AS predicted, it did turn out that Public Bank Bhd would eat into its sisterly insurer arm LPI Capital Bhd.

So, Malaysia’s third largest bank with total assets at RM493.26 bil has unveiled its intention to acquire the entire equity stake in LPI from Consolidated Teh Holdings Sdn Bhd (42.74%) and The Estate of the Late Tan Sri Dato’ Sri Dr. Teh Hong Piow (1.41%) for RM1.72 bil cash or RM9.80/share.

The price tag values LPI at 1.71 times its book value and 12.41 times its 2023 earnings. On the discount, Diona Teh Li Shian who is the youngest daughter of Public bank’s late founder Tan Sri Teh Hong Piow had justified that the valuation is in line with those of comparable companies in the global insurance industry.

“This price was negotiated based on a willing-buyer, willing-seller basis. Additionally, money is not a factor; it’s more about realigning our interests,” she told the media after yesterday’s (Oct 10) inking of a conditional sale and purchase agreement with Consolidated Teh and the estate for the proposed acquisition of 175.9 million shares in LPI.

This eventually triggered a mandatory general offer (MGO) to minority LPI shareholders which Kenanga Research expects unlikely to see acceptance owing to the 25% discount to LPI’s last traded share price of RM13 on Wednesday’s (Oct 9) prior to market suspension.

Added TA Securities Research: “However, the offer price represents a notable 23.7% discount to LPI’s five-day volume-weighted average price (VWAP) and a discount to its current PBV (price-to-book value) of around 2.3 times. Given this significant discount, we believe that minority shareholders will unlikely tender their shares under the MGO.

“The acquisition will next require shareholder approval at an extraordinary general meeting (EGM) and other regulatory consents.”

Regardless whether this is a “left hand to right hand deal” or that “Public Bank is known to be stingy”, the writing is already on the wall as LPI sees red at the time of writing with its share price having retreated 40 sen or 3.08% to RM12.60 with a hefty 855,500 shares (by LPI standard) traded which gave it a market capitalisation of RM5.05 bil.

Despite its deemed brilliant offer, Public Bank, too, did not fare better as it edged down 21 sen or 4.6% to RM4.36 with 74.75 million shares traded which valued the bank at RM84.63 bil.

Hidden sweetener

Ob the hindsight, one wonders if the entire episode his is a sheer case of ‘reverse psychology’ as one stock market observer puts it.

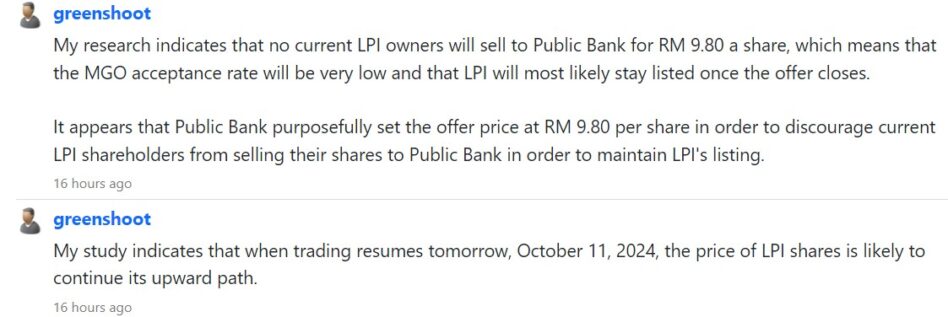

“My research indicates that no current LPI owners will sell to Public Bank for RM 9.80/ share which means that the MGO acceptance rate will be very low and that LPI will most likely stay listed once the offer closes,” he commented on the i3 investor forum.

“It appears that Public Bank purposefully set the offer price at RM9.80/share in order to discourage current LPI shareholders from selling their shares to Public Bank in order to maintain LPI’s listing.

“My study indicates that when trading resumes, the price of LPI shares is likely to continue its upward path.”

Another commenter acknowledged that “as long as the dividend payout is sustained, (LPI’s share) price will not drop much as dividend buyers will come in when yield increases”.

Perhaps, given that Public Bank intends to maintain LPI’s listing status on the Main Market of Bursa Malaysia, it does not matter at what price the latter’s major shareholders wish to dispose of their shares to the former.

Moreover, more details are likely to trickle in between now and 1Q 2025 (when the deal is slated for completion) as corporate horse-trading gets underway.

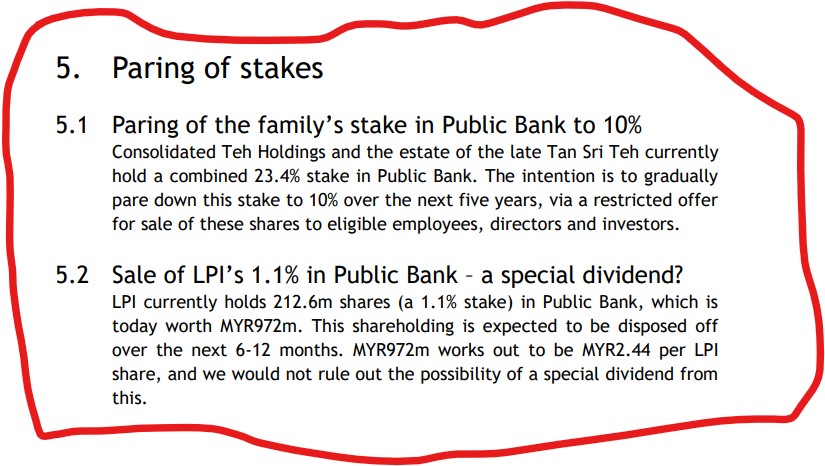

Probably, as Maybank IB Research has pointed out, all is not lost but that might even be a pot of gold for LPI loyal shareholders.

“LPI currently holds 212.6 million shares (a 1.1% stake) in Public Bank which is today worth RM972 mil. This shareholding is expected to be disposed off over the next six to 12 months,” penned its analyst Desmond Ch’ng in a company review on Public Bank.

“RM972 mil works out to be R2M.44 per LPI share and we would not rule out the possibility of a special dividend from this.” – Oct 11, 2024