DO not fall for populist statements made by certain quarters when it comes to allowing more withdrawals from the Employees Provident Fund (EPF), said Finance Minister Tengku Zafrul Abdul Aziz.

“At the end of the day, it is the contributors who will get affected in the long run, with our children and grandchildren bearing the burden of absorbing the cost to care for senior citizens,” he said in a Facebook post.

In the aftermath of the devastating floods that hit parts of Peninsula Malaysia, several Government leaders have called upon Putrajaya to allow a one-off withdrawal of RM10,000 by those affected.

However, Prime Minister Datuk Seri Ismail Sabri Yaakob had dismissed the call saying that apart from the RM1,000 aid announced by the Government, there were also banks offering loans to those affected, with a payment moratorium attached to it.

Earlier today, the Penang Malaysian Trades Union Congress (MTUC) also urged the premier not to bow to such calls and urged the latter to increase aid money to RM10,000 instead.

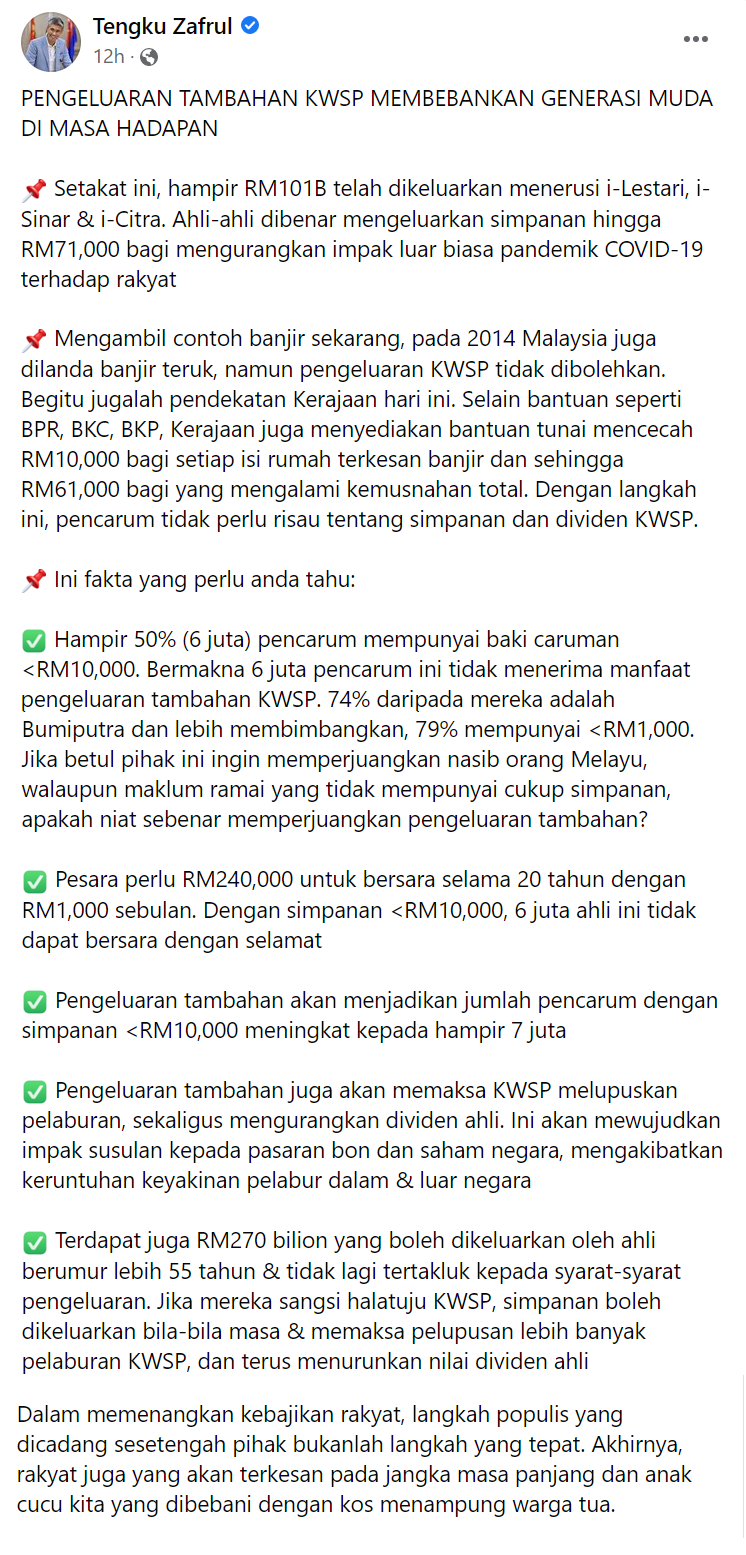

Touching on the matter, Tengku Zafrul said that during the pandemic, the EPF had disbursed almost RM101 bil via various schemes such as i-Lestari, i-Sinar and i-Citra.

Citing data, he said that almost 50% of EPF contributors have less that RM10,000 in their accounts, with 79% of them having less that RM1,000.

“And 74% of the contributors are from the Bumiputera community. If these groups really care for the Malays, given the statistics, what is their real intention here?” he queried.

With that, the senator said that a retiree needs about RM240,000 to retire, amounting to RM1,000 withdrawal per month to live for another 20 years.

“But with about six million of them having less than RM10,000 in the accounts, it means they cannot retire comfortably. If we allow another RM10,000 withdrawal, the number affected will increase to seven million.

“Plus, it will also force EPF to dispose more of its investments, which will affect dividends. As a result, it will also affect our bond and share market, driving investors’ confidence down,” Tengku Zafrul mentioned.

He remarked: “And we also have a situation where RM270 bil was taken out by those aged 55 years and above. If they become skeptical of EPF’s direction, it will affect its investments and reduce dividends further. – Jan 1, 2022