THERE is doubtlessly some form of pressure on Farm Fresh Bhd not to repeat the awful performance of consumer electrical and electronics retailer Senheng New Retail Bhd which faltered at its Main Market debut on Jan 25 by ending its maiden trading day 21.5 sen or 20.1% below its initial public offering (IPO) price of RM1.07.

Hopefully with a more justifiable evaluation, the biggest and fastest growing dairy industry players in Malaysia can ride out the storm when it gets listed tentatively on March 22.

Mercury Securities Sdn Bhd has accorded a “subscribe” recommendation on Farm Fresh with a target price of RM1.53 which is 18 sen or 13.3% above its initial public offering (IPO) price of RM1.35.

This is based on peers average price per earnings (PE) of 28.8 times and FY2023F earnings per share (EPS) of 5.3 sen.

“We like Farm Fresh for its strong market presence in Malaysia’s dairy industry, local and regional expansion plans. The company has a dividend policy of 25%,” opined analyst Ronnie Tan in an IPO note.

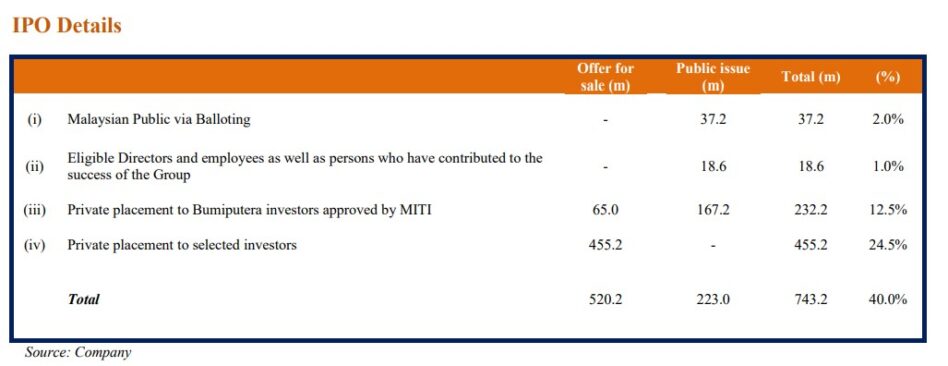

Farm Fresh whose IPO will raise circa RM1 bil has to-date received the backing of 30 cornerstone investors, including domestic and foreign asset managers, and Malaysian government-linked investment companies (GLICs).

According to Mercury Security, Farm Fresh has a strong market presence across various dairy categories in Malaysia as of its 9M FY2021 by commanding (i) 42% market share in chilled ready-to-drink (RTD) milk (54% in chilled RTD milk products manufactured with fresh milk); (ii) 10% in ambient RTD Milk (48% in ambient RTD Milk products manufactured with fresh milk); and (iii) 11% in yoghurt.

“We think that the company is well-positioned to expand its presence locally on the backdrop of a growing Malaysian dairy industry which is projected by Frost & Sullivan to grow at a five-year CAGR (compound annual growth rate) of 10%, 8%, 7% for the chilled RTD milk, ambient RTD milk, and Yoghurt industry from 2020 to 2025,” projected the research house.

Farm Fresh is currently exploring with a company to utilise the latter’s existing land spanning 500-1,000 acres for the establishment of an integrated dairy project with the first heifer expected to arrive by 1Q 2024.

The new farm is expected to have a capacity of 3,000 dairy cows, thus increasing farm Fresh’s aggregate capacity by 25.4% to 14,834 dairy cows.

Completion of the new manufacturing hub is expected to increase Farm Fresh’s total annual production capacity of finished chilled RTD products by 20.8 million litres with the additional two filling and packaging lines.

In terms of regional expansion, the company plans to increase its production capabilities in Australia through the expansion of the Kyabram Facility which will allow the group to manufacture UHT/ambient products to serve as an export hub to the Asia-Pacific region.

“Expansion is expected to begin in 1H 2022 and production expected to commence in 2Q 2023,” noted Mercury Securities.

“The company also seeks to expand its presence in Indonesia and the Philippines by establishing new production and distribution capabilities which will increase total annual production capacity by approximately 20.8 million litres of finish products.”

RTD milk segment in Indonesia and the Philippines is expected to grow at a five-year CAGR of 9.3% and 6.5% from 2020 to 2025 as forecasted by Frost & Sullivan. – March 2, 2022