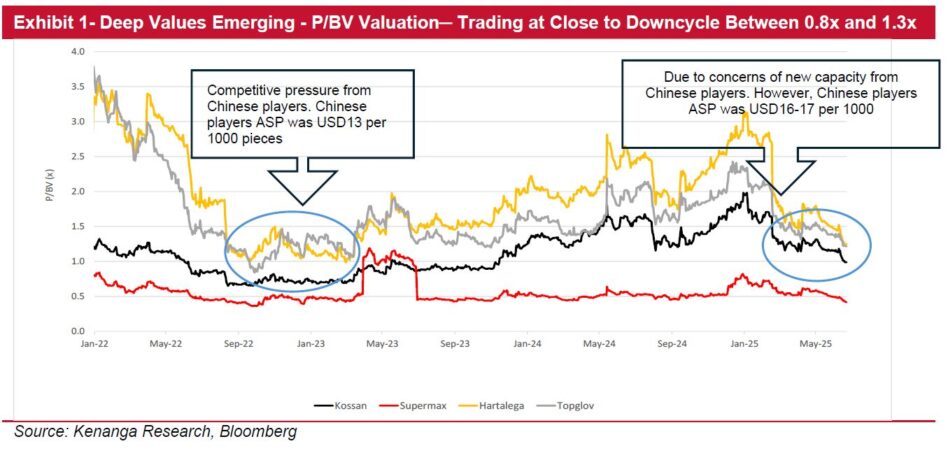

MALAYSIAN glove stocks are trading at deep value levels, pricing them close to the worst of the down-cycle.

While earnings may remain weak in the near term, structural demand and supply rationalisation offer long-term upside.

While evolving tariffs actions and trade dynamics may limit near-term visibility, the present low inventory levels could spark a sudden surge or uptick in orders.

Indications from channel checks are pointing towards a recovery for local glove players albeit at a slower pace in the second half of calendar year 2025 (2HCY25) following a slower 1HCY25 due to the front-loading effects of US customers purchasing from Chinese makers.

“We believe the YTD slump in players’ share prices by between 20%-48% were due to concerns of front-loading effects by US distributors and diverted Chinese capacity ahead of the tariff kicking in Jan CY25 and concerns of a certain Chinese glove maker’s plant slated to begin commercial production in end-CY25,” said Kenanga.

We believe the present concern of Chinese glove makers to further lower ASP is overplayed since the present average selling price (ASP)s at USD15-17 per 1,000 pieces (and this is the indicative ASP for a certain Chinese glove maker’s plant in Indonesia which market expect to commence production in end-CY25) is higher than the previous down-cycle ASP of USD13 per 1,000 pieces.

Anecdotal evidence suggest that despite the impact of tariff-related disruptions, there is only so long customers can hold off making purchases.

If past history is of any guide, based on previous down-cycles, Malaysian glove makers’ stock prices will start to re-rate once the ASP concerns subside, and demand starts flowing back to Malaysian glover makers.

The European Commission announced recently (June 20) to exclude Chinese companies from The European Union (EU) public procurement contracts for medical devices exceeding €5 mil and not more than 50% of components used in winning bids for public contracts can be of Chinese origin.

According to an EU official guided by figures of Medtech Europe, the EU medical technology market was worth some €150 bil in 2023, with public procurement accounting for 70% share.

The restrictions include diagnostic equipment and medical gloves. The exceptions will be in a place where no alternative suppliers exist. Typically, Europe accounts for an estimated 30%-40% of Malaysia’s glove export market.

For illustration purposes, assuming:

(i) China exports 70% of their gloves to Europe (following the imposition of tariffs in the US) which is estimated at 50b pieces, and

(ii) public procurement is 70%, an estimated 35b pieces market may benefit glove makers including Malaysia. However, an EU-China summit in end July CY25 could sway away this EU restrictions.—July 4, 2025

Main image: New Straits Times