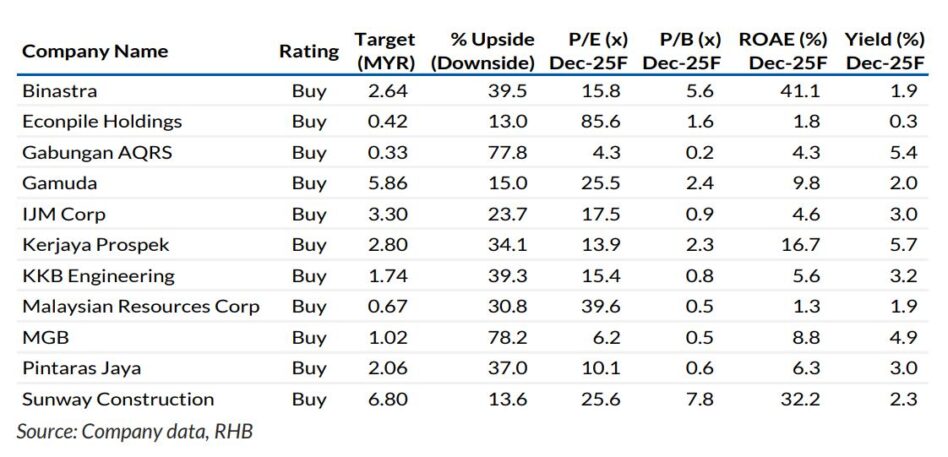

RHB’s top picks for the construction sector include Gamuda (GAM), Sunway Construction (SCGB) and Binastra.

US President Donald Trump’s administration via a draft rule plans to restrict shipments of artificial intelligence (AI) chips to Malaysia and Thailand.

This is part of an effort to crack down on suspected activities of chips being smuggled into China. However, the rule is not yet finalised, and could still change.

One provision under the draft rule would allow firms headquartered in the US and a few dozen friendly nations to continue shipping AI chips to both countries, without seeking a license, for a few months after the rule is published, according to media sources.

The licence requirements would still include certain exemptions to prevent supply chain disruptions.

Therefore, US-based tech giants such as Google, Microsoft, Oracle, EdgeConneX and Amazon Web Services may continue their planned investments in Malaysia, which entails data centre (DC) setups.

We also do not discount the possibility of some form of validated end user (VEU) status (similar to former US president Joe Biden’s AI diffusion rule) to be obtained by US tech giants and allies which enables them to ship AI chips more freely to countries like Malaysia, given their massive planned investments in the country.

However, VEU status holders may also then be subject to stringent security requirements, eg supply chain security including personnel checking and transit security.

These “friendly nations” may be countries previously listed under Tier 1, under the US AI diffusion rule proposed by the previous US administration.

Some of the countries include the UK, the Netherlands, Australia and Japan. Key non-US DC players currently expanding in Malaysia include Yondr, Vantage, AirTrunk and NextDC.

GAM, SCGB and IJM mainly have their DC jobs coming from either US-based corporations, or DC players from countries that could be deemed as friendly by the US, in our view.

In fact, the near-term DC job pipeline is dominated by US-backed MNCs. For instance, there are some DC tenders, with outcomes expected to be known over July-September.

The said tenders are related to Elmina Business Park Phase 2, and Eco Business Park V at Puncak Alam. Based on our estimates, there could be a potential construction value worth MYR7.4bn from the five DC tenders.

Other DC hotspots include Negeri Sembilan – one in Port Dickson via a 389- acre piece of land (acquired from GAM) developed by PCM and another plot in Nilai that is said to be backed by a US investor, according to the Chief Minister of Negeri Sembilan.

The 389-acre land could likely house between 500MW and 700MW of DC capacity based on our analysis.

Key downside risks to our sector call now include an unexpected slowdown in DC builds from US-based DC developers in Malaysia. —July 7, 2025

Main image: Freepik