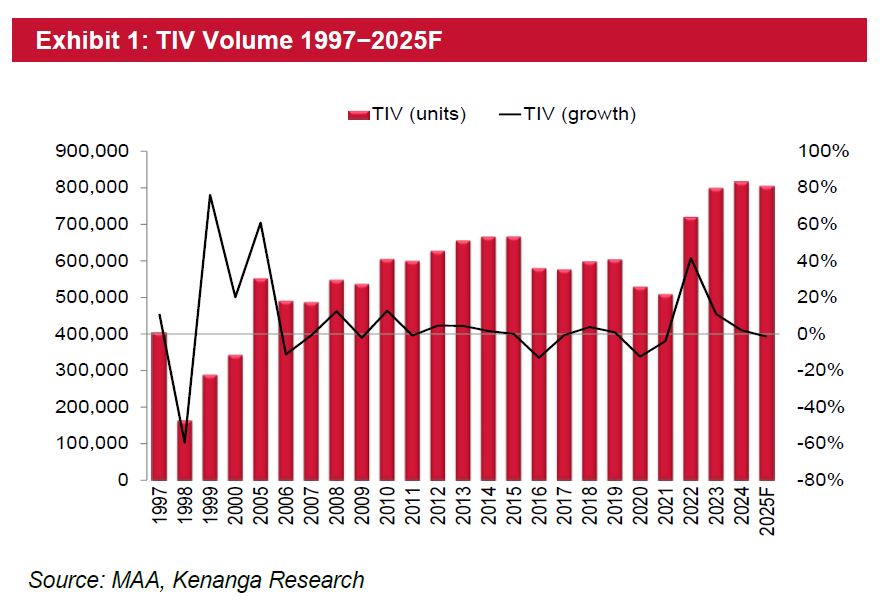

BASED on Kenanga Research’s total industry volume (TIV) forecast of an unchanged 805k units for calendar year 2025 (CY25).

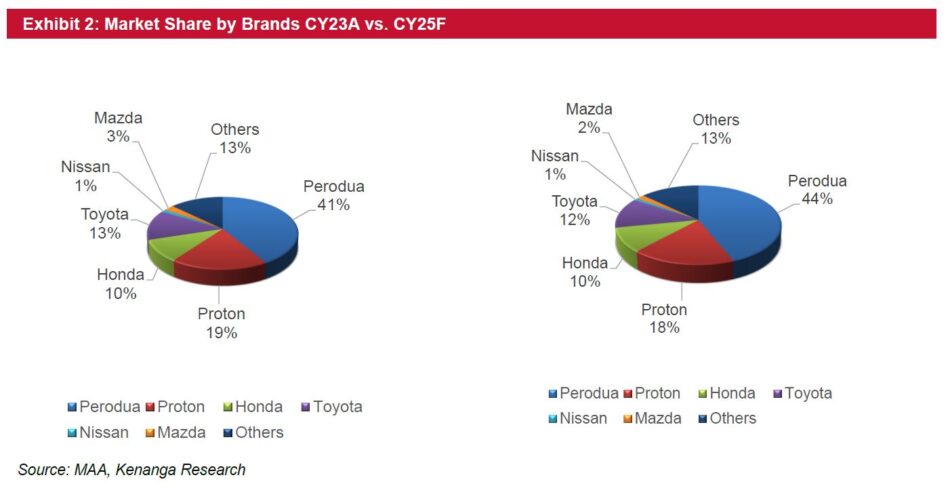

They estimate that national marques will expand their market dominance to 64% of CY25 TIV compared to 58% of TIV in CY22.

This is due to increasing demand for the affordable vehicles, displacing the non-nationals marques’ market share on which their target focus is mostly in the RM100k and above vehicles segment.

“This was evident in our stock coverage over the 1QCY25 results season, and we believe the heavyweights under our coverage is experiencing valuation de-rating due to intense competition in the non-nationals space as well as worsening externals factors,” said Kenanga.

A two-speed automotive market locally will persist stretching to end-2025 and flowing into CY26. It will be business as usual for the affordable segment as its target customers, i.e. the B40 and lower tier M40 groups, will be spared the impact of the impending RON95 subsidy rationalization and could also potentially benefit from the introduction of the progressive wage model.

Government is still finalizing the mechanism to use for the RON95 subsidy rationalisation and expects that 90% of the Malaysian will not be affected.

Initially, government looks to float the RON95 price to market rate for foreigners only, and then to the T15 or T10 or T5 tier group after finalizing the income bracket range classification to improve income targeting scheme.

Concurrently, household bills will also be affected by the higher fuel bills, as well as expected 14% increase in base tariff for the higher-end usage which could also drive consumers to switch to solar-panels, in-turn boosting the demand for EV to funnel the excess grid electricity (essentially free energy).

Additionally, EV routine maintenance costs are considerably lower than ICE’s due to fewer moving parts and wear & tear parts.

In general, the industry’s earnings visibility is still good, backed by a booking backlog of 155K units as at end-May 2025, which is higher than 130k units, three months ago.

More than half of the backlog is made up of new models, alluding to the appeal of new models to car buyers. This trend is likely to persist to-end CY25 and flowing into CY26 given a strong line-up of new launches.

Vehicle sales will also be supported by new BEVs that enjoy SST exemption and other EV facilities incentives up until CY25 for CBUs and CY27 for CKDs.

The new registration for BEVs leapt from 274 units in CY21 to over 3,400 units in CY22, 13,301 units in CY23, and 21,789 units in CY24 (based on the Ministry of Transport’s press release), or 3% of TIV.

We expect more favourable incentives from the government which has set a national target for EVs and hybrid vehicles of 20% of TIV by CY30 and 38% by CY40.

Meanwhile, the government will speed up the approval for charging stations. The number of proposed charging stations is currently at 4,299 (3,611 built to date) and this should more than double to 10,000 by end-CY25.—July 9, 2025

Main image: Clean Mobile Shift