RHB expect 2026 to be a more balanced year fundamentally, with lower year-on-year (YoY) crude palm oil (CPO) prices, but geopolitical risks will translate to more volatility.

Spot CPO prices have moderated from MYR4,600-4,800/tonne in 1Q25 to a low of MYR3,780/tonne in May, only to bounce back to the current levels of MYR3,900-MYR4,100/tonne.

The downward movement was mainly driven by geopolitics in the light of the US trade tariffs, wars, and crude oil prices falling, all of which pushed CPO prices in the same direction.

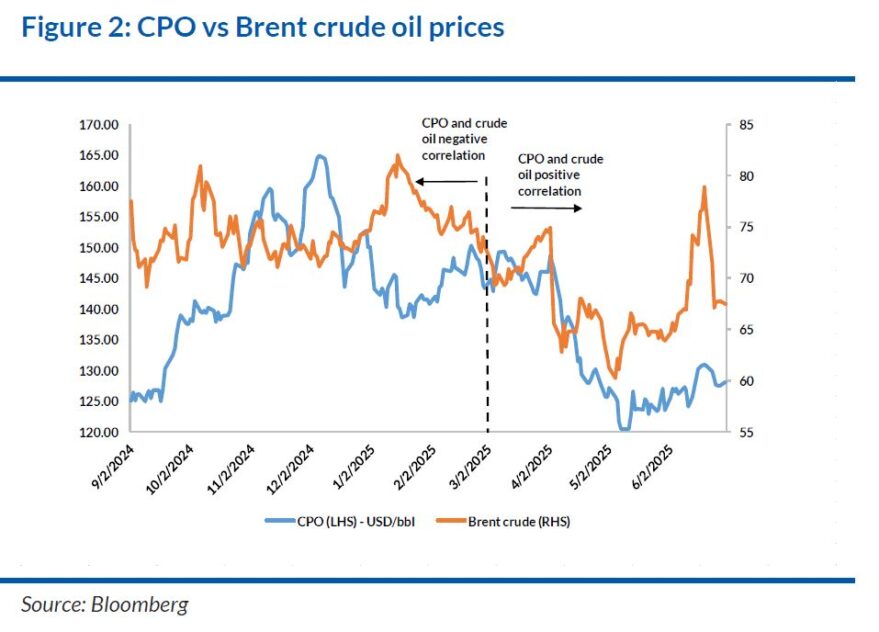

Correlation between CPO prices and crude oil prices surged to 0.47 in Apr 2025 from -0.6 in 1Q25, and subsequently rose further to current levels of 0.68, due to raised geopolitical risks.

Besides following crude oil price trends, CPO prices also followed the lead of soybean oil (SBO) prices which rose due to the recent US biofuel policy change, leading to a rise in blending targets.

We expect CPO prices to remain volatile given the ever-changing geopolitical situation. Fundamentally however, global supply and demand will likely be more balanced in 2026, as supply improves, while demand should pick up given the more attractive relative prices.

Supply of 17 oils and fats complex is expected to improve YoY in 2026F, coming from a partial recovery of palm, sunflower and rapeseed supplies, as well as continued growth from soybeans.

Still, the stock/usage ratio of the 17 oils and fats complex is still expected to remain below the historical average of 13.6%, at 12.9% for Oct 2025/Sep 2026, albeit up from 12.7% in 2025.

This leaves very little cushion in case of any short-term bullish supply or demand surprises, hence raising the risk of price volatility going forward.

What does this mean for relative prices of vegetable oils and demand? Ignoring the noises from geopolitics, we expect 2026F to see:

i) Muted soybean prices, due to continued strong supply in 2026F.

ii) SBO prices remain supported at higher levels, due to the higher demand from increased US biofuel blending.

iii) CPO prices to continue trading at a discount to SBO in the medium term (currently at USD217/tonne discount).

iv) demand from price sensitive countries like India, Pakistan, Bangladesh come back.

We revise down our CPO price assumptions to MYR4,100/tonne (from MYR4,300) for 2025 and to MYR4,000/tonne (from MYR4,100) for 2026 and 2027; but revise up our PK prices to MYR3,300/tonne for 2025F (from MYR2,800) and to MYR3,200/tonne for 2026F and 2027F (from MYR2,600).

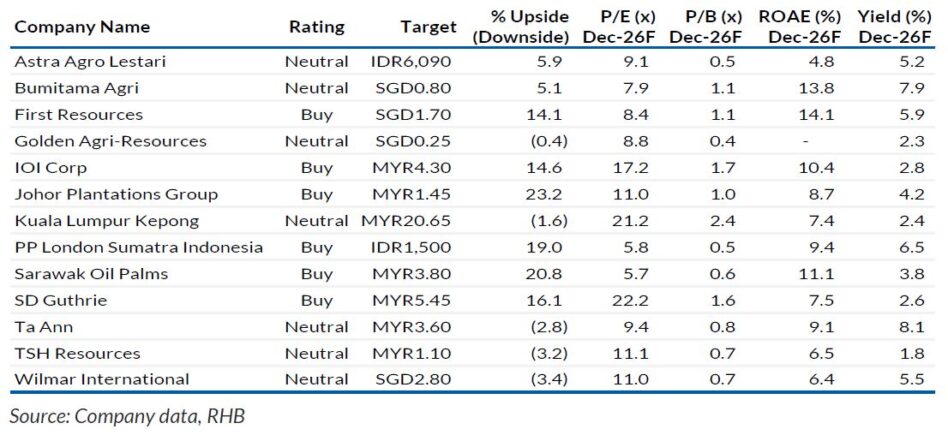

Post annual ESG review, we have made several changes to our ESG scores and rolled forward our valuation targets to 2026 (from 2025).

All in, we downgraded two stocks to NEUTRAL – Kuala Lumpur Kepong (KLK) and Bumitama Agri (BAL), post earnings revision. —July 9, 2025

Main image: The Healthy.com