VOCAL veteran journalist Datuk A. Kadir Jasin leads the chorus of criticism against the Securities Commission (SC) for “expectedly” letting off Malaysian Anti-Corruption Commission (MACC) chief commissioner Tan Sri Azam Baki.

Conclusive or otherwise the market regulator’s investigation into the Azam’s stock trading fiasco is not the key issue but the very fast that Azam himself has not denied the stock ownership in question, so opined the former editor-in-chief of the New Straits Times from 1988 to 2000.

“It is only that he (Azam) claimed that his brother (Datuk) Nasir Baki ‘uses’ his personal Central Depository System (CDS) account for stock trading,” Kadir pointed out in a Facebook posting.

Despite yesterday being a public holiday, the SC issued a statement saying it has not been able to establish that there was a breach of regulation in the controversial acquisition of public shares related to Azam who openly admitted that his brother Nasir had used his CDS account – with his permission – to purchase securities in two public-listed companies in 2015-2016 (Gets Global Bhd and Excel Force MSC Bhd).

“It is ridiculous that a trade transaction conducted in 2015-2016 cannot be traced and verified,” lamented Kadir.

“This is unlike 1972 when I first learned how to file a stock market report. Back then, trade transaction was written on blackboards and kept in ledger. We are now living in a digital world, my dear ladies and gentlemen (referring to SC executive chairman Datuk Syed Zaid Albar and its board members).”

An elated Azam greeted the SC’s findings by feeling “grateful” that there was no wrongdoing on his part.

“I was informed by the SC that the inquiry into the matter has been concluded. As such, it has closed the inquiry file accordingly,” he said in a statement. “With that, I will continue my responsibilities as the MACC chief commissioner to fight corruption without fear or favour.”

But Puchong MP Gobind Singh Deo has this to say in his Facebook posting:

“One-lined statements from the SC are insufficient. Make the details public. Explain who was called in to assist in the inquiry, what the inquiry revealed, what impact the evidence had on the law applicable and why you are unable to conclude whether a breach occurred.

“Reasons should be given in support of any decision. All the more reason for a PSC (Parliamentary Select Committee) hearing to be held on an urgent basis. The SC should also be called in to assist and explain their position at that hearing.”

In a related development, the PSC’s special meeting scheduled today to hear Azam’s stock trading controversy has been postponed indefinitely due to several legal issues.

In a letter addressed to all MPs yesterday (Jan 18), Parliament secretary Dr Nizam Mydin Bacha Mydin said a new date for the meeting would be announced later.

“The meeting scheduled on Wednesday will be postponed to a later date as there are several legal issues that require legal opinions from the Parliament’s legal adviser’s office,” said the letter.

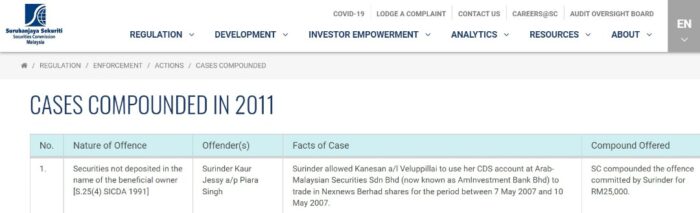

Given the latest chain of events, some netizens have called on the SC “to refund” investor Surinder Kaur Jessy who was compounded RM25,000 in 2011 for allowing her CDS account to be used by one Kanesan Veluppillai to trade in shares of Nexnews Bhd (delisted in July 2020 after a name change to Berjaya Media Bhd) between May 7 and 10, 2007.

Meanwhile, a FocusM check on the Behaviour and Discipline Management of Public Service Officer circular (Version 1.0 [2022]) reveals that civil servants are not prevented from purchasing shares provided the quantity:

- Does not exceed 5% of the paid-up capital or RM100,000 of the current value whichever is lower in any one company which is incorporated in Malaysia;

- Does not exceed 5% of the paid-up capital in investment or industrial-centric companies established by State or the Federal Governments;

- Not exceeding the limit fixed by the Government in any one of the government-backed unit trusts

Last October, reports surfaced that Azam owned 1.9 million shares in GETS Global Bhd as of end-April 2015 and that his shareholding was reduced to 1.03 million shares as of end-May, 2016.

The same report also stated that he had 2.156 million Excel Force MSC Bhd warrants as of end-March 2016. The warrants can be converted into shares at an exercise price of 68 sen per share. – Jan 19, 2022