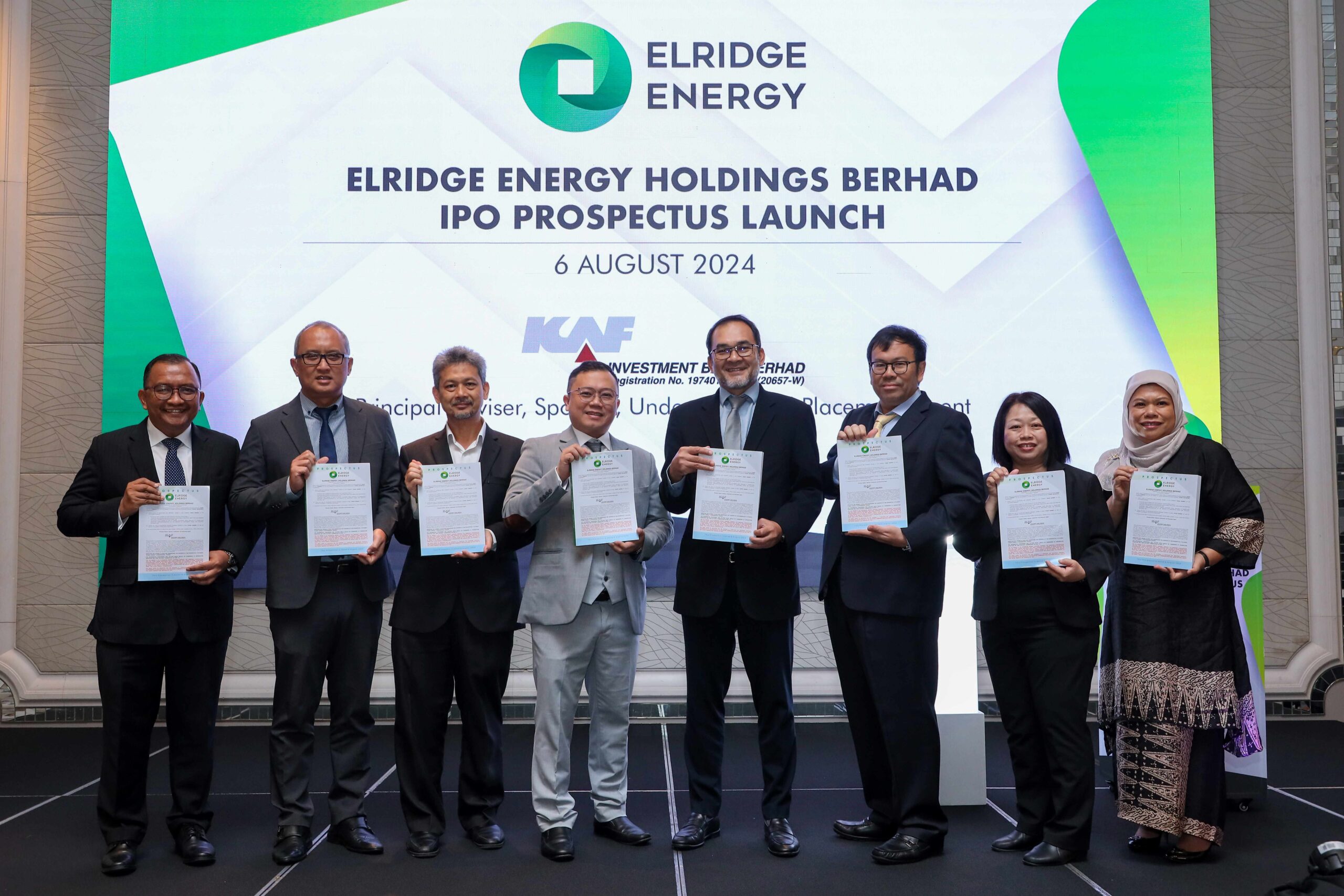

BIOENERGY-based Elridge Energy Holdings Bhd has unveiled its initial public offering (IPO) prospectus today (Aug 6) in conjunction with its proposed listing on the ACE Market of Bursa Malaysia Securities Bhd.

The IPO shall entail a public issuance of 350 million new ordinary Elridge shares which comprises 80 million shares made available to the Malaysian public via balloting; 20 million shares for eligible directors and employees of Elridge and 250 million shares will for Bumiputera investors approved by the Investment, Trade and Industry Ministry (MITI).

Additionally, an offer for sale of 350 million existing EEHB shares will be made available to selected investors by way of private placement.

Through the public issue portion of its IPO, EEHB targets to raise about RM101.5 mil in which RM47.0 mil will be utilised for the land acquisition and construction of a new factory and warehouse in Kuantan, and RM21.1 mil for the purchase of new machinery and equipment.

Elsewhere, RM27.0 mil will be utilised as working capital while the remaining RM6.3 mil will be allocated to finance listing expenses.

Based on an issue price of 29 sen/share and enlarged share capital of 2 billion shares, Elridge will have a market capitalisation of RM580.0 mil upon listing. The application period of Elridge’s IPO is made available from today till 5pm on Aug 12.

“The increasing global push for renewable energy sources has led to a rising demand for biomass fuel products, particularly in Asia Pacific,” commented Elridge executive director and CEO Oliver Yeo on the group’s prospects.

“Malaysia with its abundant natural forestry resources and a strong agricultural sector fuelled by fertile soil and a tropical climate stands out as a major supplier of biomass fuel products such as palm kernel shells and wood pellets.

“The positive market outlook underscores the potential for biomass fuel products which are recognised for their energy efficiency and environmental benefits to contribute substantially to global energy needs and environmental goals.”

Via its wholly owned subsidiary, Bio Eneco Sdn Bhd, the Elridge Group specialises in the manufacturing and trading of biomass fuel products with a focus on palm kernel shells and wood pellets. Currently, the company’s customers are based in Asia Pacific, mainly Malaysia, Singapore, Indonesia and Japan.

According to the independent market research report by Providence, the palm kernel shells industry in Asia Pacific is forecast to grow at a CAGR (compound annual growth rate) of 8.9% from an estimated US$308.6 mil (RM1.4 bil) in 2024 to US$366.1 mil (RM1.7 bil) in 2026.

Likewise, the wood pellets industry in Asia Pacific is forecast to grow by a further CAGR of 8.6%, from US$10.6 bil (RM48.4 bil) in 2024 to US$12.5 bil (RM57.1 bil) in 2026.

“As a market leader in the production of high-quality biomass fuel products that reduce net greenhouse gas emissions, we are poised to capitalise on the burgeoning market for sustainable and eco-friendly renewable energy solutions,” enthused Yeo.

“This listing exercise is crucial for Elridge as it presents a valuable opportunity to enhance our capabilities and further bolster our presence in the region. It also allows us to create value for our stakeholders and enables us to tap into a new customer base while maintaining our industry-leading position in terms of product quality.”

KAF Investment Bank Bhd is the principal adviser, sponsor, underwriter and placement agent for Elridge’s IPO exercise. – Aug 6, 2024