DESPITE the recent headwinds from the Israel-Iran conflict, Kenanga decided to maintain their Brent average targets of USD64/bbl and USD67/bbl for 2025 and 2026, respectively.

“Based on the information available to us, we have previously said in our report dated 16 June 2025 that the elevated premiums could last for a quarter, and we also now believe that it is safe to assume for now that the conflict would not be sustained in a large scale for a protracted period after President Trump’s call for a ceasefire,” said Kenanga.

Conversely, while potential disruptions ahead cannot be entirely ruled out, we believe that OPEC still possesses higher than average spare capacities which allows room to fill up any potential supply gaps in oil production in the event of conflicts in the Middle East.

Kenanga concur with the EIA’s forecast of a year-on-year global oil demand increase of 0.8m barrels per day (bpd) in 2025, improving to 1.1m bpd in 2026.

On the supply side, the EIA projects an increase of 1.6m bpd of which OPEC+ has already restored 1.4 mil bpd between April and July 2025.

The research house estimates that approximately 0.8 mil bpd remains to be unwound, with OPEC+ currently deliberating whether to accelerate the full unwinding by October 2025, contrary to its earlier plan of completing it by March 2026.

For now, Kenanga maintain the base case assumption that the full unwinding will occur in March 2026, as OPEC+ is likely to avoid placing undue pressure on the oil market through a steep supply increase, assuming no further geopolitical disruptions arise.

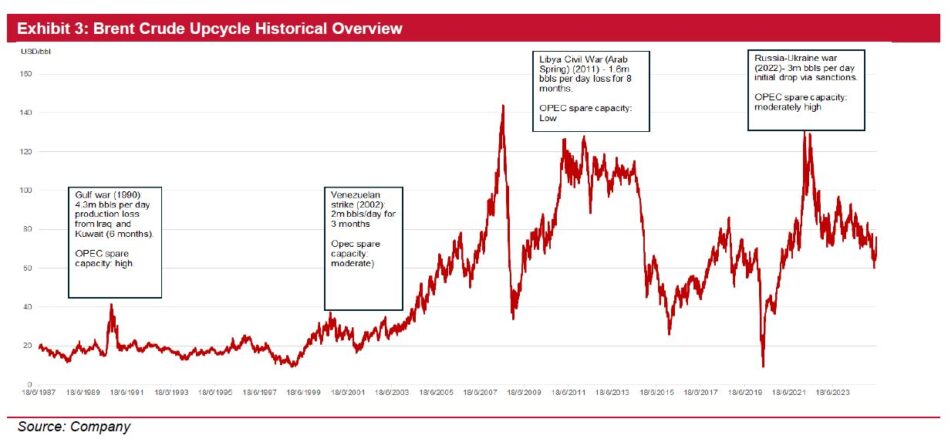

Unlike the Arab Spring-induced oil price rally, we believe any sharp near-term spikes in Brent crude prices are likely to be short -lived, given OPEC’s above-average spare capacity to offset potential supply disruptions.

For context, in addition to the ongoing unwinding of 2m barrels per day (bpd ) cut, OPEC+ retains two further tranches of production cuts: a 1.65m bpd voluntary cut by eight members (scheduled to end in late 2026), and a broader 2.2m bpd cut across all members, also extending through end-2026.

While there is currently no indication that OPEC+ will unwind these cuts prematurely, the group’s capacity to respond to global supply instability within 60 to 90 days provides a buffer against sustained price surges.

As such, we do not anticipate a durable upcycle in Brent crude prices materialising in 2025 or 2026.

We maintain that upstream activities, despite lower YoY, are still at a decent level overall as contractors are still executing their remaining order book, which has been built up significantly in the past few years.

Beyond that, we anticipate higher uncertainty in FY26F earnings outlook as upstream spending might be tepid by Petronas amid the still unresolved PETROS-Petronas saga and uncertain global crude price outlook.

This is also evident as Petronas has announced publicly its intention to reduce its staff force by 10% (https://theedgemalaysia.com/node/758121), indicating the group’s cautious outlook in the medium term.

This, in confluence with Brent prices likely to range between USD60-70/bbl for the next two years, would result in lower appetite for upstream capex spending in FY26.

Since 2022, the KL Energy Index (KLENG) has been trading at approximately 9x forward PER, reflecting a period of strong earnings expansion across the sector from 2022 to 2024.

This sustained earnings growth explains the persistently low PER during that timeframe, making it a favourable period for sector-wide investment.

Looking ahead to 2026, however, we see potential for PER expansion as cyclical earnings may peak in 2025 and subsequently enter a downtrend.

Historically, the sector has exhibited higher PER multiples during earnings downcycles (e.g., 2020–2021), suggesting that share prices, particularly for upstream service providers tend to peak when forward PER reaches its trough.

This also indicates to us that the FY26F consensus earnings could be overly bullish given the current tepid global macro crude outlook. —July 8, 2025

Main image: Wong Engineering Corporation